Neko Senpai

Neko Senpai The Flow of Good, Document, Money in Marine Transportation!

Video of This Article

Kamome Senpai

Kamome Senpai This is 10:17 video!

Hello, it’s IINO.

In this video, I would like to explain about export operations.

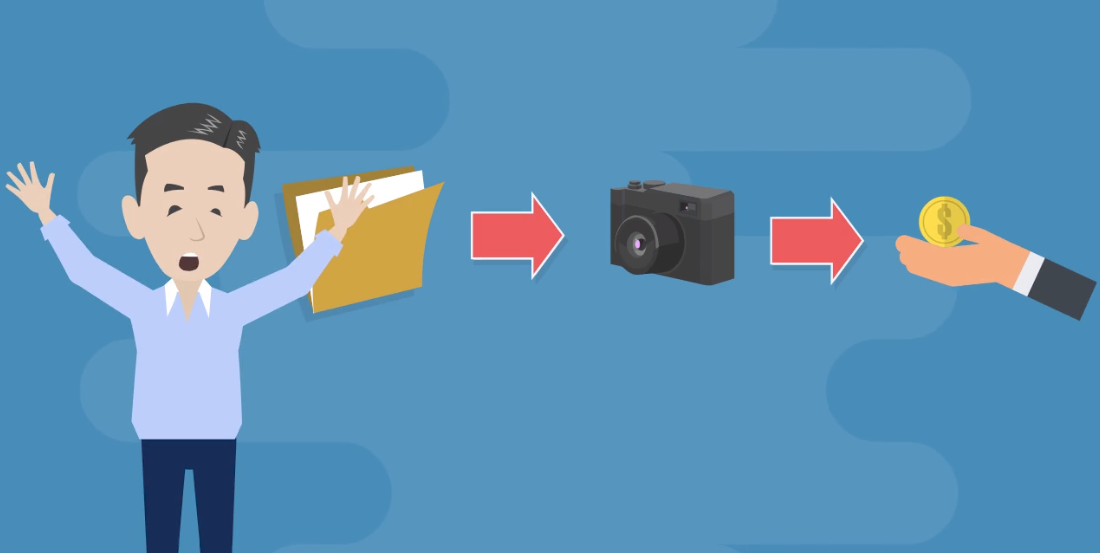

In international transportation, it is essential to understand the flow of “goods”, “documents” and “money”.

A rough explanation of the flow of the process is that there is an exchange of “documents”, such as contracts and shipping documents, at the beginning.

Then the “goods” are shipped and the “money” is received.

However, this may be difficult to understand, so I will explain it in an easy-to-understand manner in this video.

The flow of “money” this time is “L/C transaction”.

A detailed video on L/C transaction made earlier is linked in the overview section.

Letter of Credit (L/C) Process! Explained L/C transaction process with Flow Chart.

Flow of “goods”

First, let me explain the flow of “goods”, products.

There are two methods of transportation, sea and air. In general, 90% of international shipments are transported by sea.

Two of the advantages of ocean transport are that it is “inexpensive” and “convenient for shipping large packages or quantities of goods.”

On the other hand, there are some disadvantages, such as “taking time” and “strict checking of declaration documents.”

Therefore, it is decided whether to use sea or air as the transportation method by discussing between the exporter and the importer the contents of the goods to be shipped and the costs involved.

In this video, I will explain about ocean transportation.

Factory ~ Bonded Area ~ Exporting

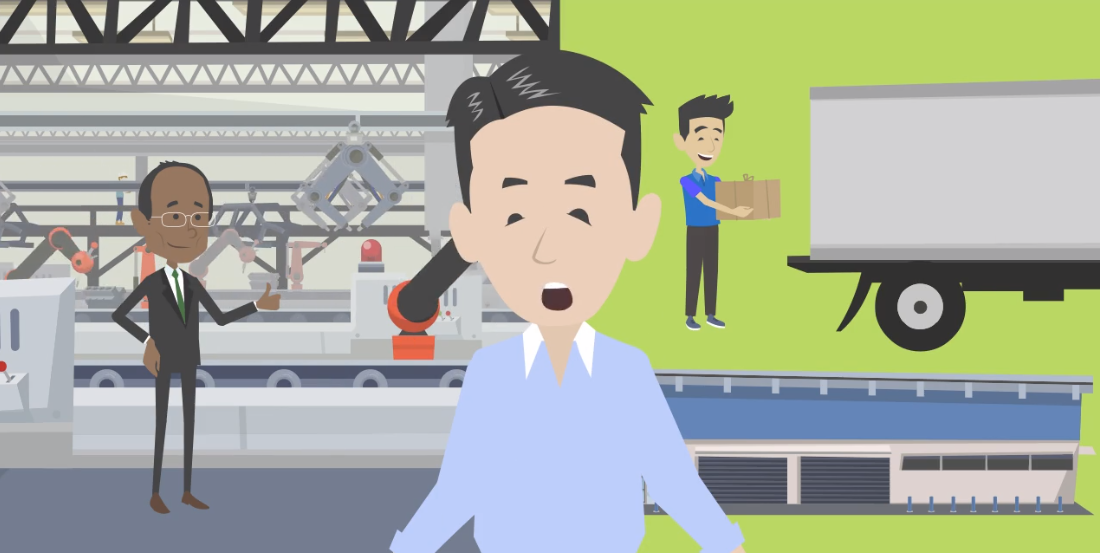

After the goods are produced and packed at the exporter’s factory, they are loaded into containers or trucks and transported to bonded areas such as CY or CFS.

The responsibility for transportation and freight charges are determined by Incoterms at the time of contract.

Incoterms are trade terms and conditions that define the scope of responsibility and cost between an exporter and an importer in conducting trade.

As of 2021, “Incoterms 2020” is in use.

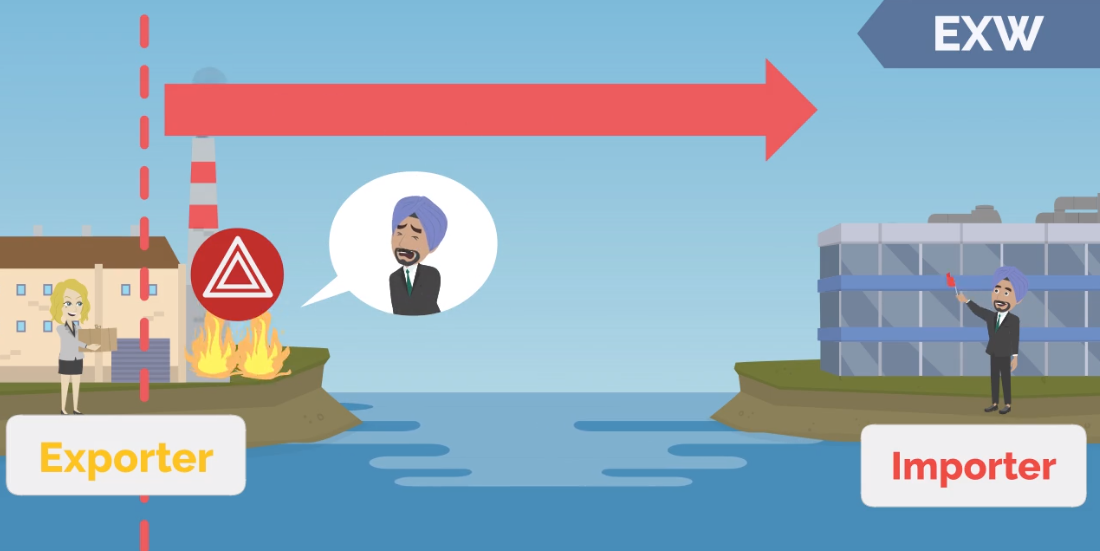

Let’s take the case of EXW as an example.

Once the exporter hands over the goods to the importer at their factory, all responsibility is transferred to the importer’s side.

Therefore, if any damage occurs to the goods between the factory and the bonded area, the responsibility will be borne by the importer.

Once the goods have been transported to the bonded area, they will be delivered after receiving an export license from the customs office and the shipping procedure will proceed.

About Bonded Area

The following is a brief explanation, of bonded areas related to exports.

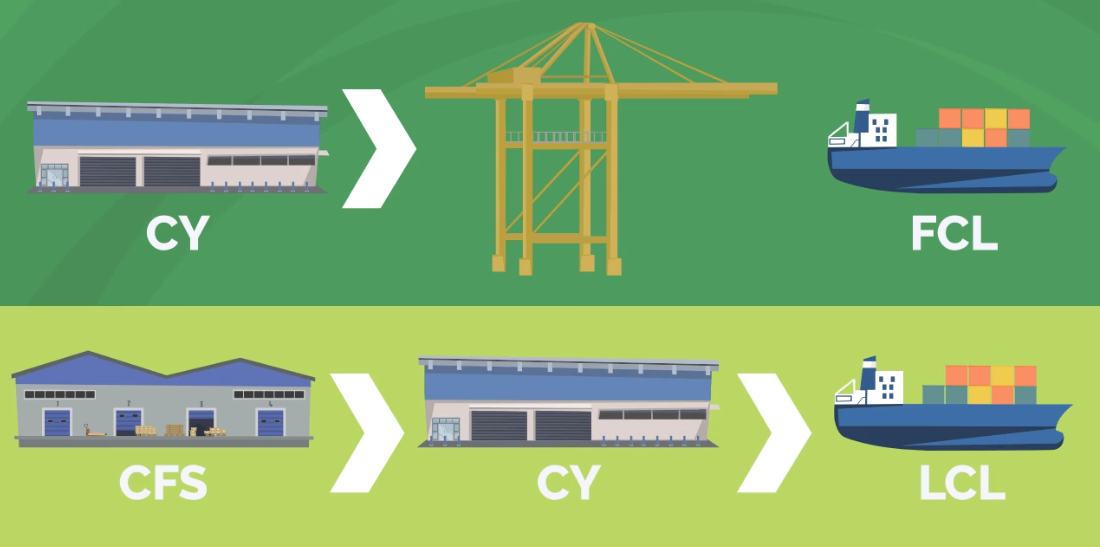

In case that the goods are FCL cargo, they are dispatched from CY, container yard, and loaded onto the vessel by gantry crane.

If it is LCL cargo which is small cargo less than one container unit, it is mixed with other LCL cargo at the CFS, Container Freight Station.

After that, transported to the CY to be loaded onto the vessel in the same way as FCL cargo.

After departure from the vessel, the “goods” are transferred to the importing country and the export is completed.

Flow of “documents”

Next, I will explain the flow of “documents”, shipping documents.

Shipping documents are looked over by forwarders and customs agents on a daily basis.

The main documents are as follows;

・Invoice

・B/L (Bill of Lading)

・Insurance Policy

・Packing List

・Certificate of Origin, (if you want to apply for EPA, etc.)

In general, the documents are prepared by the exporter.

It is easy to make mistakes in describing the name, amount and value of the goods. If there are any errors or discrepancies with the goods, there is a possibility that you cannot export.

Note that in the case of ocean transport, the decision tends to be more stringent than in air transport.

For this reason, exporters try to declare their goods in a perfect state by double or triple-checking to ensure that there are no document errors.

S/I from Exporter to Forwarder/Custom Agent

The exporter sends S/I, Shipping Instruction, to the forwarder or customs agent.

The contents of S/I are related to the work to be requested, cargo information, shipping documents and Booking information (ETD, vessel, VOY, etc.). The format varies from exporter to exporter.

B/L issued after the ship leaves port is based on the information contained in S/I.

Export Declaration besed on S/I

The forwarder or customs agent makes an export declaration to customs based on S/I.

Currently, many export cargoes are declared using the NACCS, in Japan.

The declaration is completed by entering the declaration information in NACCS and sending it to customs.

In case of Japan with NACCS, after declaring, the following three categories will be output.

Category 1: Expedited Screening, export license is granted immediately after filing the declaration

Category 2: Document Examination, documents need to be submitted

Category 3: Inspection, customs officers will visit the bonded area for physical inspection

Most of the shipments will be classified as Category 1.

However, if the customs decides to classify the shipment as Category 2 or 3, it will take some time to obtain a permit.

Therefore, if the cargo is urgent, follow the instructions of the customs office to get the permit as soon as possible.

Submit Shipping Documents to Shipping Company

Forwarders and customs agents prepare shipping documents (Dock Receipt, CLP, etc.) and submit them to shipping companies.

Dock Receipt is prepared based on S/I according to the shipping company’s format.

CLP, Container Load Plan, is created by the shipper to clarify what is in what position in the container.

B/L from Shipping company to Forwarder/Custom Agent

The shipping company issues B/L and hands it to the forwarder and customs agent.

If the Incoterms is CIP, CPT, DAP, in which the exporter is responsible for the ocean freight, the exporter can receive B/L, by paying the freight cost to the shipping company in advance.

However, in general, the forwarder advances the freight charges, and bills the shipper later.

At this time, double check that B/L is issued as per the information on S/I.

Also, since this is a container ship, make sure that the “On Board Notation” at the bottom of B/L is dated and signed by the shipping company or agent.

In the case of L/C transaction, “On Board Notation” have value as a guarantee that the goods are properly loaded on the ship and headed for the port of import.

Thus, it is important to be aware of this.

Shipping Documents from Forwarder/Custom Agent to Exporter

Forwarders and customs agents hand over the shipping documents, such as export license and B/L, to the exporter.

The exporter sends the importer the shipping documents and S/A, Shipping Advice, to let them know that the shipment has been completed.

It is fine to send S/A twice by email, once when the schedule is decided and once when the ship leaves port.

The importer receives S/A and documents and prepares to pick up the shipment.

Documentary Bill from Exporter to Bank

The exporter presents “Documentary Bill” together with the shipping documents to the bank and requests the purchase.

Once Documentary Bill and L/C are verified, settlement is made. And the goods are delivered to the importer, the export is complete.

Flow of “Money”

Finally, I will explain about “money”, payment.

This time, I will explain the flow of payment in L/C transaction. L/C is an abbreviation for Letter of Credit.

Adbantages of L/C Transaction

L/C transaction makes, the exporter can receive the payment once the goods are shipped. So it avoids the situation where the goods are sent but no money is received.

The importer, on the other hand, does not have to pay for the goods before receiving them thus eliminating the risk of loss of payment.

L/C transaction is a method that has great advantages for both parties.

Checking Documentary Bill with L/C

In the case of L/C transaction, the payment appears after shipping is loaded.

After loading, the exporter requests Exporter Side Bank to purchase Documentary Bill which is various shipping documents, such as B/L.

At this time, if the contents of Documentary Bill match L/C, the transaction will be settled.

Remittance of Payment

Then, Exporter Side Bank sends Documentary Bill (shipping document) to Importer Side Bank and receives remittance of payment from Importer Side.

Importer Side Bank notifies the importer of the arrival of the shipping documents and requests payment, then the importer pays the bank.

Importer Side Bank remits the payment to Exporter Side Bank to complete the process.

Summary

What did you think?

In exporting, “goods”, “documents” and “money” are intricately intertwined and play different roles.

In the beginning, it may seem a little complicated. However, after a few times of practical experience, you will gain a deeper understanding and feel the joy of export business.

That’s all for this time. Thank you very much!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!