Neko Senpai

Neko Senpai About D Group Revised Ver.!

Video of This Article

Kamome Senpai

Kamome Senpai This 6:34 video!

Hello, it’s IINO.

In this video, I would like to explain D Group of Incoterms.

In the current Incoterms 2020, there are three types of terms and conditions of trade that begin with the letter D, DAP, DPU, DDP.

What Incoterms is

First of all, let’s have a brief explanation of Incoterms.

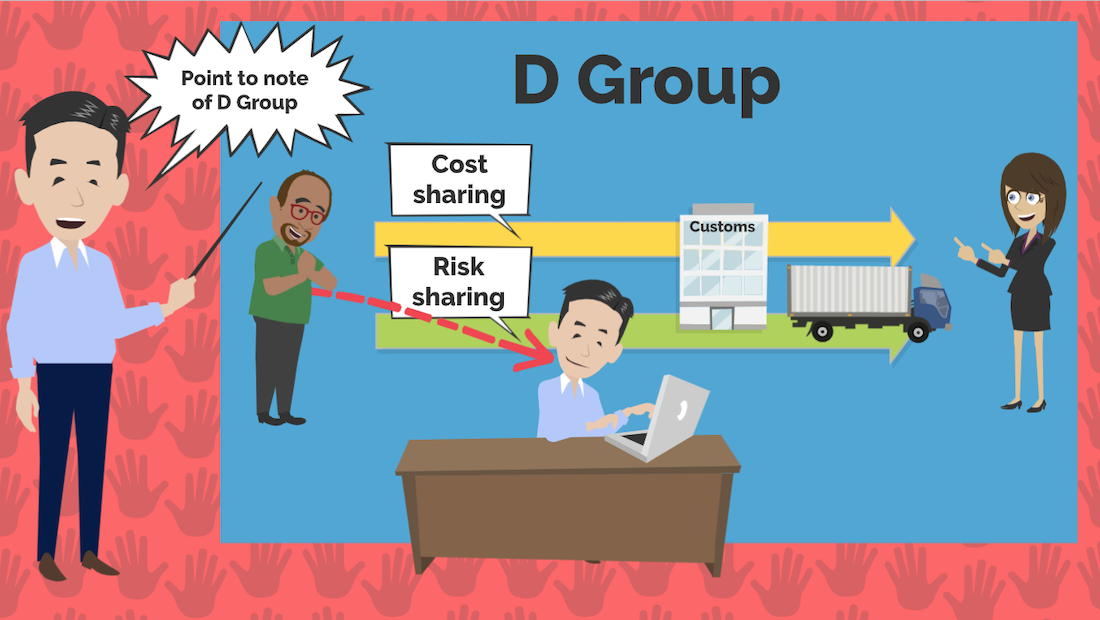

Incoterms are trade terms and conditions that stipulate the scope of “cost sharing” and “risk sharing” between a seller (exporter) and a buyer (importer) in a trade transaction.

The D in D Group is an acronym for DELIVERY and a condition that includes delivery within the importing country as arranged by the exporter.

Therefore, in conditions, the importer only needs to receive the cargo or clear import customs. It means that the importer is not burdened by the trade arrangements.

About DAP

First, let’s talk about DAP which stands for Delivered at Place.

In DAP, the exporter bears the cost and risk of the goods up to the point where they are unloaded at the designated place of import.

The key point here is “until before unloading”. The exporter is not obligated to unload and the importer is responsible for any risks during unloading.

Arrangements for import customs clearance and taxes including duties and consumption taxes are the responsibility of the importer.

About DPU

Next, DPU stands for Delivered at Place Unloaded.

The cost and risk of DPU shipments are borne by the exporter “until unloading is completed” at the designated place of import.

Import clearance is the responsibility of the buyer and the exporter is not obligated to arrange for import clearance.

The difference between DAP and DPU is the cost and responsibility of unloading.

About DDP

Lastly, there is DDP which stands for Delivery Duty Paid.

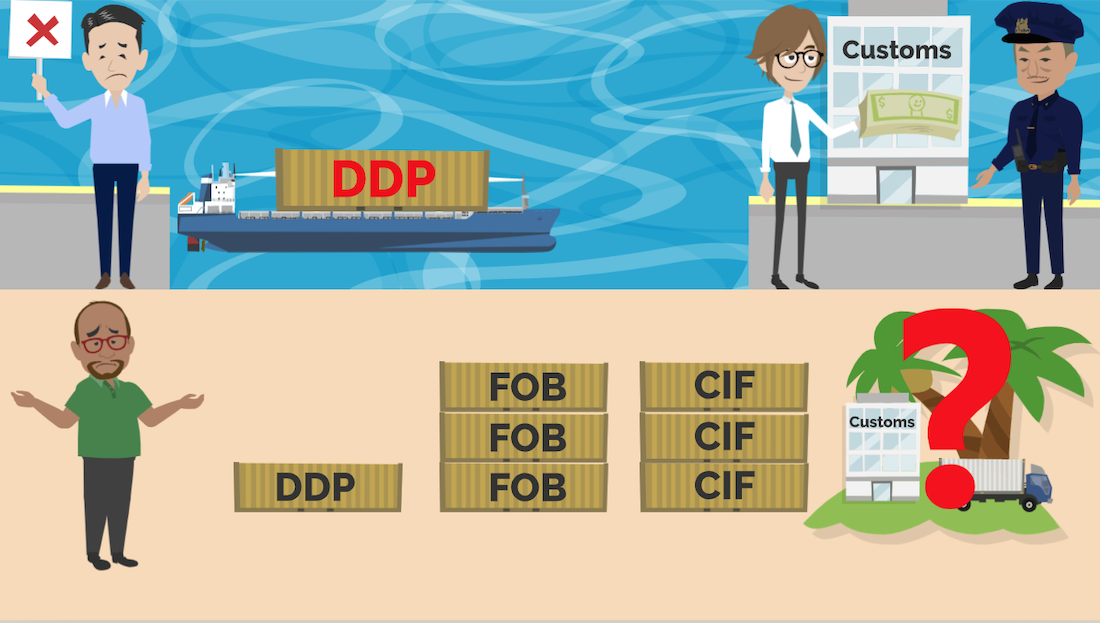

DDP is a transaction term in which the exporter as the seller bears all costs and risks until delivery is completed. This is the easiest transaction for the buyer, the importer.

With DAP and DPU, the importer is responsible for customs clearance arrangements. However, with DDP, the exporter is for both customs clearance arrangements and taxes.

Points to Note of D Group

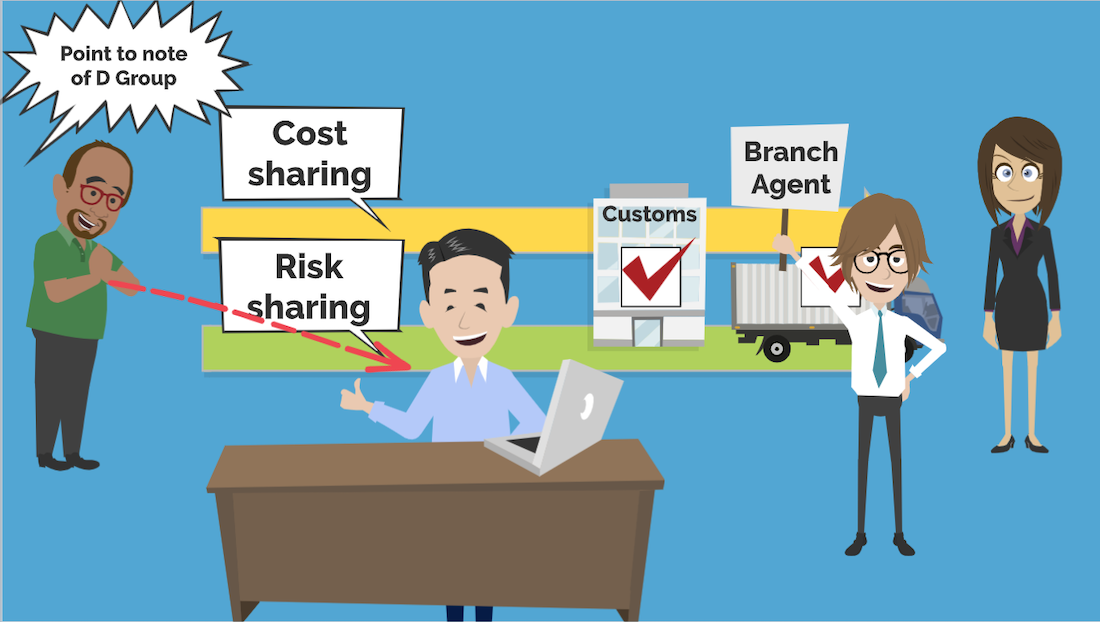

I will explain what to expect when actually using the D Group.

In D Group, the exporter arranges for the cargo to be delivered to the destination specified by the importer.

In this case, the exporter actually makes a request to the forwarder and the forwarder makes arrangements for detailed delivery and customs clearance to the import destination.

The key point here is whether the forwarder is able to arrange logistics and customs clearance to the destination country without any problems.

If the forwarder does not have a branch or agent in the area where the cargo will be shipped, it will be difficult for D Group to make arrangements.

If it is DDP condition, there are cases where the forwarder will temporarily advance the customs duties, due at the time of import. Therefore, whether or not they can handle it depends on the amount of taxes.

It is rare that an exporter in another country is better at arranging transportation and customs clearance in the importing country. It can be said that D Group transactions are less common than FOB or CIF.

Use of Courier

However, for transportation by courier, D Group’s terms of trade are common. Couriers are often used to transport samples and small shipments.

Since a courier such as DHL would deliver the goods to the destination in case that the exporter bears the cost, it is easy to arrange for D Group.

About DDU and DAT

I have explained DAP, DPU and DDP. These three terms of trade are the ones listed in Incoterms 2020.

And Incoterms are subject to revision every 10 years.

In the current Incoterms 2020, DDU and DAT of D Group conditions which have already been abolished are still seen in practice. Thus, I would like to introduce them together.

About DDU

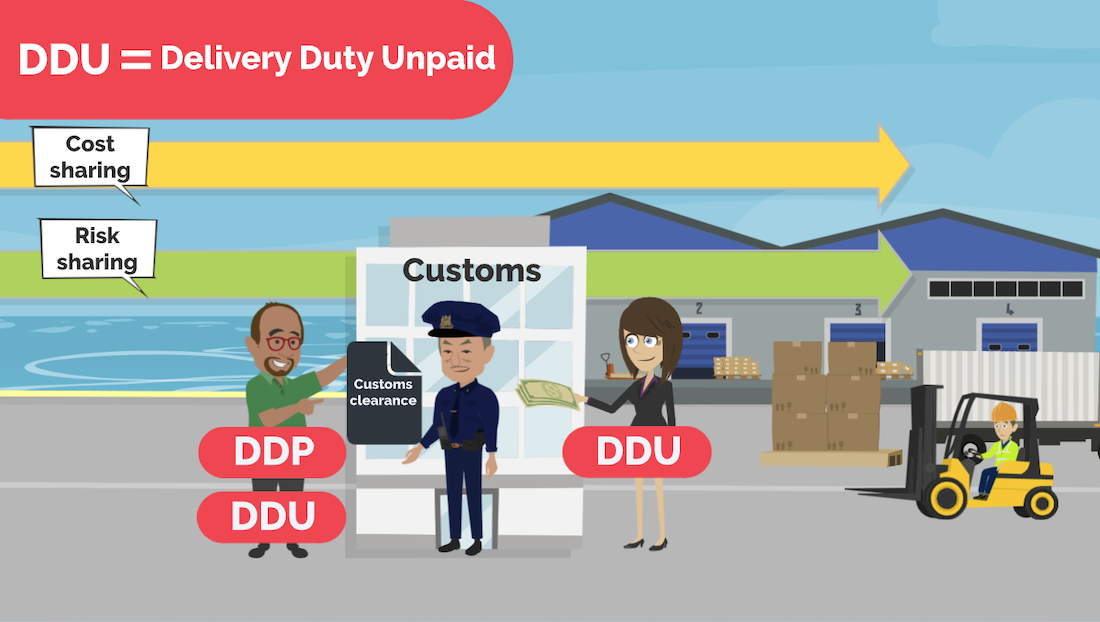

DDU means Delivery Duty Unpaid.

DDU is very straightforward when compared to DDP. In DDP, the exporter is also responsible for duties and taxes, while in DDU, the importer is responsible only for duties and taxes.

Unlike DAP and DPU, customs arrangements are both handled by the exporter.

About DAT

DAP means Delivery at Terminal.

The handover and risk liability transfer takes place at the import terminal. This has been replaced by DAP which is handover at the designated location.

Actual Transaction of DDU and DAT

In Incoterms 2020, ICC, International Chamber of Commerce, recommends the use of DAP instead of DAT, but it is only a recommendation.

In trade, if there is a clear agreement between the buyer and seller, any problems that may arise in the transaction can be resolved through discussion.

Therefore, if the contract or Invoice says DDU or DAT and the seller and buyer agree to it, there is basically no problem.

Summary

In this video, I have explained about D Group of Incoterms.

D Group is a condition that is less burdensome for the importer, but as I explained, some forwarders may have difficulty handling it.

If you are approached about shipping in D Group, it is a good idea to consult with the forwarder you are doing business with beforehand.

If you found this useful, please subscribe to my channel, like it and share it on social media!

See you again in the next video. Thank you very much!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!