Neko Senpai

Neko Senpai About “Settlement Methods in Trade Transactions Vol.1 – L/C, D/A, D/P” !

Video of This Article

Kamome Senpai

Kamome Senpai This is 9:19 video!!

Hello, it’s IINO.

This time, I would like to explain “Settlement Methods in Trade Transactions.”

Documentary Bill of Exchange

There are two main methods of settlement in trade.

It depends on whether or not the bank acts as an intermediary between exporter and importer to advance payment.

There are “Documentary Bill of Exchange” and “Telegraphic Transfer”.

This video focuses on “Documentary Bill of Exchange” and “Telegraphic Transfer” will be explained in another video.

What “Documentary Bill” is

Documentary Bill is what Bill of Exchange which instructs the exporter to pay the importer for the goods together with shipping documents.

Shipping documents are B/L, invoices and packing lists required for customs clearance in the importing country.

And there are two types of Documentary Bill, “Documentary Bill of Exchange with L/C” and “Documentary Bill of Exchange without L/C”.

Risk of Bussiness with Overseas

Trade transactions with overseas companies involve a variety of risks including the following.

・Risks associated with language, legal system, economic conditions etc. due to differences in countries

・Risk of damage to cargo

・Risk of foreign exchange fluctuation

・Risk of credit

・Risk of payment collection

・Risk of obtaining products

・Risk of financial burden

When focusing on this theme of “settlement method”, we must pay attention to “Risk of Credit” and “Risk of Financial Burden”.

In addition, risk of foreign exchange fluctuation is also significant. However, since the risk can be avoided, by using exchange contracts, I will skip it this time.

Risk of Credit

First is “Risk of Credit.”

Risk of Credit is having credit concerns and not certainty that it is safe to proceed with the contract.

It is because that it is difficult to ascertain information about the financial situation of the counterparty.

If a contract is signed without knowing the credit status of the counterparty, problems may occur such as delays in settlement due to cash flow.

In order to ensure payment collection, it is important to ascertain the credit status of the counterparty by using credit bureaus from the beginning of the business.

Risk of Financial Burden

Next is “Risk of Financial Burden”.

It refers to the risk that either exporter or importer will unilaterally bear the financial burden by making payment in advance or later depending on the method of payment.

Both exporter and importer negotiate and sign a contract for a settlement method that bears as little risk as possible in order to keep the fund operation running smoothly.

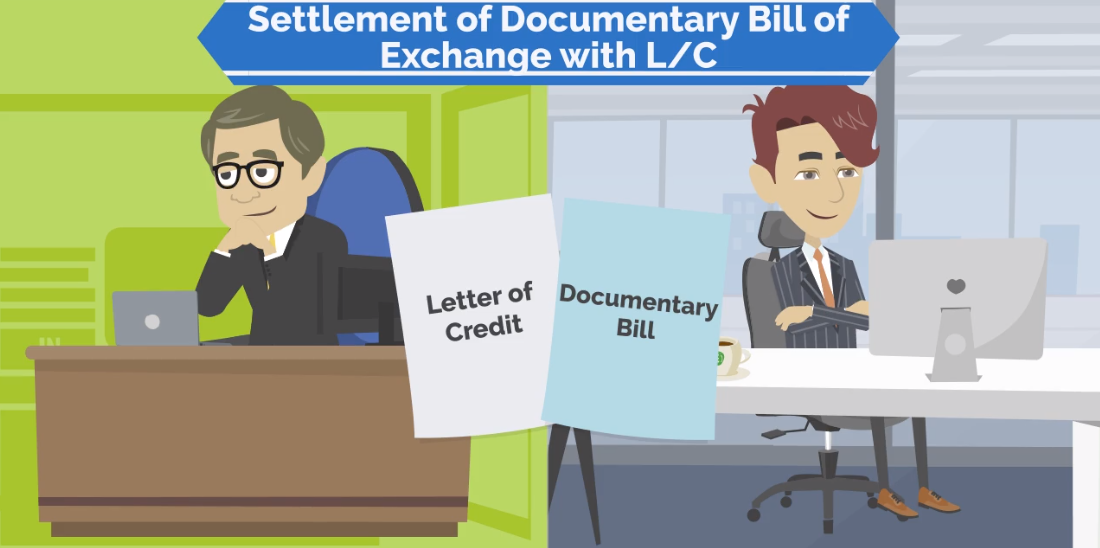

Settlement Methods to Avoid Risks

In trade transactions, it is “Settlement of Documentary Bill of Exchange with L/C” which can avoid these two risks can be avoided, commonly known as “L/C Settlement.”

By combining Letter of Credit and Documentary Bill, the burden on both exporter and importer can be reduced.

Settlement Methods of Trade

Next, I will introduce the typical settlement methods used in trade transactions.

・Settlement of Bill of Exchange with L/C called L/C Settlement.

・Settlement of Bill of Exchange without L/C called D/A or D/P Settlement.

In addition to these, there is also “Telegraphic Transfer” called “T/T Settlement”, which I will explain in another video.

Let’s take a look at each of them including their advantages and disadvantages.

About Settlement of Bill of Exchange with L/C

The first is “Settlement of Bill of Exchange with L/C.” This is commonly referred to as L/C Settlement.

This is a method of settlement in which the bank guarantees payment for the goods on behalf of the importer. It is on condition that the exporter presents the documents listed in Letter of Credit terms to the bank.

If the documents submitted to the bank differ from the contents of Letter of Credit payment may not be made.

Advantege of L/C Settlement

The advantage is that exporter can trade with security as a reliable bank pays the importer on its behalf.

Note here is that exporter can collect the payment by presenting Documentary Bill at the place of export without waiting for payment from the importer.

Since exporter wants to receive payment for goods as soon as possible, L/C Settlement is a secure payment method for exporter.

Disadvantage of L/C Settlement

The disadvantage is that the bank acts as an intermediary which incurs high fees.

Another disadvantage is that if the documents are “discrepancy” it takes longer to settle the transaction. And at the same time the importer also receives shipping documents later.

Settlement of Bill of Exchange without L/C

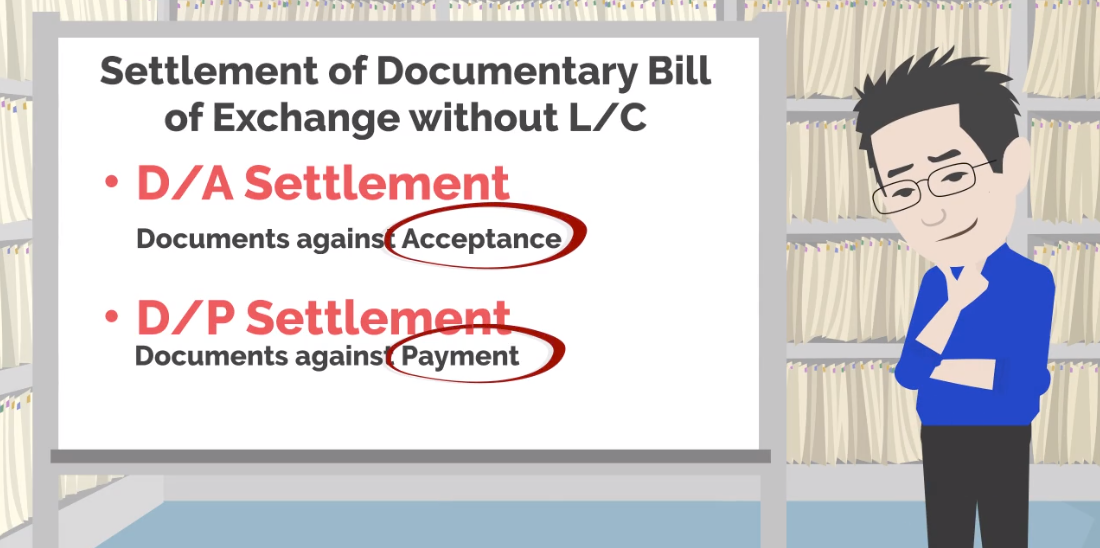

Next is “Settlement of Documentary Bill of Exchange without L/C.”

There are two types of settlement methods as follows.

D/A Settlement, Documents against Acceptance.

D/P Settlement, Documents against Payment.

Exporter collects the payment either by acceptance the bill or by payment by importer.

D/A Settlement

D/A Settlement is a condition under which importer may take delivery of shipping documents on condition that importer accepts payment by the due date of the bill.

Since importer is allowed to defer payment until the due date stated on the bill, it is also called “Usance Bill.”

There are two types of payment dates.

Description on D/A

One of the payment date descriptions for D/A Settlement is “At “A” days after sight” and exporter sets the number of days.

It clearly states that importer is obligated to pay the bill “A” days after the date of acceptance of the bill.

Another description is “At “A” days after “B” days” and in “B” often has a fixed date such as B/L date.

It clearly states that the importer is obligated to pay “A” days after the fixed date indicated on “B”.

Advantage and Disadvantage of D/A Settlement

The advantage of D/A Settlement lies with importer.

This is because importer can obtain shipping documents and receive the goods prior to settlement.

On the other hand, from exporter’s perspective, it is risky settlement.

For exporter, importer’s creditworthiness is the only basis, since ownership of the goods is transferred when importer accepts Bill of Exchange.

D/P Settlement

Next, I will explain D/P Settlement.

D/P Settlement is a condition under which importer can take delivery of the shipping documents upon settlement of Documentary Bill.

It is also called “At Sight Bill” since the documents cannot be received unless the bill is settled immediately after listing.

Advantage and Disadvantage of D/P Settlement

The advantage of D/P Settlement lies with exporter.

The documents are never handed over unless importer settles, thus exporter can avoid the risk of collection and own the goods.

On the other hand, importer is responsible for the funds since he must pay before receiving the goods.

How To Choose Settlement

Unlike L/C Settlement, D/A and D/P Settlement do not allow exporter to collect payment immediately after submitting Documentary Bill to the bank.

Therefore, from exporter’s standpoint, it may be best to avoid them unless importer has a great deal of confidence in exporter.

In many cases especially for first-time transactions, L/C Settlement is used due to risk considerations. If you are going to use D/A or D/P Settlement, consider purchasing comprehensive insurance.

In the below cases, Telegraphic Transfer called T/T Settlement is smoother than L/C, D/A or D/P Settlement.

・want to keep costs as low as possible

・have not yet established a relationship of trust with the counterparty

・want to avoid complicated document transactions”

I will explain about Telegraphic Transfer in another video.

Summary

How was it?

In this video, I have explained the important payment methods when doing business with foreign countries.

It is important to choose the payment method that best suits the transaction such as L/C Settlement for first-time transactions and D/A or D/P Settlement for companies with which you are familiar.

Be sure to understand the advantages and disadvantages of the payment methods introduced here so that your business can take advantage of them.

If you found this video useful, please subscribe, like and share it on social nedia!

That’s all for this time! Thank you!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!