Neko Senpai

Neko Senpai About L/C (Letter of Credit)

Explained about L/C (Letter of Credit) by Video

Kamome Senpai

Kamome Senpai This is 8:22 video.

Hello, it’s Iino. This time, we would like to take a look at the benefit of using L/C in trading and how L/C works.

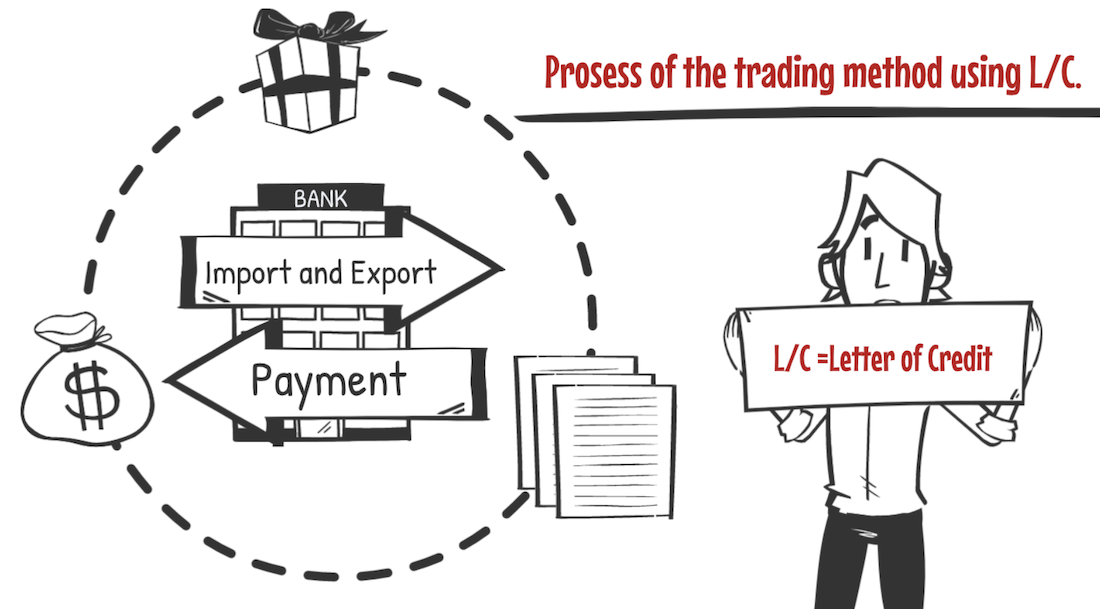

We may use L/C, “Letter of Credit” during the trading process to make payment of importing and exporting, through a bank.

When using L/C, the process of money movement, goods and documentation are different from other trading payment methods.This time, let’s learn the fundamental process of the trading method using L/C.

Purpose of L/C

When you deal with a foreign company for the first time, you need to be careful of the following.

・If they are an exporter. – are they going to make payment for the products?

・If they are an importer. – are they going to deliver the product once payment is made?

When conducting business with a new business partner, there are risks for both exporting and importing parties, due to lack of trust and experience.

In the past, I had trouble with a Malaysian company. I purchased a sample of their product and made a payment of around US$300, however, the product was never delivered.

This example is recorded on my blog page, so I will attach the link to the website in the comment section.

At that time, it was lucky that the loss was small, however, if it wasn’t a sample order, I could have made a huge loss.

L/C is used to avoid this type of problem. L/C is a letter of credit issued by a bank. The bank will make payment of the exported goods, on behalf of an importer.

The main benefit of using L/C is, that you can ensure collection of payment and receipt of goods. If an importer is unable to make payment for some reason,the bank will take the responsibility of the payment.

An exporter can ensure that they will get paid, as the bill will be processed quickly.

For an importer, they are assured that their cargo will be delivered by using L/C. Also, an importer will receive the cargo soon after they make a payment.

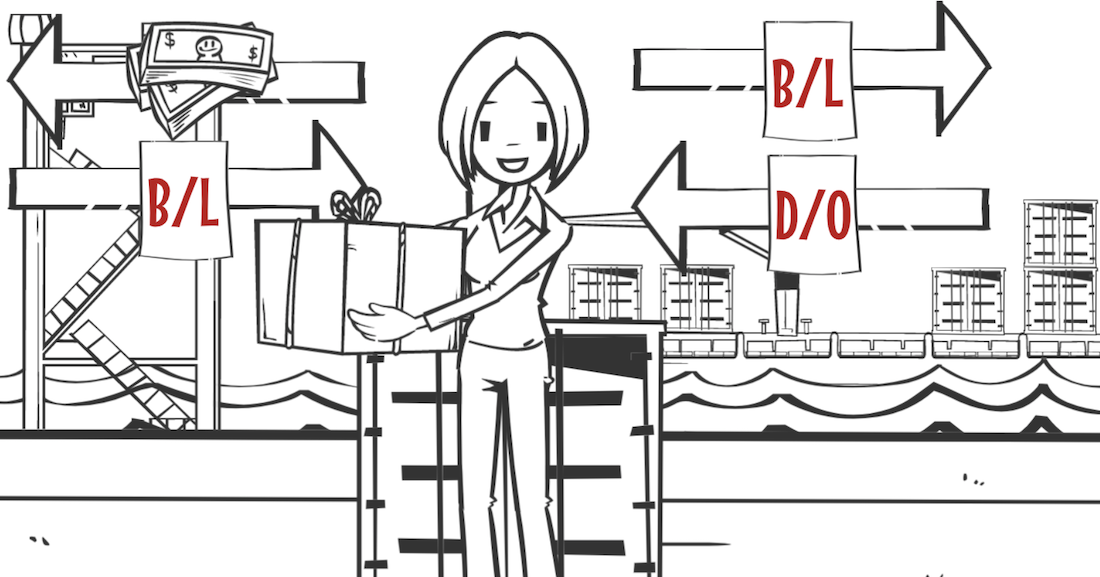

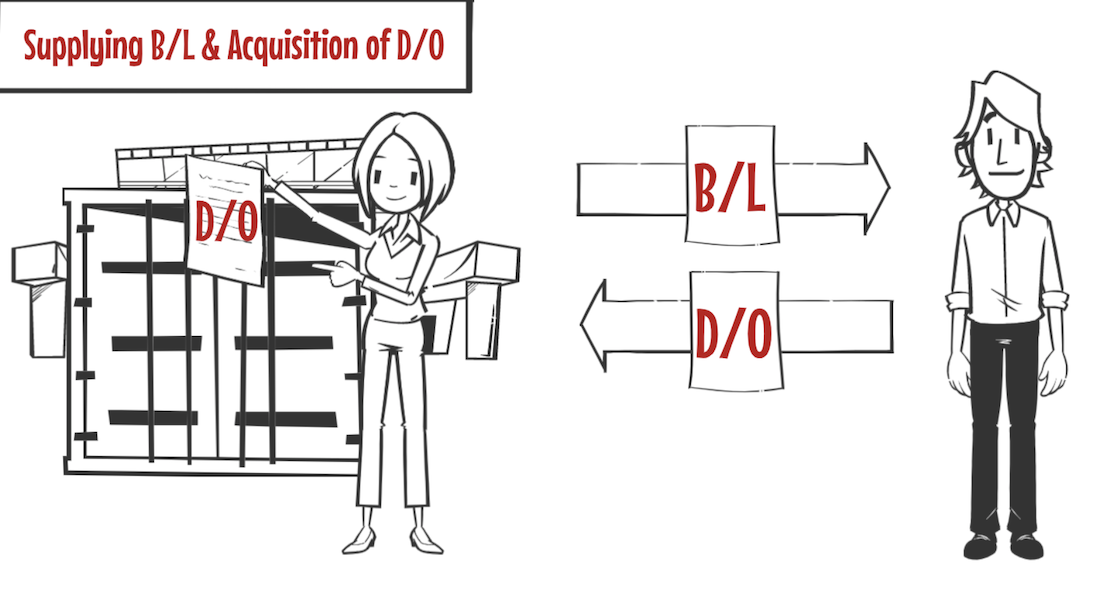

When using L/C, an importer will obtain B/L after making payment. Then, they will exchange the B/L and the D/O to receive the cargo.

The risk is reduced, as there is a minimal time gap compared to T/T in advance.

How Bank is involved in L/C

I have explained that L/C is a trading method that involves a bank. Now, I would like to explain how the bank is involved.

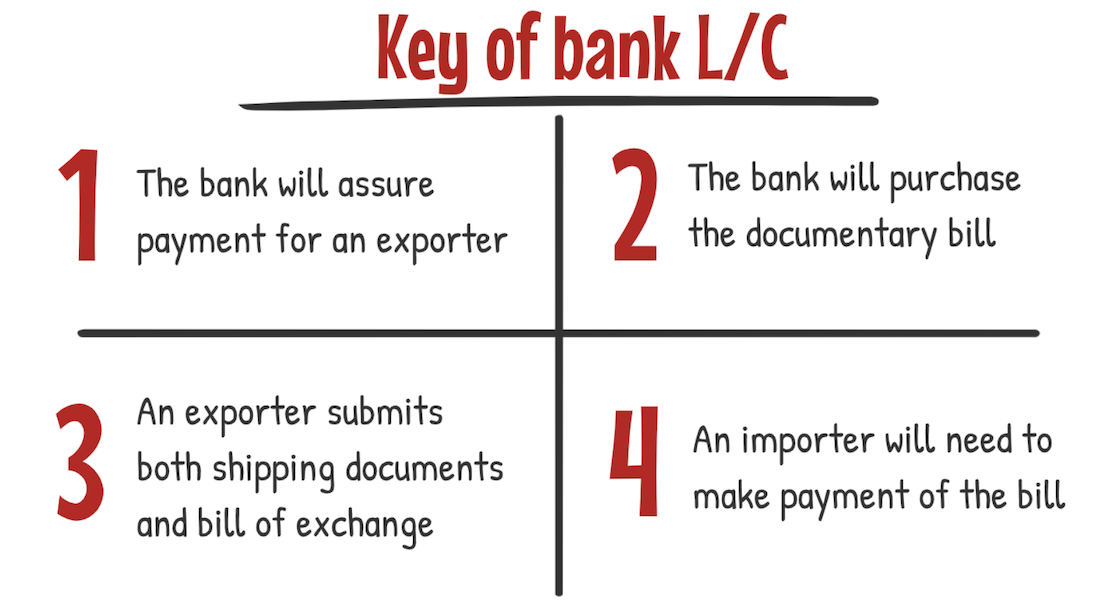

①The bank will issue a letter of credit and assure payment for an exporter, before product export arrangement is made.

②The bank will purchase the documentary bill (bill of exchange and shipping documents), when an exporter submits it.

③Unless an exporter submits both shipping documents and bill of exchange outlined in the letter of credit, the bill will not be bought.

④An importer will need to make payment of the bill, otherwise they are unable to receive shipping documents from a bank to collect the cargo.

The bank will act like a broker, for an exporter and importer to deal with their cargo, documents, and money.

L/C Business Flow

Now, let’s take a look the step by step L/C business flow. Please remember, we will be talking about.

An importer. The importer’s business partner bank.

An exporter. The exporter’s business partner bank.

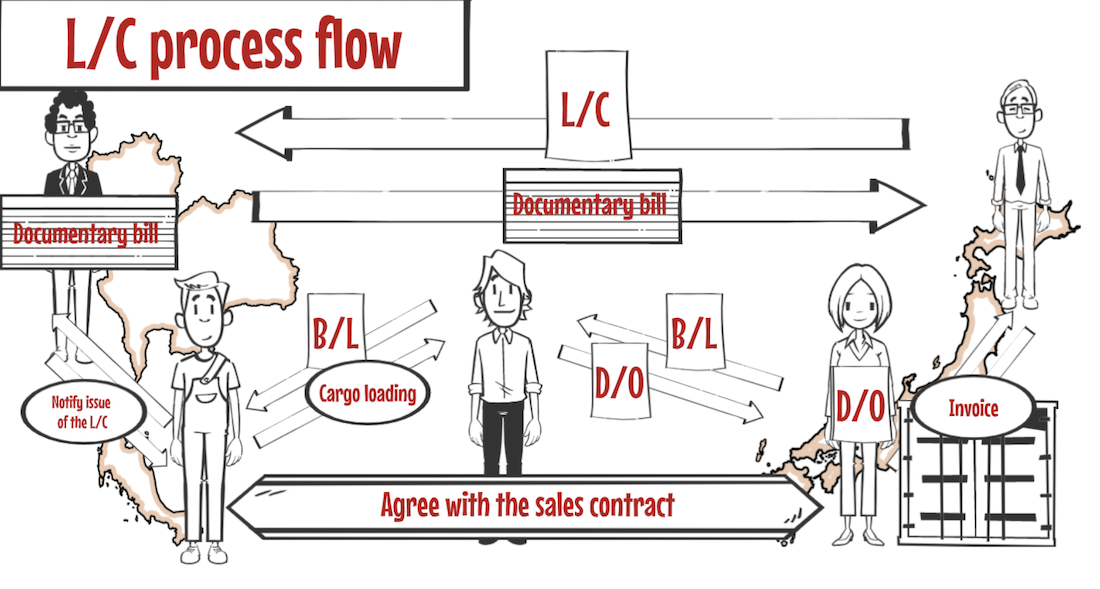

In this example, we will use a business case between Japan and Thailand.

The exporter is a company in Thailand and the importer is a company in Japan.

Sales Agreement

First, the Japanese company and the Thailand company agree with the business, and decide the term using L/C.

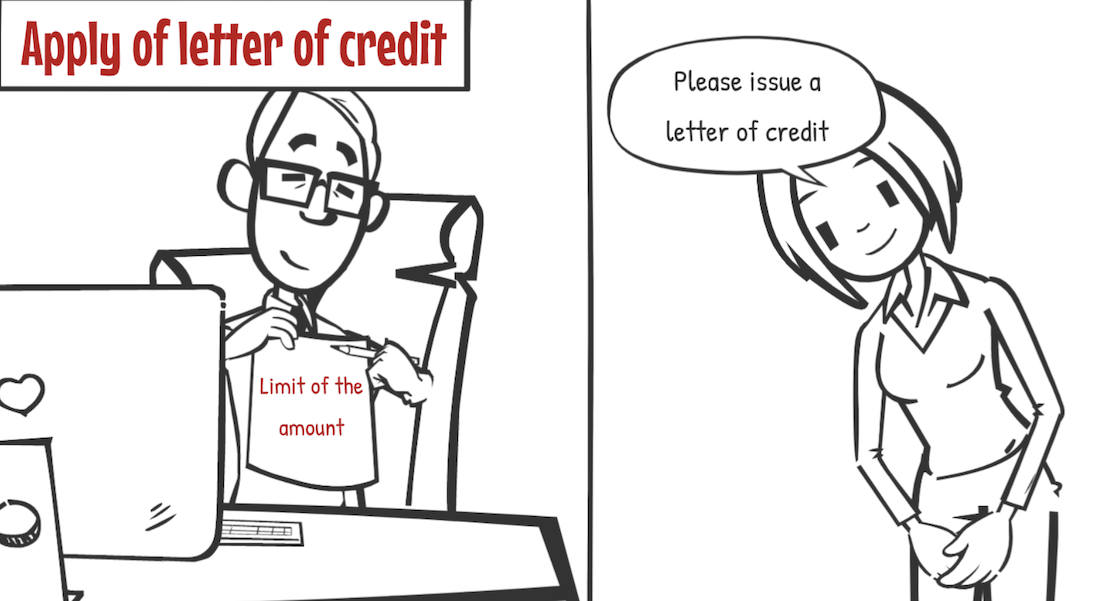

Apply of L/C

Next, an importer requests their bank to issue a letter of credit. At this point, the bank will assess the importer’s credit score for payment.

Once it’s approved, depending on the importer’s credit score, the bank will decide the issue limit of the amount. A letter of credit is issued within the range of the issue limit.

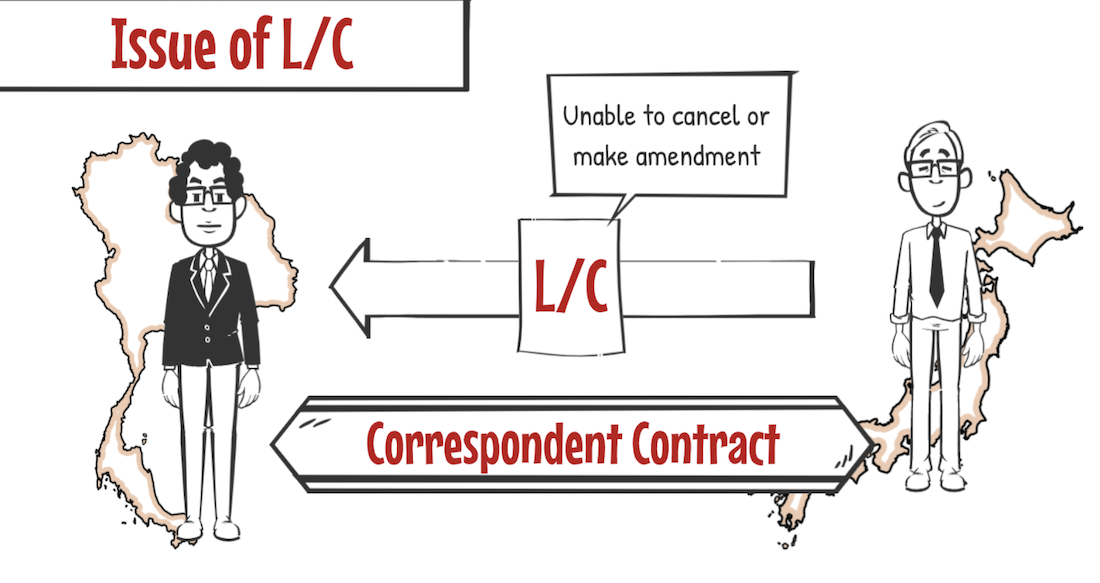

The importer’s bank will issue letter of credit, for the bank of the overseas exporter. Once the letter of credit is issued, they are unable to cancel or make amendment, without agreement of all parties.

– the bank, the exporter and the importer.

Both banks will need to have a correspondent contract. This enables banks in different countries to connect using a decryption code.

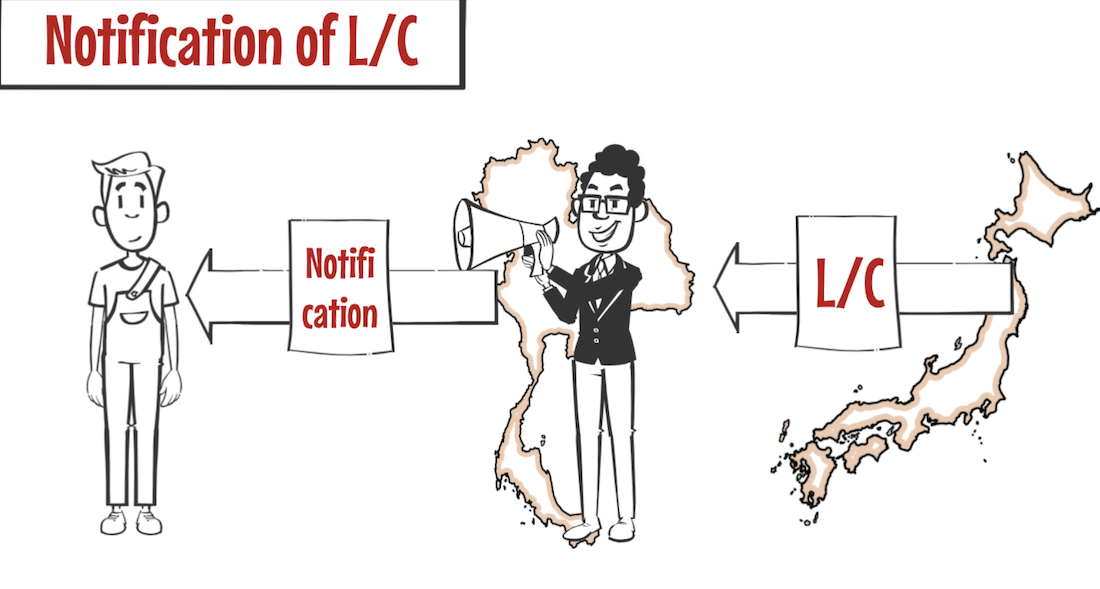

Notification of L/C

Notification of issuing L/C for the exporter is confirmed, through the exporter’s bank.

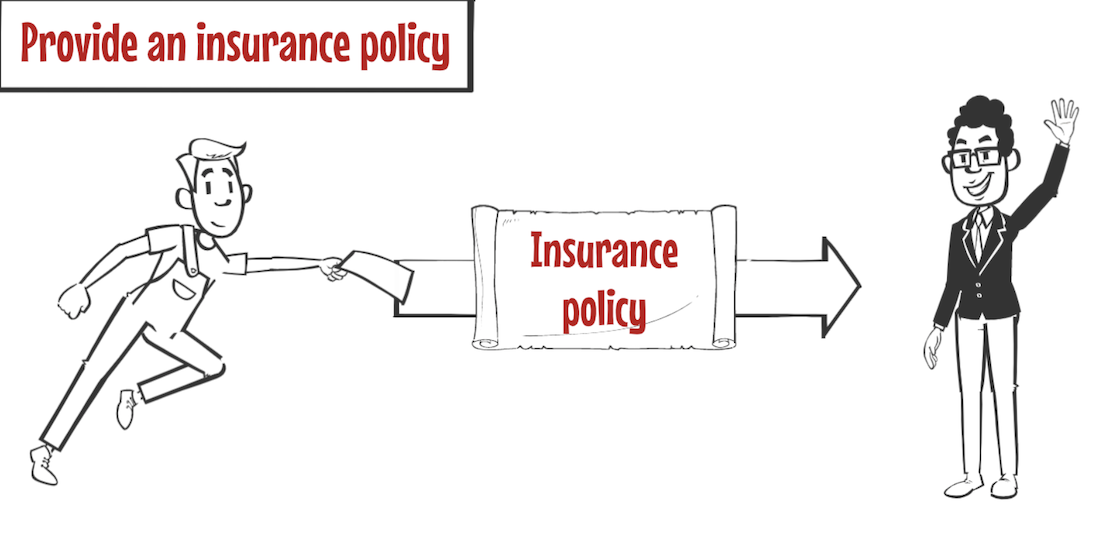

Provide an insurance policy

If you are using incoterms of CIF or CIP, condition of insurance will be noted on the L/C. You may be required to provide an insurance policy.

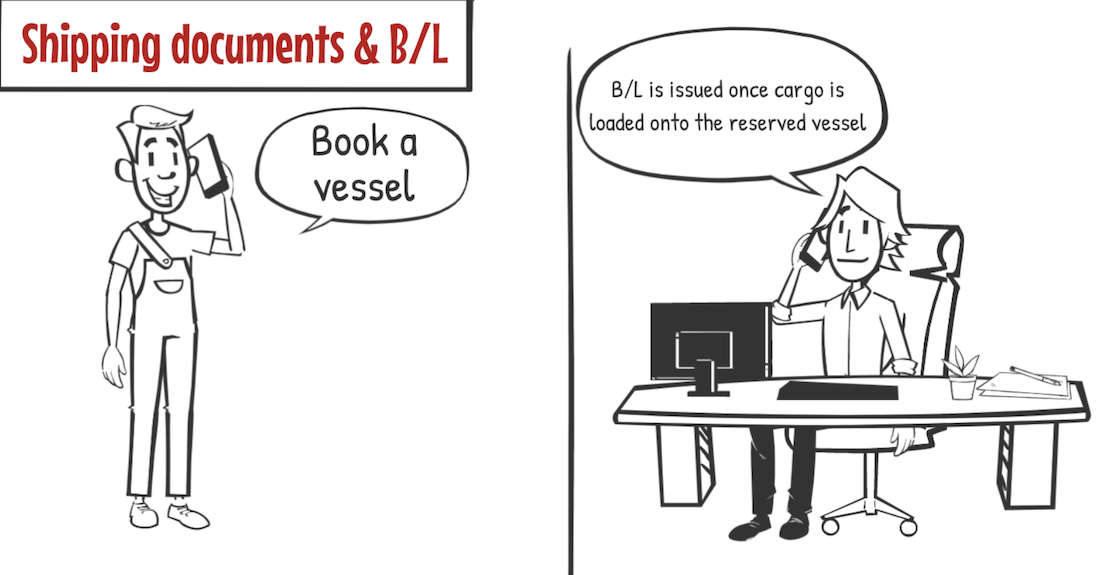

Booking and Issue B/L

The exporter will ask a freight forwarder to book a vessel to transport cargo.

The exporter will make arrangements of cargo loading and custom clearance, and obtain the required documentation, including B/L. B/L is issued once cargo is loaded onto the reserved vessel.

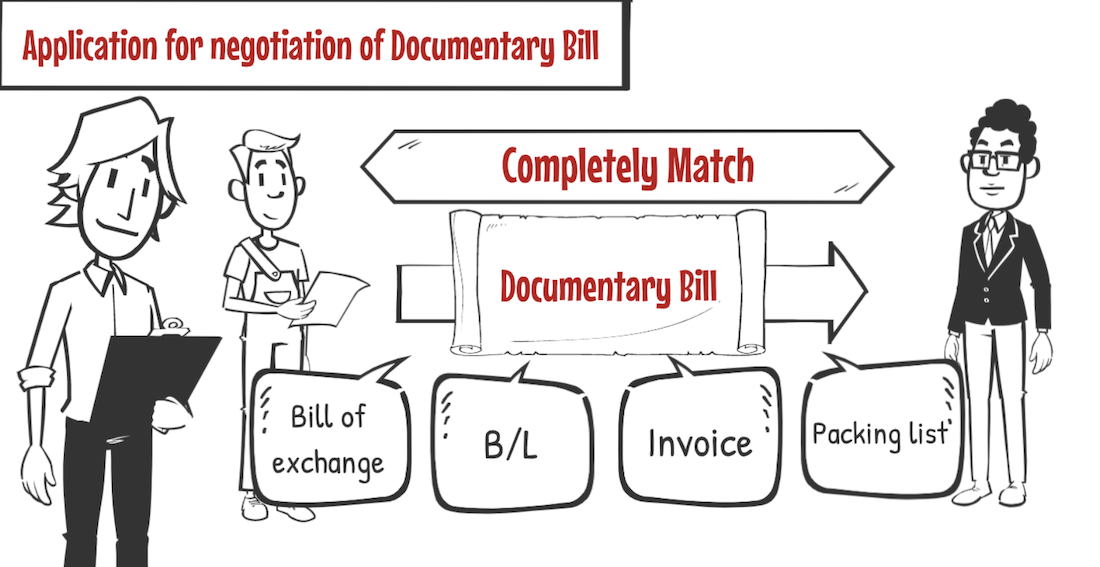

Provide “Documentary Bill”

The exporter prepares a bill of exchange and the shipping documents.- such as B/L, invoice, packing list, and then,provides them to the bank as “Documentary Bill” to collect payment.

When preparing these documents,you need to be careful to ensure B/L and shipping documents, follow the contents of L/C.

The name of the product, condition, importer and exporter must match with the L/C, which is notified beforehand.

When the exporter requests an exporting arrangement under L/C, a freight forwarder needs to check the contents of L/C, and ensure the documents match with the contents.

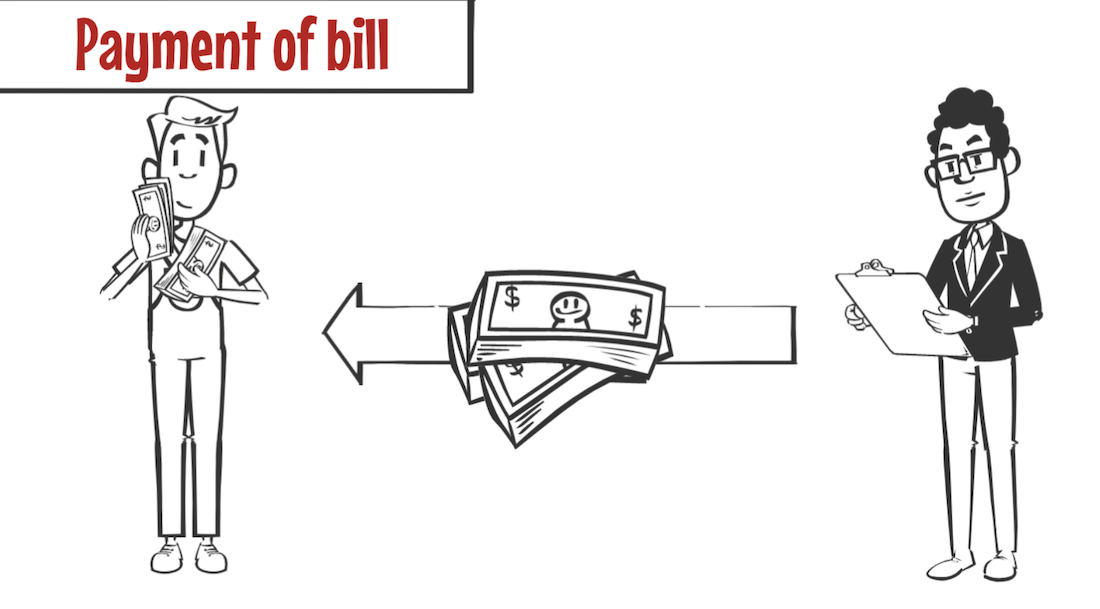

Payment of Bill

The bank will make payment of the product to the exporter. The contents of L/C and shipping documents are checked by the bank, and if there is any discrepancy, the bank may refuse to make payment.

At this point, the exporter completes collection of the product payment.

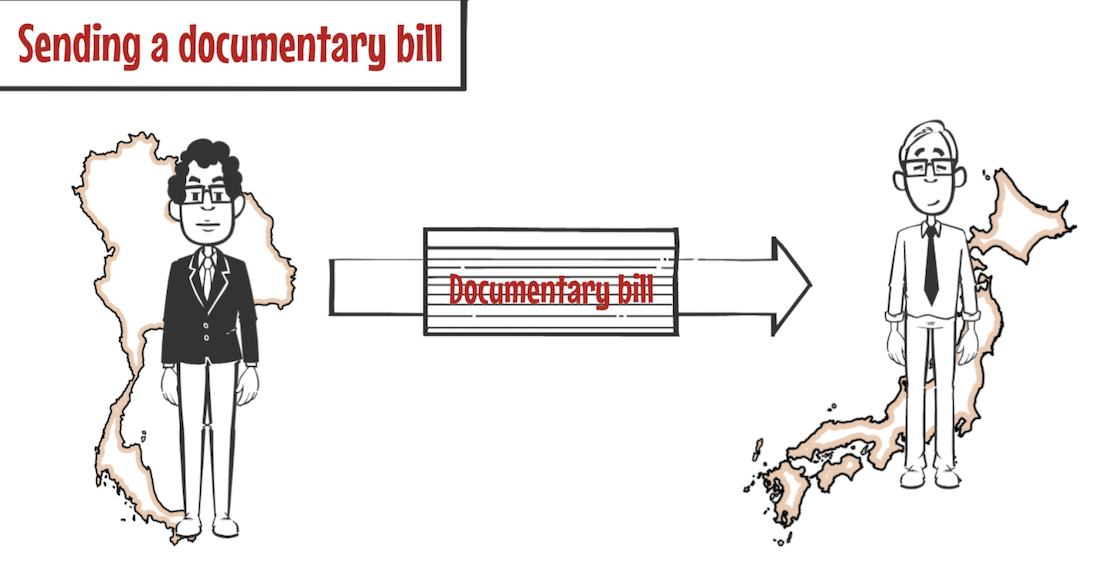

Sending “Documentary Bill”

To request the payment of bill, the exporter’s bank sends the documentary bill, to the importer’s bank who issued the L/C.

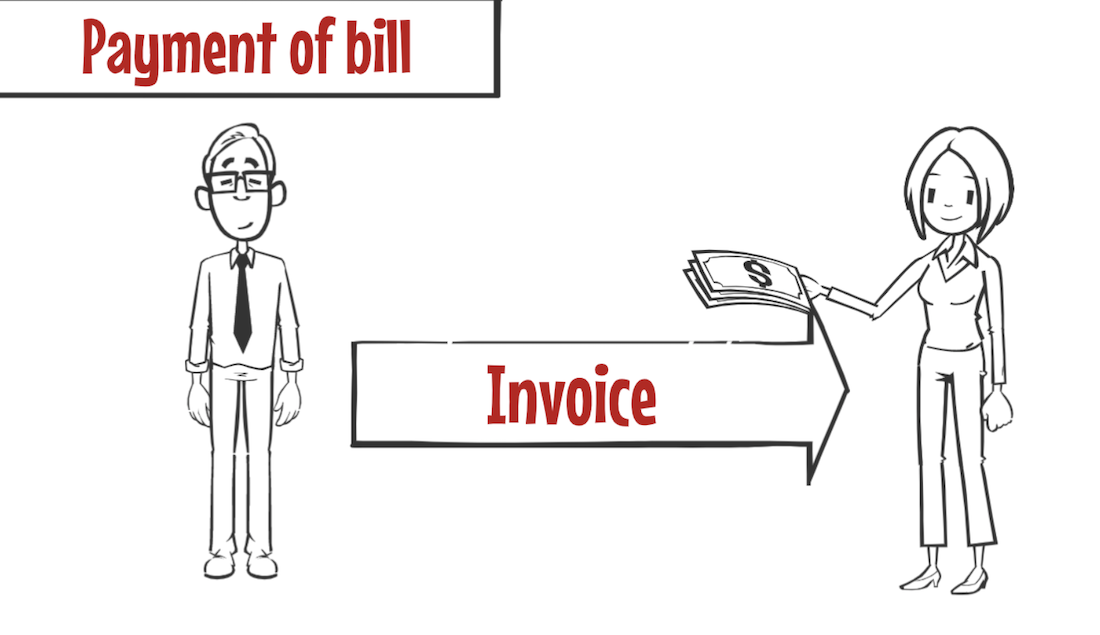

Payment of Bill

The bank sends an invoice of the advance payment to the importer, and the importer will process the payment.

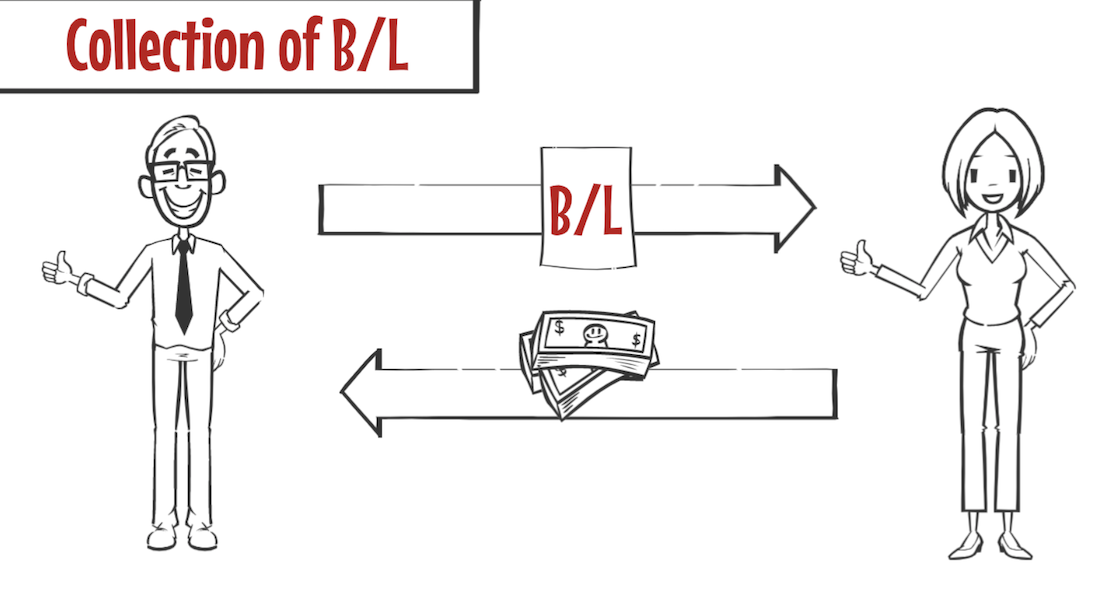

Collection of B/L

The importer makes payment to the bank and receives B/L. To ensure the payment, the bank will give B/L to the importer once payment has been made.

Exchange B/L to D/O

B/L will be exchanged to D/O,- Delivery Order. Once importing custom clearance is completed, an importer will submit D/O to the port to finally receive the cargo.

Summary

Finally, let’s summarize the L/C process flow in a chart.

・An importer and exporter will agree with the sales contract.

・The importer requests their bank to issue the L/C

・The importer’s bank will issue the L/C to the exporter’s bank.

・The exporter’s bank will notify issue of the L/C to the exporter.

・The exporter requests arrangements for cargo loading to a freight forwarder.

・Cargo is loaded onto a vessel and the B/L is issued.

・The exporter will submit the B/L and other documents to the exporter’s bank.

・The exporter’s bank will purchase a documentary bill including B/L from the exporter.

・The exporter’s bank will send a documentary bill including B/L to the importer’s bank.

・The importer’s bank will send an invoice to the importer.

・The importer obtains the B/L in exchange with payment.

・The importer submit the B/L to their freight forwarder to obtain D/O.

・Once import custom clearance is completed, D/O is supplied to the port to collect cargo.

This is the process flow of using the L/C.

Trading by using L/C has benefits for both exporters and importers.

To take advantage of using this method, and ensure a smooth business flow, it is very important to pay attention when preparing the shipping documents.

If there are any discrepancies on the documents when using the L/C method, problems may occur or payments may be delayed.When making arrangements, you need to understand the process flow of L/C.

It is important for each business partner to deal with care.

I hope the video will be useful and help you to understand L/C.

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!