Neko Senpai

Neko Senpai Explanation of L/C Contents !

Video of This Article

Kamome Senpai

Kamome Senpai This is 8:50 video!!

Hello, it’s IINO.

In this video, I would like to explain about “L/C” which is used for the settlement of trade transactions.

What L/C is

L/C is an abbreviation for Letter of Credit. It is a letter of guarantee from the bank on behalf of the importer to guarantee payment of the cargo price.

The exporter is required to prepare and present the documents listed in the L/C to the bank.

All L/C are written in English. Therefore, if you are not good at English you may feel a little intimidated.

In trade practice, people tend to think that “checking L/C” is just checking documents. However, I personally think it is a difficult task because it requires understanding of L/C terms and conditions clearly stated in English.

Advantages of L/C

L/C settlement has the advantage of avoiding the following three risks in trade transactions.

1. Risk of obtaining goods

2. Risk of collection of payment

3. Risk of financial burden

Especially these three risks are high for first-time trading partners.

In case that it is deferred payment, the exporter may wonder “I have shipped the goods, but will the importer really pay for them?”

On the other hand, in case that the payment is settled in advance the importer is left wondering if the exporter will actually send the goods.

As you can see, there is a financial burden on both parties whether you pay later or in advance.

However, with L/C settlement, the importer can obtain the goods and the exporter can collect the payment with a reliable bank as an intermediary.

It is used in trade transactions because it is a settlement method with advantages that relieve both exporters and importers of mutual concerns.

L/C Contents

Now, let’s take a look at the contents of L/C.

If I were to explain all of the items, it would be an enormous amount of information, so I will focus on the items and names that I think are particularly important.

Banks

First is “Issuing Bank”. This is the bank at the importing country that issues L/C.

Issuing Bank is the exporter’s “reliance” on payments on behalf of the importer. It is necessary to thoroughly check that the bank meets the credit requirements before entering into a transaction.

Next is “Negotiation Bank”. This is the bank on the exporting side that buys the documents and bills of exchange that the exporter has prepared on the basis of L/C.

If there are any errors in the documents submitted by the exporter, the bank can refuse to buy them.

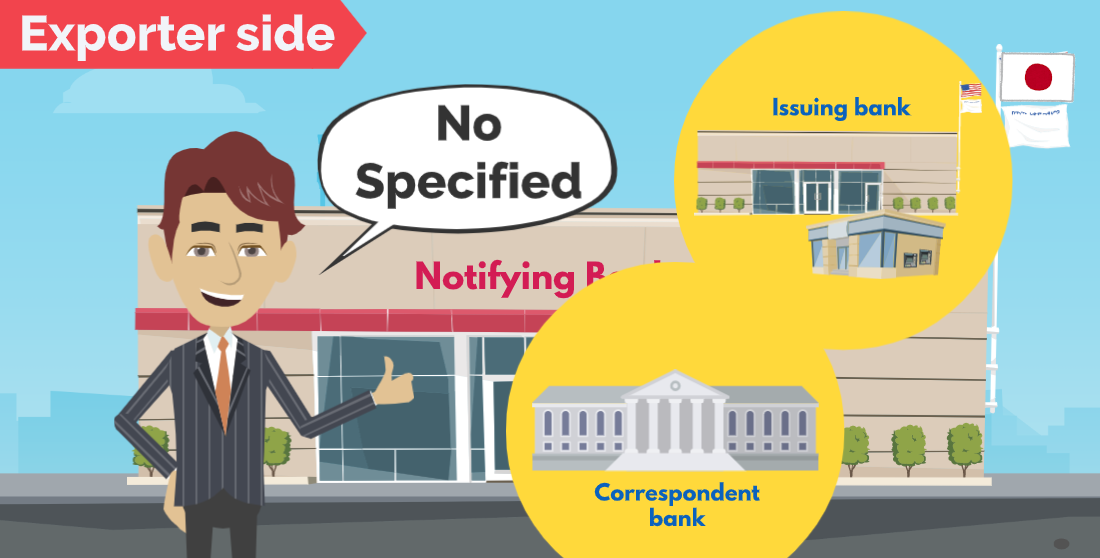

“Notifying Bank”. This is the bank at the place of export that notifies the exporter of L/C.

In some cases, it is also Negotiation Bank that purchases the bill.

If the exporter does not specify the notifying bank, it is often a branch of the issuing bank or a correspondent bank near the exporter’s location.

A correspondent bank is to facilitate foreign exchange transactions. The bank has entered into a contract with other banks across the border on necessary various terms and conditions for each other.

Applicant, Beneficiary

Let’s get on with it.

The item, “Applicant” usually refers to the importer.

It contains the company name and address.

The item, “Beneficiary” usually refers to the exporter.

As with Applicant, spelling errors are common, so pay special attention to this item.

Currency Code, Amount

“Currency Code, Amount”.

It is indicated clearly the currency and the amount of L/C.

By adding “about” in front of the amount, the amount can be increased or decreased within the range of 10%. However, if the invoice amount on the shipping document exceeds this L/C amount, it will be “discrepancy.”

“Discrepancy” refers to inconsistencies between the letter of credit terms and the shipping documents.

If it becomes “discrepancy”, Negotiation Bank can refuse to purchase the proceeds, so the exporter must be careful not to become a “discrepancy”.

Date

“Latest Date for Shipment”.

This means the last day of loading. If the shipment cannot be loaded by this deadline, it will be “discrepancy”.

“Date and Place of Expiry”.

It is the period of validity during which payment is guaranteed.

You must submit the bill of exchange and the shipping documents required by L/C as a set to Negotiation Bank within the stated deadline.

If you miss the deadline even by one day, it will be “discrepancy”.

Allowable of Partial Shipments and Transshipment

“Partial Shipments”.

This item describes the allowable split loading of goods.

It will be clearly marked as “ALLOWED” or “PERMIT” if allowed and “NOT ALLOWED” or “PROHIBITED” if not allowed.

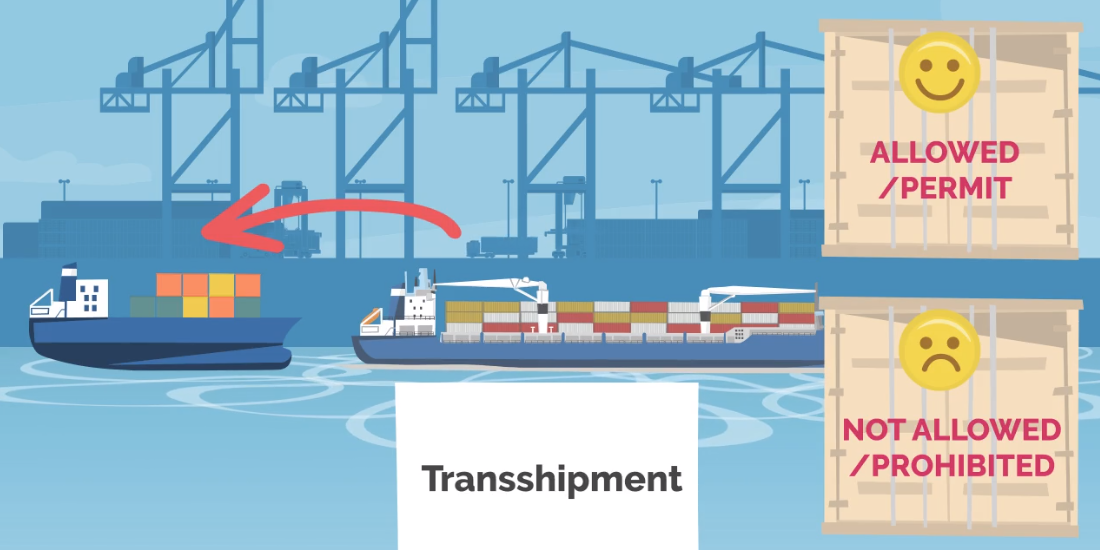

“Transshipment”.

It describes whether it is permissible to transship the cargo from the port of loading to the port of unloading to another vessel or other means of transport.

As with Partial Shipment, it will be clearly marked as “ALLOWED” or “PERMIT” when permitted and “NOT ALLOWED” or “PROHIBITED” when prohibited.

Documents Required

“Documents Required”.

It describes the conditions regarding the required shipping documents and number of copies.

In most cases, the following documents are instructed to be submitted.

Commercial Invoice

Packing List

B/L

Insurance Policy

Certificate of Origin

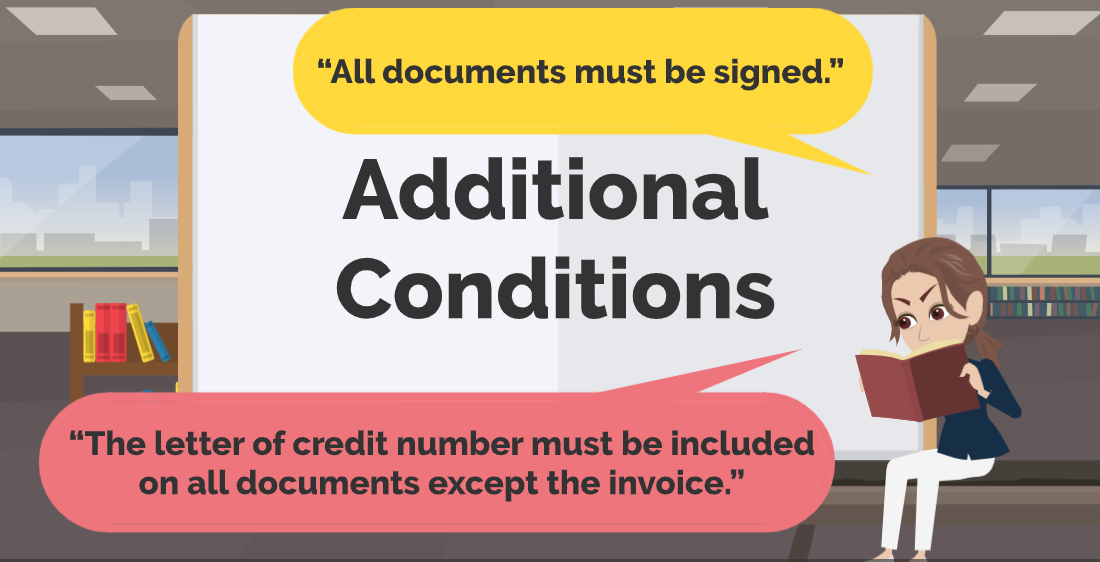

Additional Conditions

“Additional Conditions”.

Other conditions are described in this item. For example, the following conditions are listed.

“All documents must be signed.”

“The letter of credit number must be included, on all documents except the invoice.”

Period for Submitting Shipping Documents

“Period for Presentation”.

It specifies when the shipping documents must be brought to Negotiation Bank from the shipping date.

Usually, it is within 5 to 10 days. If the deadline for submission is not specified, the bank will refuse to purchase the documents after 21 days from the date of shipment.

So you need to pay attention to this date as well.

The items introduced here are only a part of L/C. You will need to read through the entire document when you actually check the contents of L/C at work.

Problems Related to L/C

Here is an example of a problem related to L/C.

You need to check repeatedly and carefully since it is an important document related to settlement. Then, submit a bill of lading, which is a set of bills of exchange and shipping documents to Negotiation Bank

You would get a call from the bank. And, they say “We can’t buy your document because it’s a ‘discrepancy’.”

A quick review of the documents reveals that the product name is misspelled.

You need immediately make a request to the importer to amend the product name. Then, you are able to collect the payment.

As you can see, even a spelling mistake of just one letter can result in the rejection of the purchase if the bank points it out.

I believe that there are many people in the trade who have experienced this kind of failure.

Summary

What did you think?

In order to avoid risks in trade transactions, a settlement method called L/C which is not used in Japan is used.

It is important to understand what L/C is what the benefits are for the exporter and importer and what the contents are.

On the other hand, L/C also has disadvantages which I will discuss in another video.

If you found this video useful, please subscribe, like our channel, share it on social media and share it on social media!

That’s all for this time. Thank you very much!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!