Neko Senpai

Neko Senpai About the basic knowledge of cargo insurance!

Explained The basic knowledge of Cargo Insurance by Video

Kamome Senpai

Kamome Senpai This video takes 5:58 !

Hello, it’s IINO.

I would like to explain the basic knowledge of Cargo Insurance this time.

Cargo insurance may not be necessary, if the cargo is transported without any problems.

However, it is recommended to have insurance since there is any possibility that unpredictable things can happen in international transportation.

I will explain the basics of cargo insurance in this two-part series.

1st Knowledge of Cargo Insurance

The first time, I will explain the detail about:

・What Cargo Insurance is

・Cargo Insurance Terms

・About Insurance Premiums

When you understand these key points, you will be able to arrange cargo insurance smoothly.

Let’s get started.

What “Cargo Insurance” is

Cargo insurance is an insurance for import and export cargo to cover various unforeseen accidents and risks that may occur during transportation.

Since international transportation involves, longer distances and more transshipment than domestic transportation, it is higher that the possibility of cargo damage and problems occurred during transportation.

So, what kind of problems does cargo insurance cover?

The insurance covers water damage to containers on the ship as well as human error when reloading containers onto trucks.

Apply to insurance company

When you get an insurance policy, you need to fill out an application form with the insurance company.

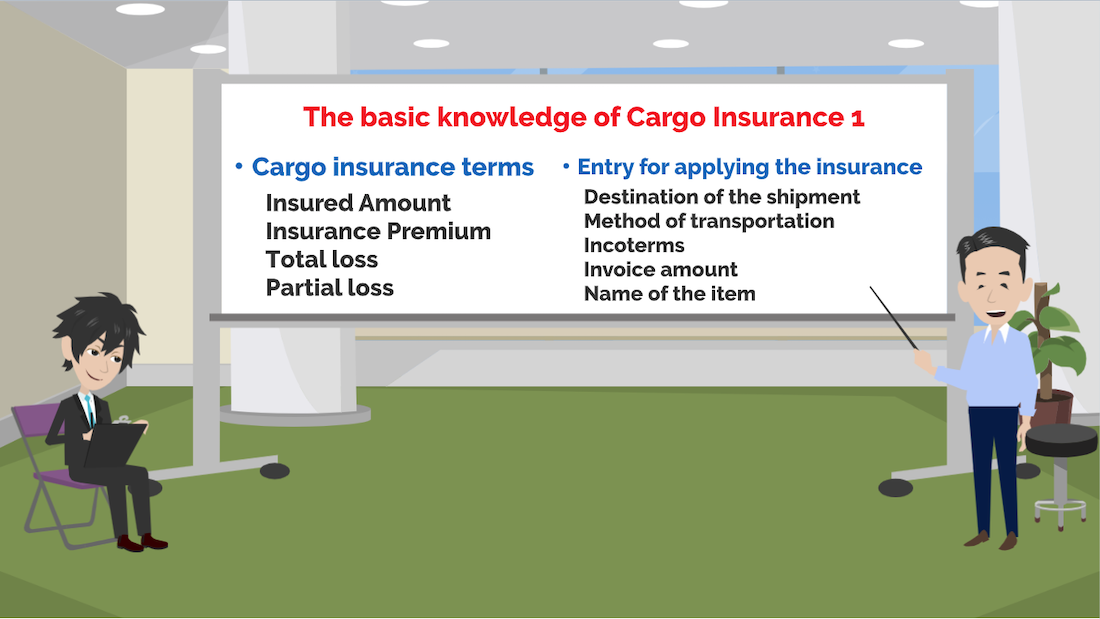

Let’s take a look at some of the basic cargo insurance terms that you need to know in order to fill out an insurance application.

Insured Amount

Firstly, “Insured Amount”.

This is the maximum amount that can be paid out as insurance in case of an accident. The insured amount is usually 110% of the CIF price listed on the invoice.

Insurance Premium

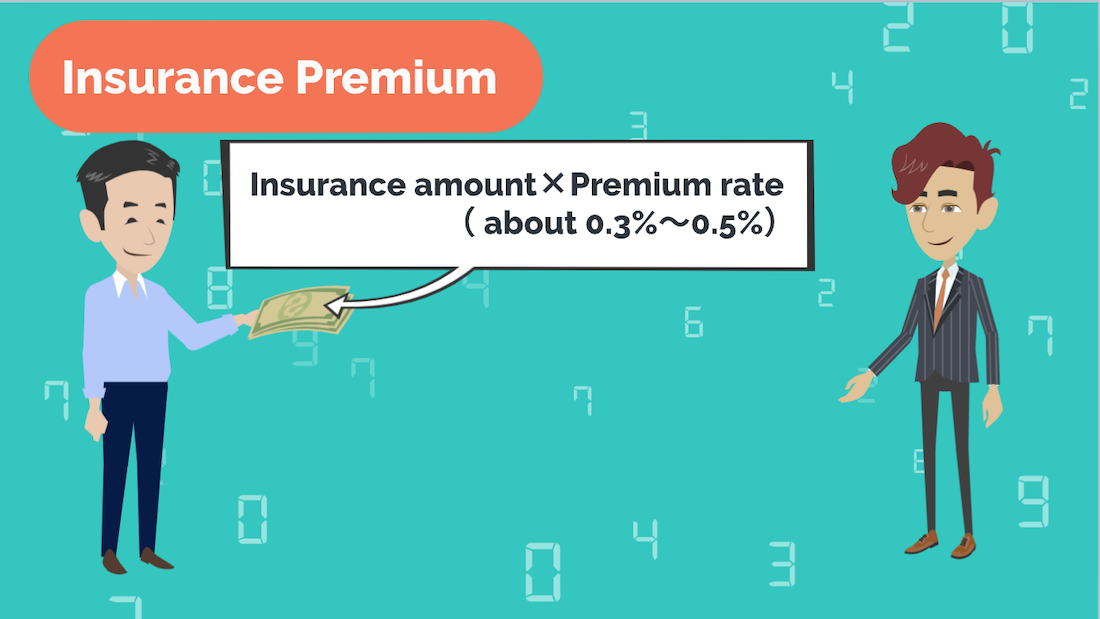

Next is “Insurance Premium”.

This is the amount you pay to the insurance company. The premium is calculated by multiplying the insurance amount by the premium rate (about 0.3% to 0.5%).

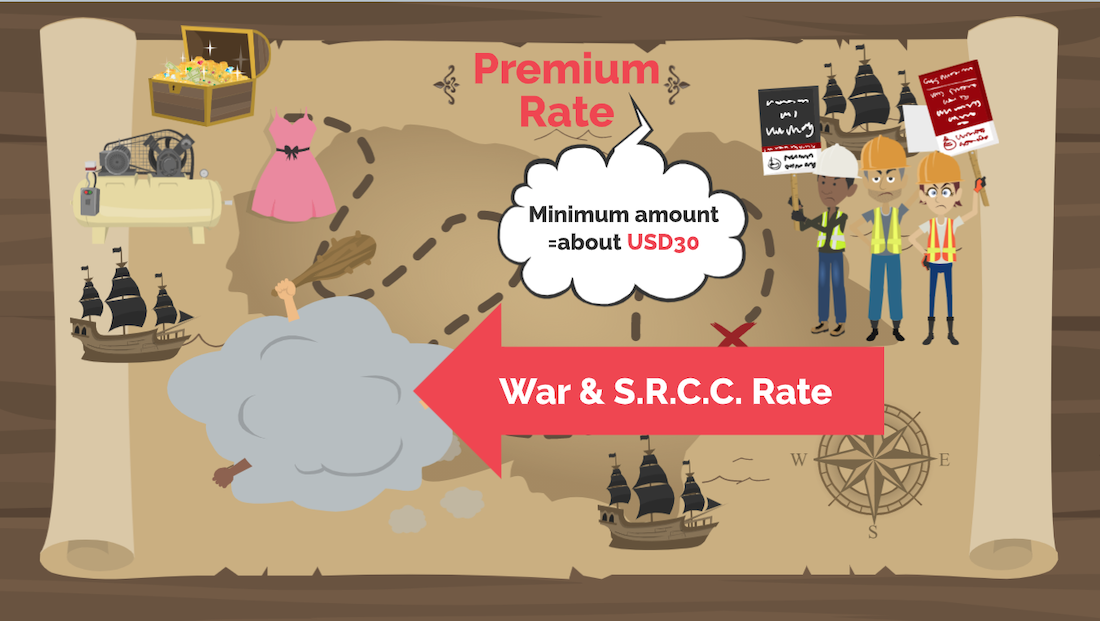

The premium rate varies depending on the route, goods, etc. The minimum amount per case is about USD30.

In some areas under the war or strike, additional premiums may be charged, which called War & S.R.C.C. Rate.

The Scope of Insurance

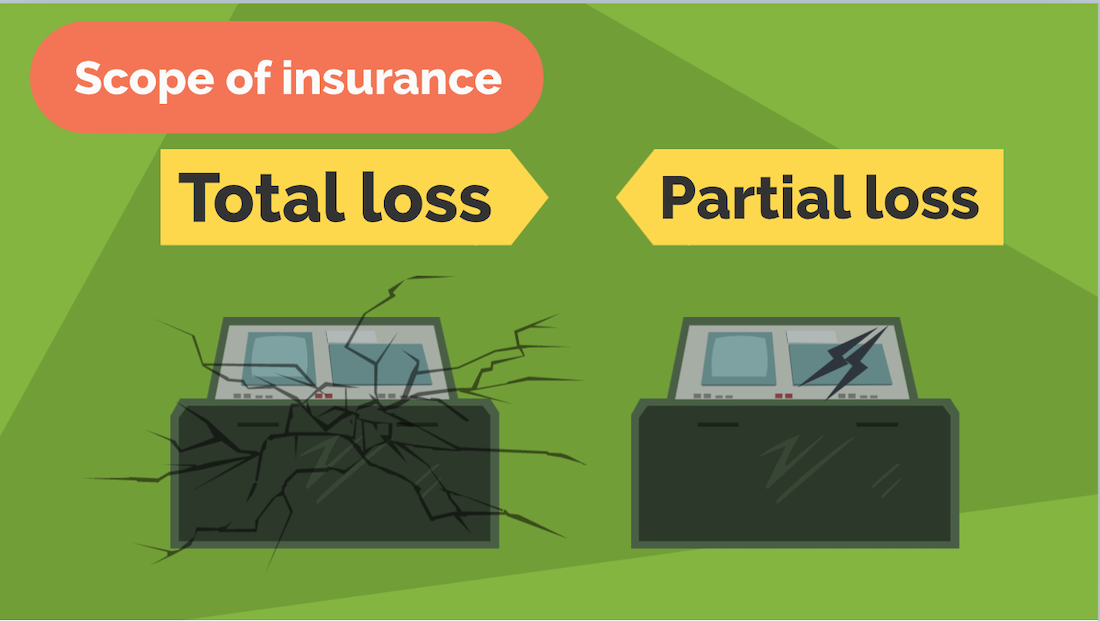

You should not forget the scope of insurance.

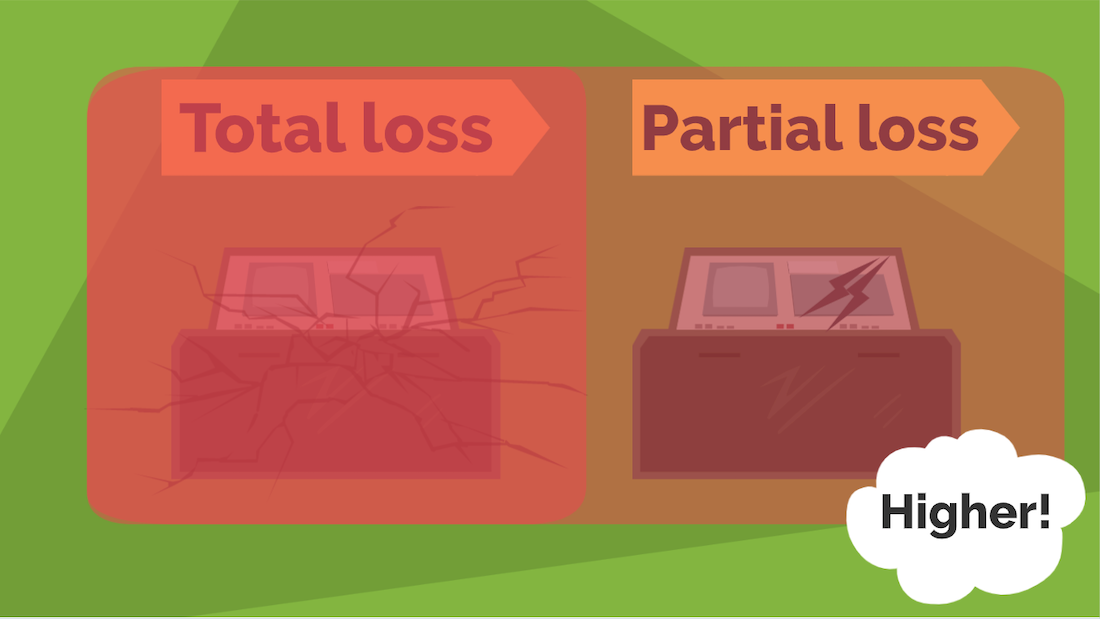

There are two types of insurance, total loss where the damage is to all of the cargo and it cannot be used anymore, and partial loss where the damage is to one part of the cargo.

There are different types of insurance policies depending on how much risk you want to cover such as an all-perils policy that covers all damages (total loss or partial loss) or one that only covers total loss.

The more risks covered, the higher the premiums will be.

Any other necessary terms

These are the terms you need to remember when applying to insurance companies.

You also need to check the destination of the shipment, the method of transportation, Incoterms, invoice amount, and the name of the item for applying the insurance.

How to calculate Insurance

Let’s calculate the cargo insurance together here.

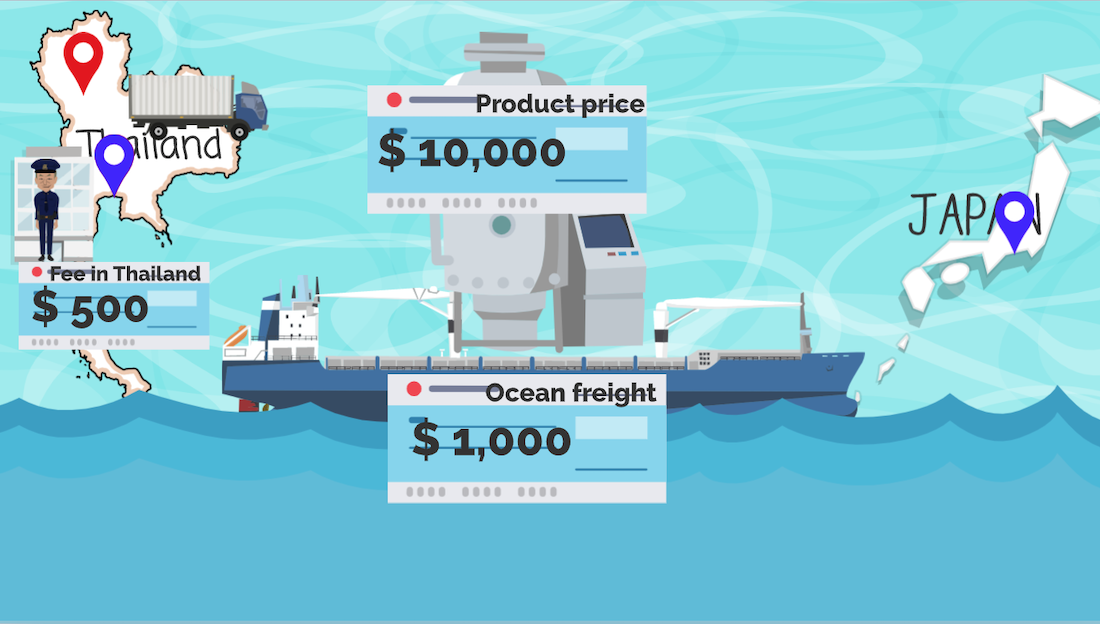

As an example, let’s say you are transporting machinery from Thailand to Tokyo.

We assume that the conditions of transportation are as follows;

The value of the machine itself : USD 10,000

The cost of transportation from the factory to Bangkok port, customs clearance and other inland charges : USD 500

The ocean freight from Bangkok port to Tokyo port : USD 1,000

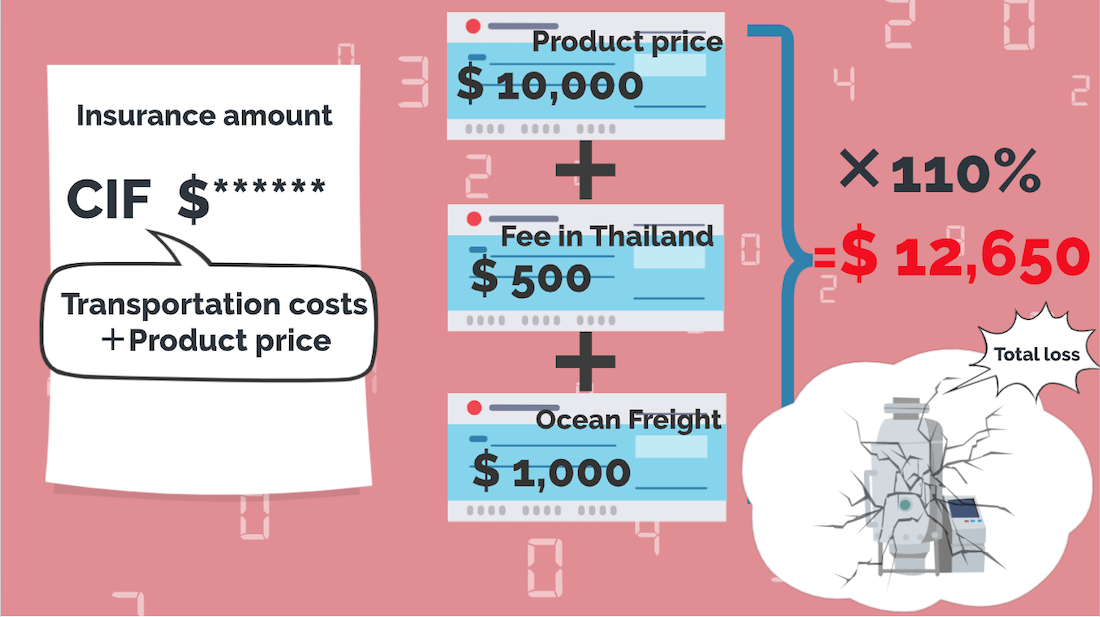

As I explained, the insurance amount is a 110% multiplier of the CIF price. The CIF price is calculated by adding all transportation costs to the import port to the product price.

Then, the formula would look like this:

(Product Price, USD 10,000 + Domestic Fee in Thailand, USD 500 + Ocean Freight, USD 1,000) x 110% = USD 12,650

In case of an accident and the machine is declared a total loss, USD 12,650 will be paid by the insurance company.

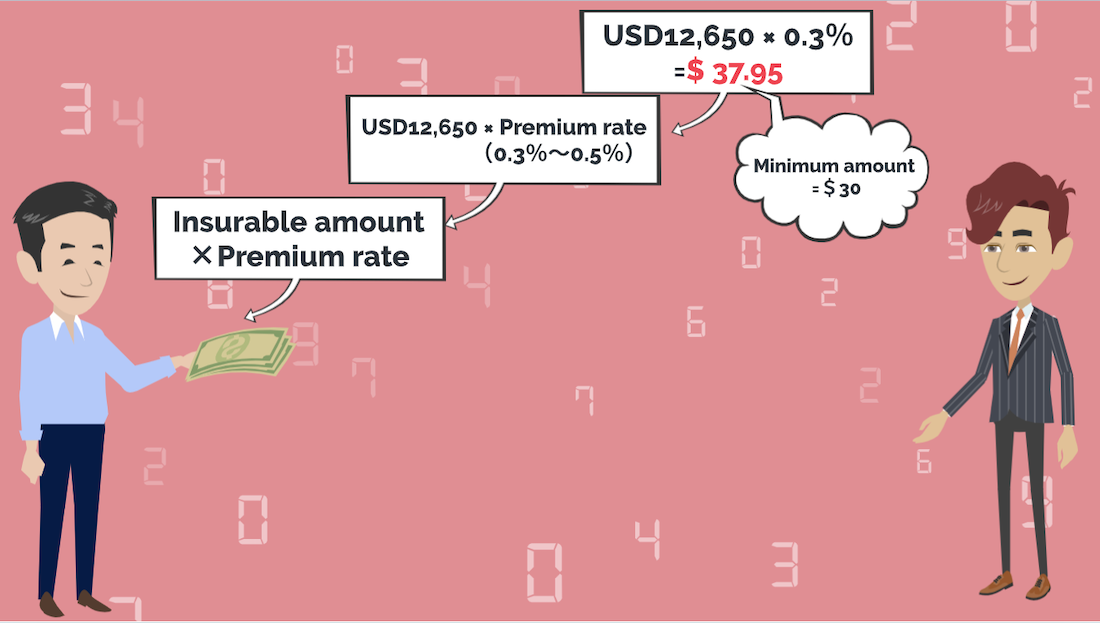

How to calculate the premium

Next, let’s calculate the premium, you pay to the insurance company.

Premium = Insurable amount x premium rate.

In this case, it will be USD12,650 x premium rate (0.3% to 0.5%).

If the premium rate is 0.3%, it will be USD37.95.

Since this is more than the minimum amount of USD30, you will have to pay this to the insurance company as the premium.

Summary

In this video, I explained the basics of cargo insurance. Cargo insurance is a way to prepare for contingency risks and is necessary in international logistics.

Let’s learn the basics of cargo insurance, and be able to arrange cargo insurance correctly.

I will keep you up to date with information, about international logistics in this channel. Please subscribe it after this video.

That’s all for this time! Thank you very much!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!