修正版-1024x576.jpg)

Neko Senpai

Neko Senpai About Basic of Customs Tariff(Duty)

- Explained about basic knowledge of customs tariff/duty by Video

- How important customs tariff/duty is

- What is custom tariff/duty?

- How the tariff rate is decide?

- Several types of tariff rate in Japan

- How to calculate custom tariff?

- How do we proceed to pay custom tariff?

- What if custom declaration is incorrect?

- The case custom tariff is exempt

- Summary

- Contact to IINO san

Explained about basic knowledge of customs tariff/duty by Video

Kamome Senpai

Kamome Senpai This is 8min 27min video

Hello, it’s IINO.

This time, I’d like to explain an essential process for import, “Basic knowledge of customs duty”.

How important customs tariff/duty is

When working on the freight forwarding process, we receive high volumes of enquiries for customs duty import.

This is a very important part of the import process, as the declaration and payment for customs duty, needs to be completed in line with each country’s treaty and law.

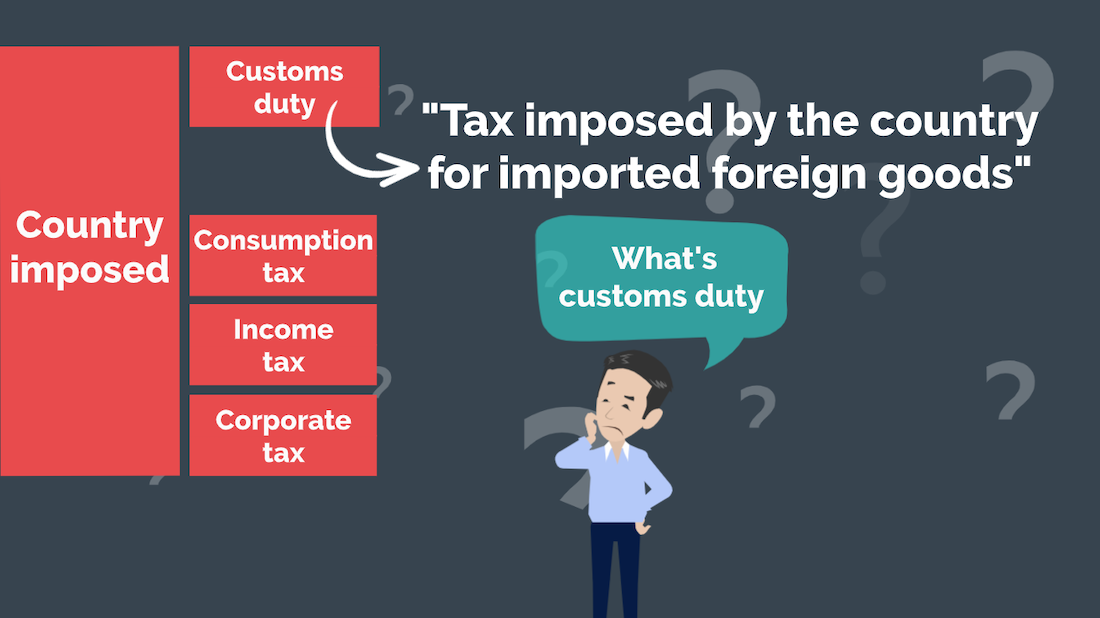

What is custom tariff/duty?

First, what is customs duty? You may often hear the word “customs duty” on the daily news.

Customs duty is defined as, “tax imposed by the country for imported foreign goods”.

As the country imposed such as consumption tax and income tax paid by an individual, and corporate tax paid by a company, customs duty is just another one of these taxes.

Main purpose of custom tariff

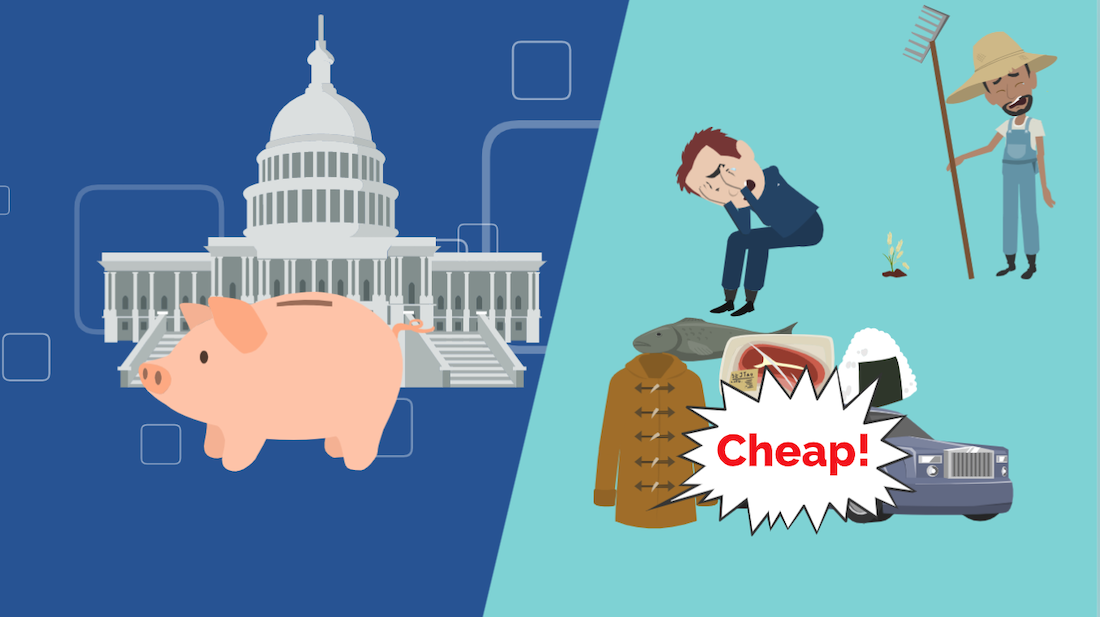

Collected customs duty will become funds for the country. However, the main purpose of imposing custom duty is to protect products which are produced within the country. domestic products.

If cheaper foreign products are imported and are sold on the market, the domestic product sales will decrease, and domestic industry may close.

When imported products are imposed with customs duty, the sales price for the product will be set higher.

It means that customs duty can regulate the competitiveness on the imported goods market.

Punitive tariff

By the way, custom duty involves trade policy and foreign policy with overseas.

For example, due to the foreign affairs, “a punitive tariff” may be imposed. High customs duty may be imposed for the opponent’s imported product as sanctions.

This will make it difficult for the opponent country to enter the product market, and this will cause a huge impact to their exporting industry.

How the tariff rate is decide?

Next, how do they decide the rate of customs duty?

The structure of deciding customs duty for import exists in each country in the world, including Japan.

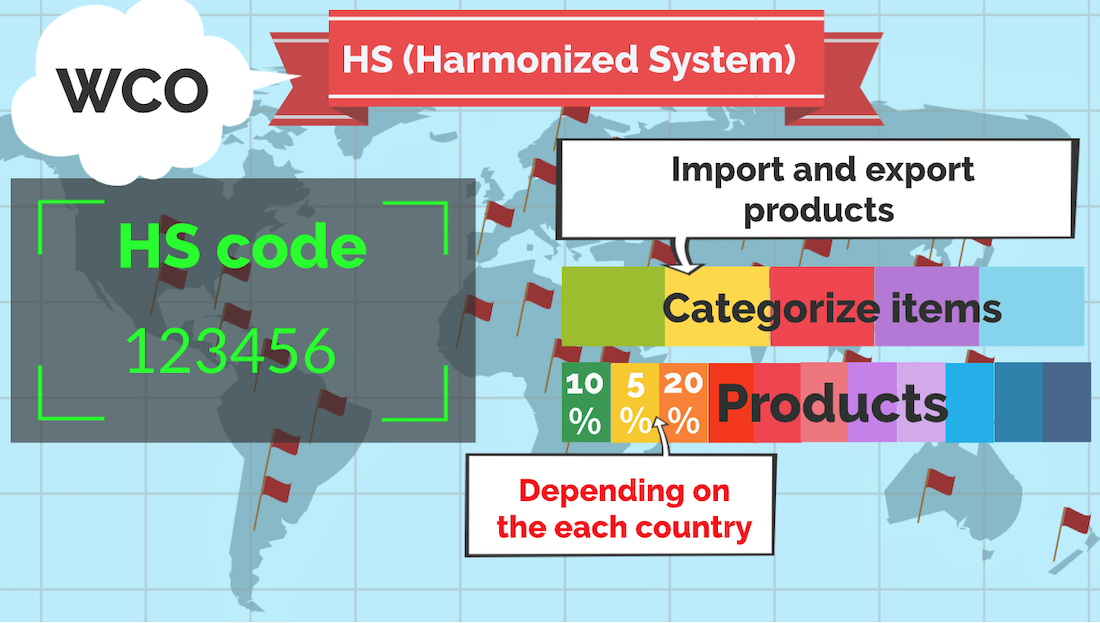

The International World Customs Organization (WCO) is engaged in standardization of customs and customs duty processes.

HS Convention

WCO develops the system of customs duty, called HS which stands for Harmonized System on their Harmonized System.

This system The HS Convention is joined by the majority most of the countries in the world, and they use HS code with 6 digit numbers to categorize items for import and export, and the customs duty rate is decided for each product.

The customs duty rate for each importing country is different.

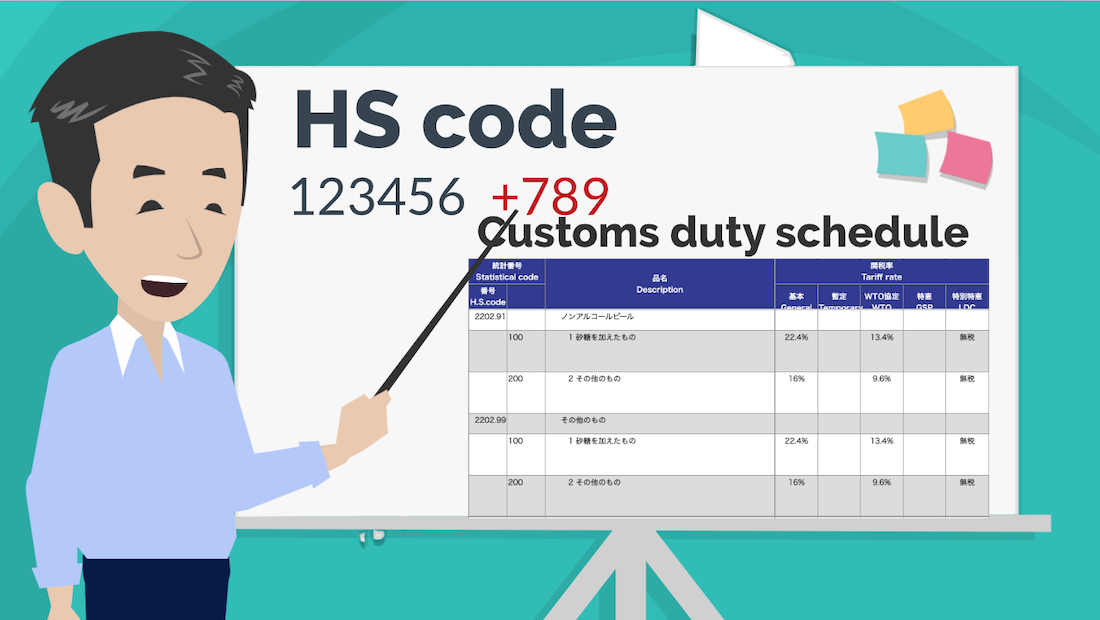

By the way, in Japan, they add 3 more digits in the world universal 6 digits of HS code,

Products are categorized on the statistic schedule, and the schedule which outlines each tax rate is called “customs duty schedule”.

Also, customs duty is normally imposed to on an importer.

The classification of the HS code is essential to identify the correct customs duty rate, and this will relate to the amount of payment for an importer.

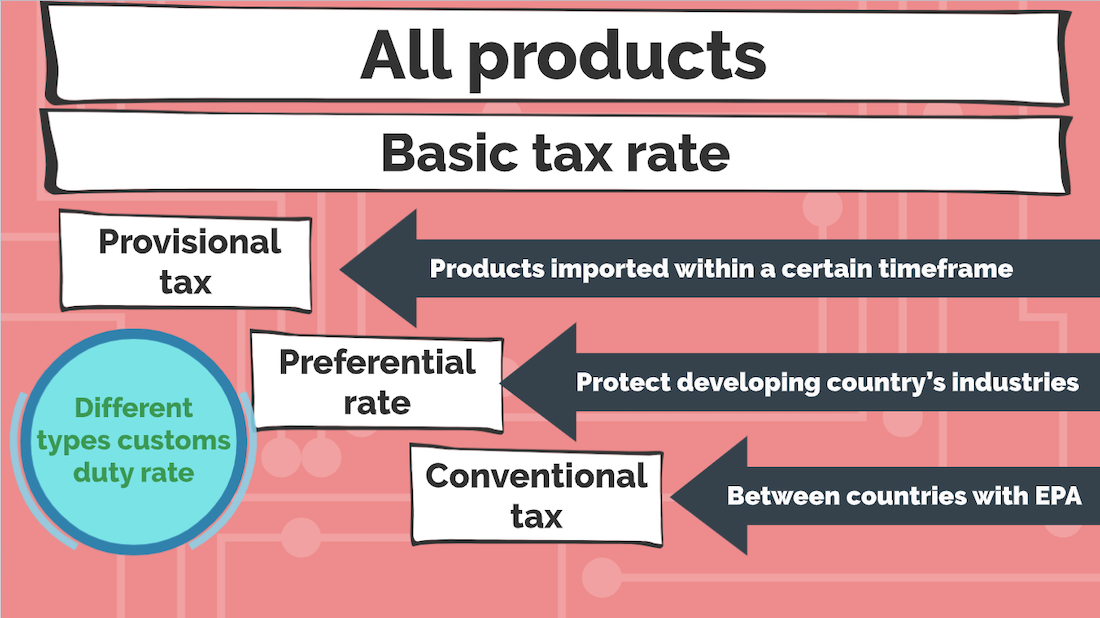

Several types of tariff rate in Japan

There are different types of Japanese customs duty rate. On the custom duty schedule customs tariff schedule, the basic tax rate is outlined for all products.

In addition, there is another tax called provisional tax. This is applied for the products that are imported within a certain timeframe. A preferential rate is used to protect the developing country’s industries.

Conventional tax is used between countries with EPA where the countries have an economic partnership. (Economic Partnership Agreement).

How to calculate custom tariff?

Customs duty is decided based on the price of CIF on an invoice.

CIF price includes the product cost, domestic transportation cost, ocean or air freight cost, and insurance cost.

In addition to the cost, the origin of the product is also a very important element when customs duty is decided.

This means, depending on the origin of the product, the applicable tax rate will change.

As previously explained, if the product of the country the origin of the country is a developing country with preferential trade arrangement on customs duty tariff schedule, they may not be taxed, due to preferential tax rate.

Or, if the product is produced in a country where they have EPA and FTA agreement, they will be able to use conventional duty rate for import customs duty.

To apply a preferential customs duty, a certificate of origin is required as proof of the origin of the product.

How do we proceed to pay custom tariff?

Now, what processes are involved to make payment of customs duty.

First, a cargo, a vessel or an airplane arrives at the importing country, and they will be loaded into a bonded area.

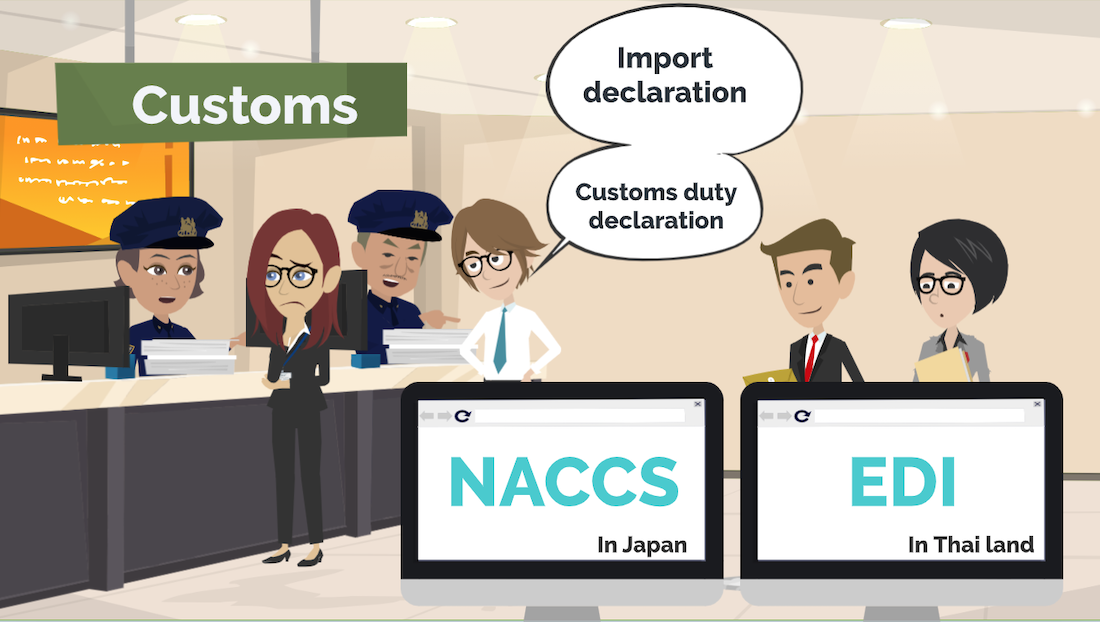

Then, normally, when processing import declaration to customs, customs duty declaration is also submitted.

This declaration will be processed on the system called NACCS in Japan. By the way, EDI,(Electric Data Interchange) is used for customs process in Thailand.

The importer is responsible for the customs duty payment, however, normally customs duty payment request is also made to a freight forwarder or a customs clearance agency, a customs broker such as a freight forwarder, when they request them to process import declaration.

Nowadays, there are some issues that the amount of customs duty, which custom clearance agency customs broker has to subsidize is too high.

Custom tariff payment in DDP

By the way, depending on the term, such as DDP, the exporter may be responsible for the customs duty payment.

When declaring payment of taxes, the name and the quantity of products, invoice, packing list, shipping document and certificate of origin need to be presented.

What if custom declaration is incorrect?

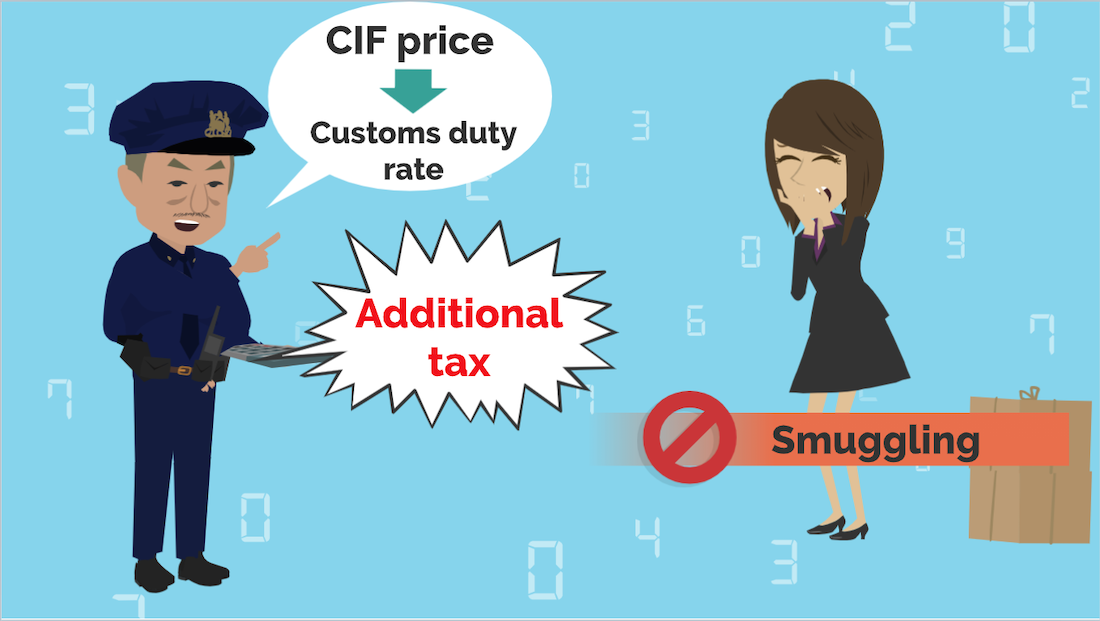

The customs duty rate is calculated based on CIF price, and the actual price is decided.

However, if the content of declaration is incorrect and if any specific products are not declared, an additional tax on underpayment or an additional tax for no return for undeclared item may be imposed by customs.

The content of the declaration must be correct. If you do not declare on purpose, this will be treated as smuggling.

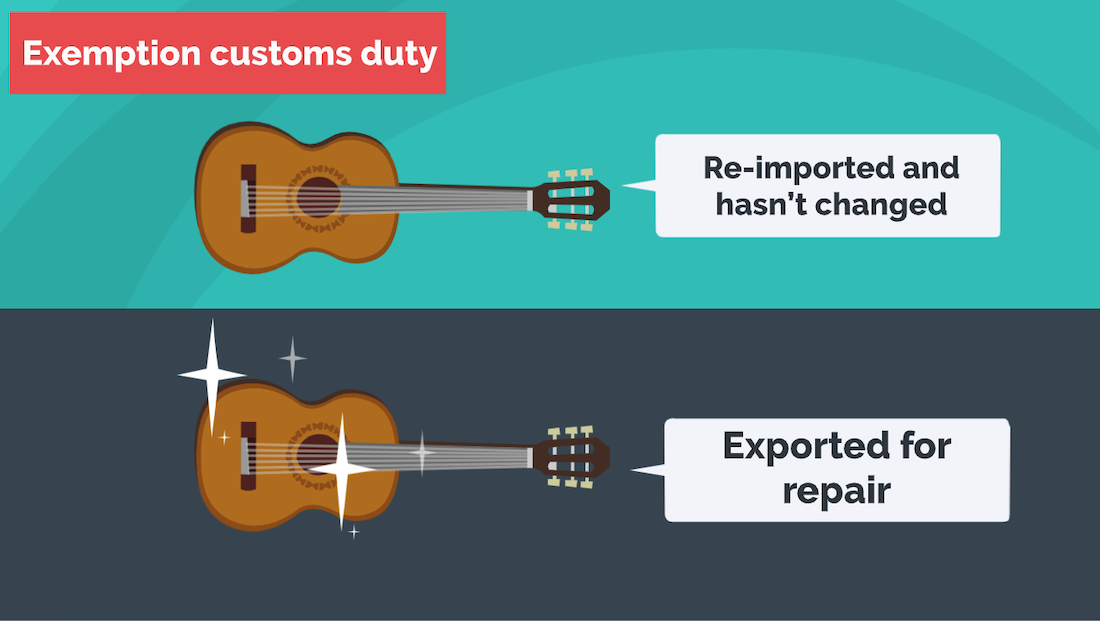

The case custom tariff is exempt

On the other hand, there are cases when the customs duty is exempt.

For example, if cargo is re-imported and it hasn’t changed its quality and shape, and also, if cargo is exported for repair may be exempt for customs duty as well.

If the invoice shows the price of tens of millions of yen, customs duty will be imposed for millions of yen.

If a preferential tax rate, conventional tax, and tax exemption scheme is used, there will be millions of yen difference for payment.

There are different types and rate for custom duty. -such as basic tax rate, preferential tax rate. They are related to the law and policies.

It is necessary to make correct judgment to identify, which declaration is applicable to the specific type.

The process includes the declaration for import customs duty, so the import customs duty clearance process needs to be completed with care.

Summary

Let’s summarize today’s topic.

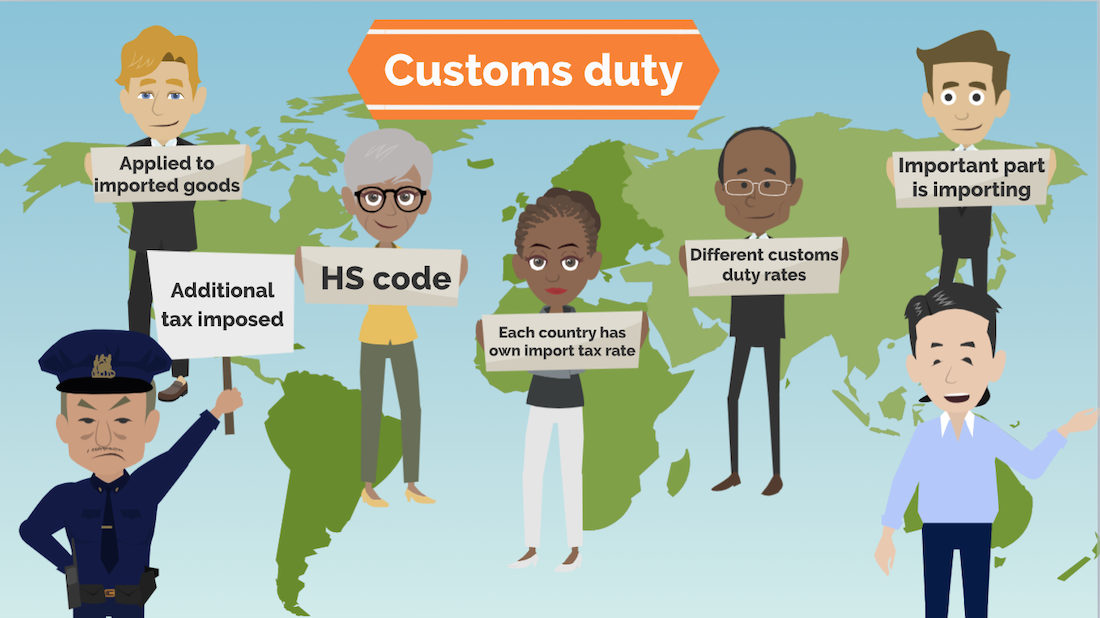

Customs duty is a global tax, which is applied to imported goods to protect the importing country’s industry.

HS code is used to classify common products, and each country has its own import tax rate for goods.

There are different customs duty rates, such as, basic general tax rate, preferential tax rate which is applicable for specific origin of the products, and conventional tax rate.

Customs duty declaration is completed when clearing customs for import or export at customs, and the most important part is the importing country’s customs declaration.

Depending on the content, customs duty may be exempt, but if there is an error of underreporting, an additional tax may be imposed.

This will affect an importer’s cost, so you need to pay extra attention for customs duty.

That’s all for today. Thank you.

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!