Senior Cat

Senior Cat About DAP,DPU and DDP

Video of This Article

Senior Seagull

Senior Seagull This is 6:53 video.

This time, let’s look at DAP,DPU,DDP, of Incoterms 2020 Group D. Incoterms rules have been revised in 2000, 2010, and 2020, to ensure that the trade terms are clearer.

However, the terms DDU and DAT which are already abolished are still being used in commercial practices.We will now focus on the latest Incoterms 2020 Group D.

Definition of INCOTERMS

First of all, let me explain briefly about Incoterms. Incoterms are the terms and condition of cost and risk responsibility, for a buyer and a seller in trading business.

Please remember, it is an international trading condition for a buyer and a seller, which set clear responsibility range for the cost and the risk.

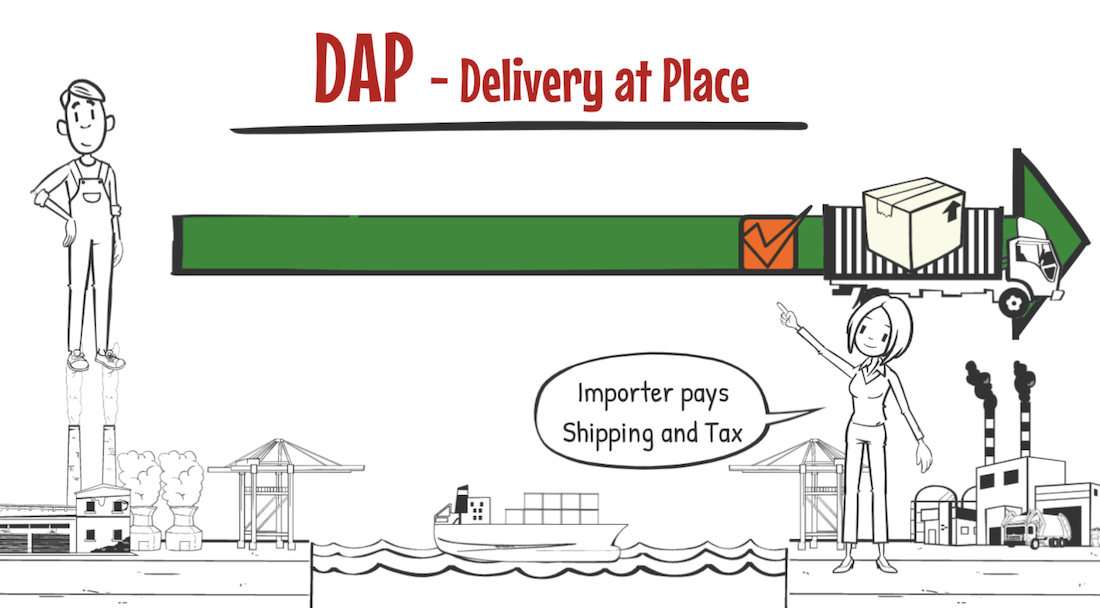

DAP – Cost & Risk

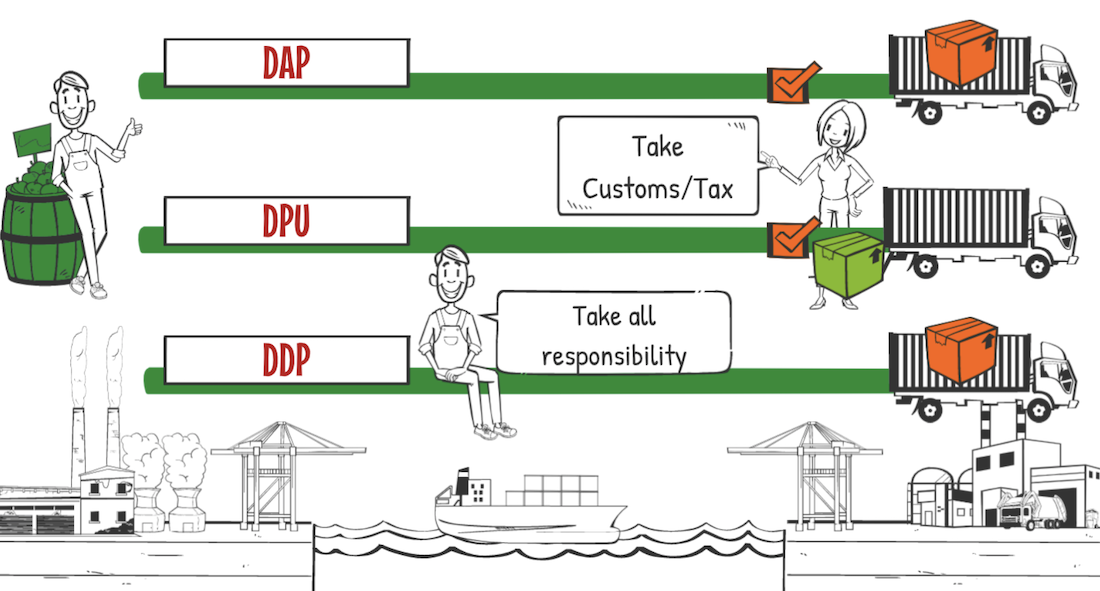

Let’s take a look at the meaning of DAP, DPU, DDP terms, and cost and risk responsibility.

The first term is DAP. DAP is a short form of “Delivered at Place”.

It means a cargo is delivered to the designated location.

With DAP, an exporter will take the responsibility for the cost and the risk, until the cargo is delivered at the designated importing location before being unloaded.

Therefore, the exporter does not have the responsibility to unload the cargo. The buyer is responsible for the risk of unloading.

An importer is responsible for charges, such as import customs clearance, duty and tax. We have another video which briefly explains DAP and provides a better understanding.

But this is the explanation in detail.

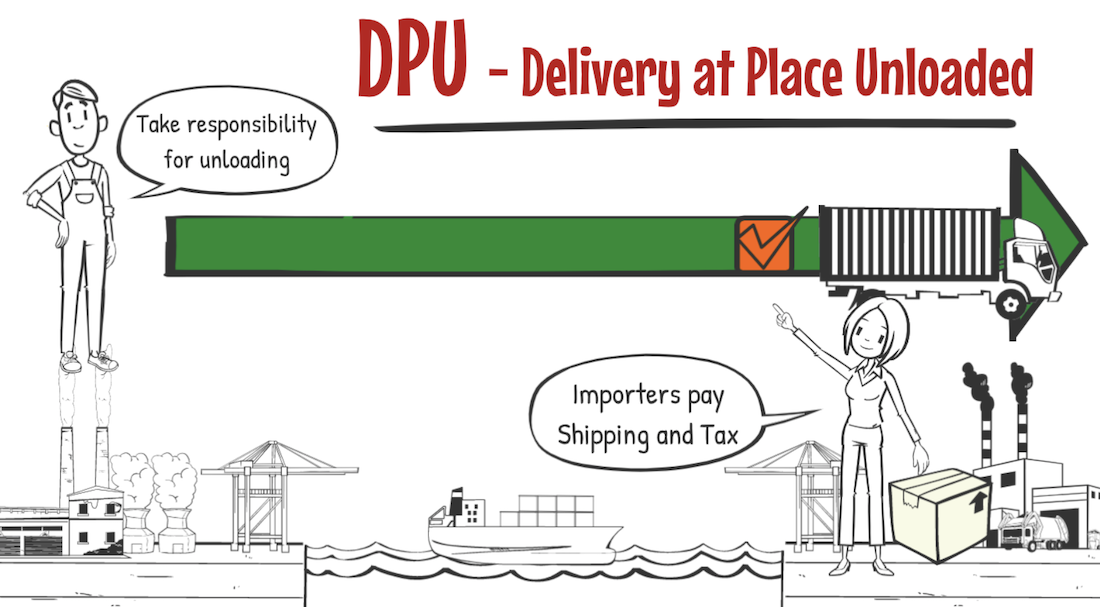

DPU – Cost & Risk

The second term DPU is a short form of “Delivered at Place Unloaded”.

It means cargo is delivered and unloaded at the designated location.

With DPU, an exporter takes responsibility of the cost and risk, until the cargo is delivered and unloaded at the importing designated location.

The buyer is responsible for import customs, and the exporter does not have responsibility for this.The difference between DAP and DPU is “the responsibility of the cost and the risk of unloading”.

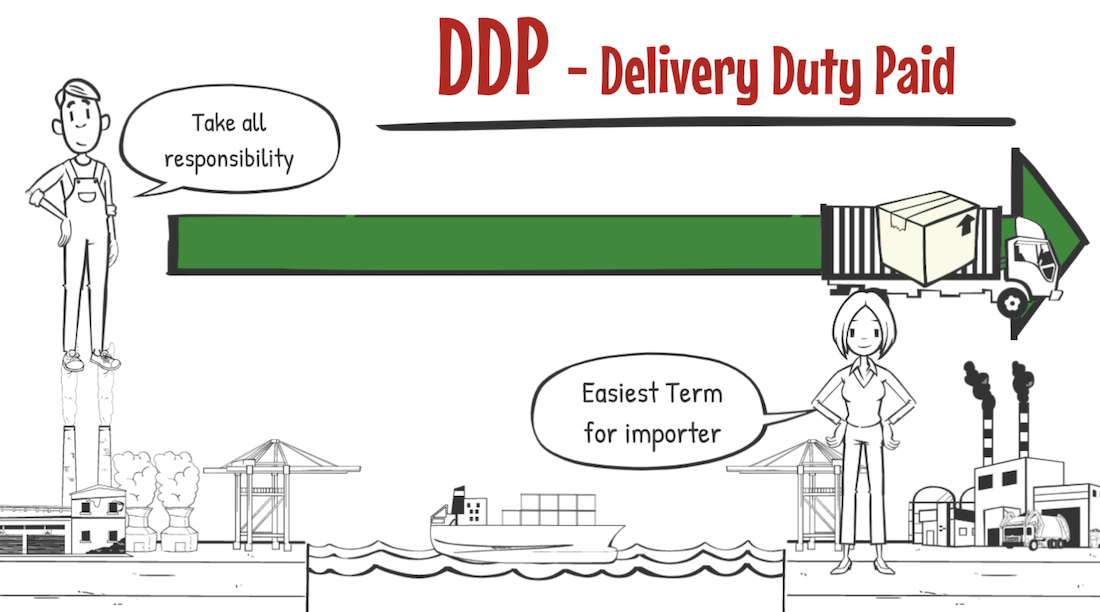

DDP – Cost & Risk

The third term DDP is a short form of “Delivery Duty Paid”.

It means cargo is delivered and to the designated location with custom duty paid.

With DDP, a seller is responsible for the entire cost and the risk, until the delivery is completed. It is the easiest term for a buyer who imports cargo.

With DPU and DAP, the custom charge are the responsibility of a buyer, but with DDP, a seller is responsible for customs and taxes. The following illustration explains the cost and risk responsibility of Group D.

Cost & Risk responsibility – INCOTERMS D Group

A buyer is responsible for unloading cargo with DDP.

If you are a buyer and transporting machine which is difficult to unload, you should choose the DPU term. With the DPU term, an exporter takes the responsibility of unloading.

How to write the term on Invoice?

With Group D of Incoterms, it is important to clearly instruct the location of unloading. The term should be recorded on a contract and an invoice in the following format.;

DPU, DAP, DDP plus “address”, and Incoterms2020.

For example, DPU ABC Warehouse Shinagawa Incoterms2020

Do not put the name of the port and the area on the address. However, you do need to specify the location.

Need cooperation with the local agents

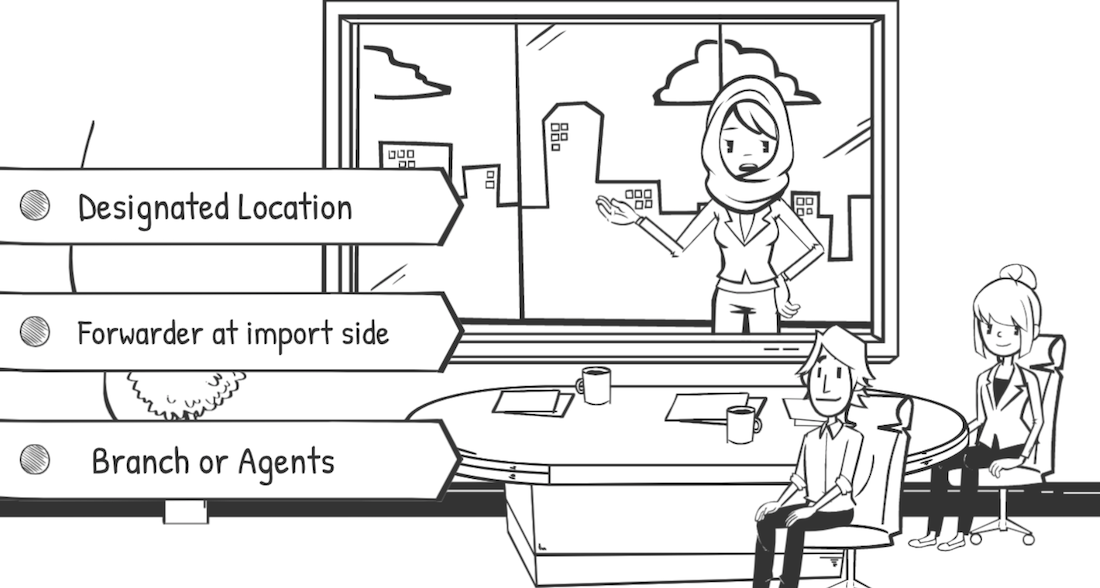

Group D requires a seller to arrange transport for the cargo to the designated location instructed by an importer, (buyer). Therefore, the seller, (exporter) needs to be familiar with the importing locations.

You will need a freight forwarder in an importing country. You need to check if your freight forwarder has a branch or agents in the exporting countries.

If they don’t, you will not be able to make arrangements for the delivery, and you will not be able to use group D terms. You will need to use CFR and FOB terms.

There is limit of advance payment for Tax

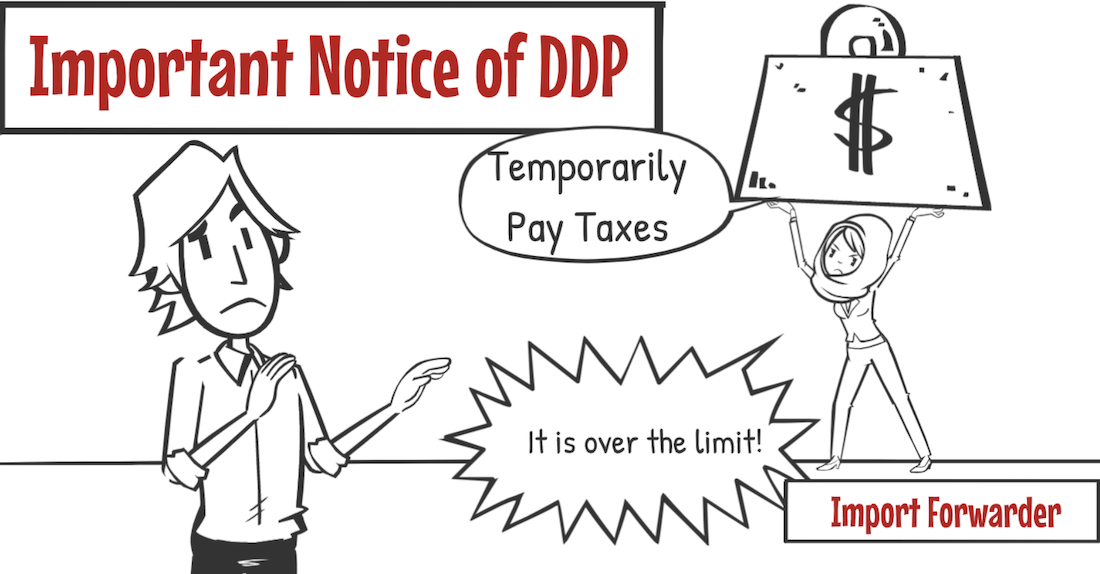

Now, let me explain an example of what you need to be careful of with a freight forwarder, in an importing country when using DDP.

With DDP, an exporter is responsible for the payment of custom duty and tax for import.

However, this tax is paid temporarily by the freight forwarder in an importing country, and the invoice will be sent to the freight forwarder in an exporting country.

If the amount of tax is high, it will become an issue. Some freight forwarding companies in an importing country may have a maximum limit of temporary payment.

The relationship between a freight forwarder in an importing country and in an exporting country is also important.

If you work for a branch company and are new to the business, you will probably be refused for a higher temporary payment.

Therefore, when a freight forwarder in an exporting country is requested to use the DDP term, They need to send an invoice to an importing country in advance, to discuss about the temporary payment for tax.

No more use of DDU and DAT?

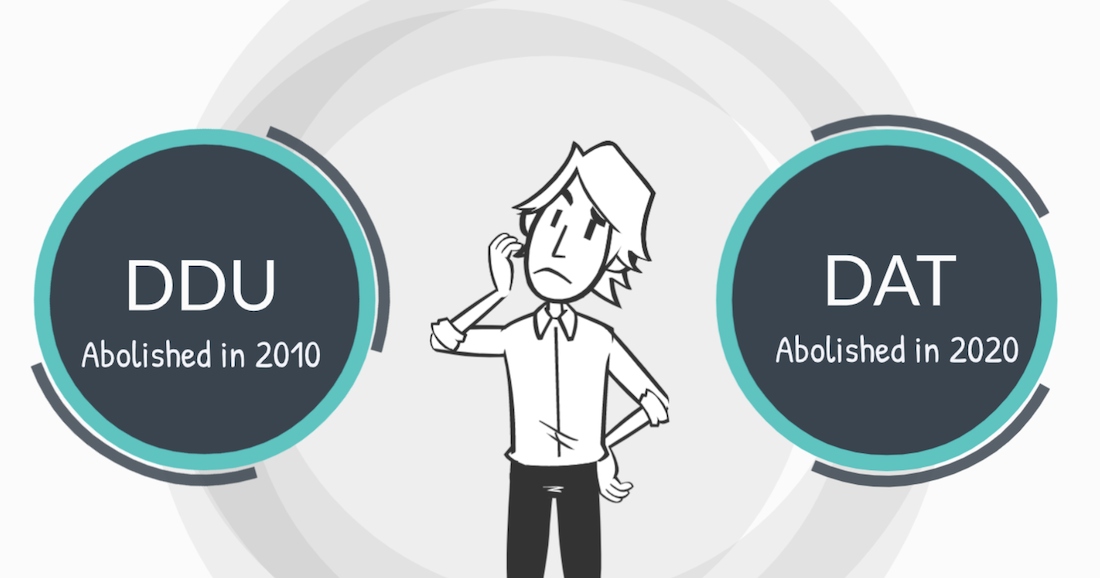

Can abolished terms such as DDU and DAT from Incoterms 2010 and 2020 be used anymore?

Yes, they can still be used.

We sometimes see the invoice showing DDU term on our customer’s invoice.

Incoterms is not law, it is terms and conditions used to create smooth business between a seller and a buyer.

In Incoterms 2020, the ICC recommends for everyone to use DAP instead of DAT.

However it is only a recommendation.

In trading, as long as there is a clear agreement between a seller and a buyer, they can solve any trading issues through discussion.

Therefore, if DDU and DAT are written on a contract and on an invoice, and a seller and a buyer have an agreement, there is no issue.

Summary

We have checked Incoterms 2020 Group D terms.

New incoterms rules have been introduced, but abolished terms like DDU are still being used from Incoterms 2010 in business practices.

As we explained, Incoterms is only a rule which support the agreement between a seller and a buyer. It is not compulsory. However, it is essential as a logistic representative to understand the latest information.

This will make it easier to make a clear business arrangement with your customers.

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!