This time, let’s look at Incoterms C Group – CFR/CIF/CPT/CIP.

Our company works as a freight forwarder in Thailand, CFR and CIF trading conditions are used by the customer, due to the volume of exports from Thailand.

Let’s take a closer look.

Video Explanation about CFR/CIF/CPT/CIP

About Incoterms

Firstly, let me explain about “Incoterms”.

“Incoterms” is a terms and condition of cost and risk responsibilities for trading between buyers and sellers.

Remember, they are international trading terms which clarify sellers’ and buyers’ cost and risk responsibilities from location to location.

What is the first task to remember the Trade Words? It might be thought that it is “Incoterms”. There are 11 kinds of Incoterms with abbreviated 3 English alphabetical letters such as CFR, EXW and so on. But don’t worry! Honestly, it is all OK to remember only 6 Incoterms out of 11 which are …

CFR and CIF

Now, let’s take a look at the terms CFR and CIF first.

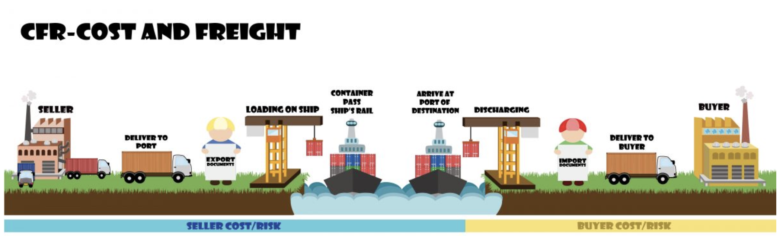

CFR is a short form of “Cost and Freight”. Therefore, sometimes it is written as “C&F”, but the correct short form is “CFR”.

CIF is a short form of “Cost, Insurance and Freight”. The difference between CFR and CIF is insurance, “I” stands for “Insurance”, which makes it easy to remember.

Cost responsibility of CFR and CIF

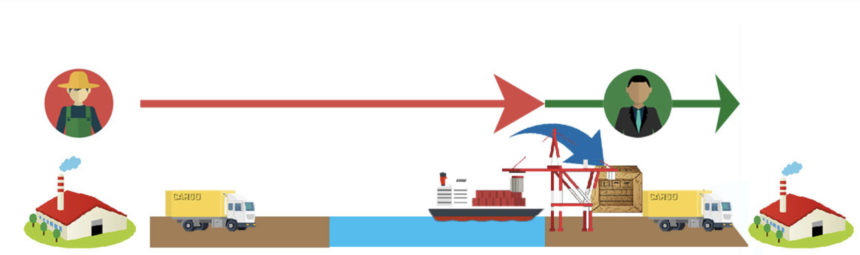

The following illustration explains CFR and CIF cost and risk responsibilities. Sellers are responsible for the cost until the cargo arrives at the importing port.

Risk responsibility of CFR and CIF

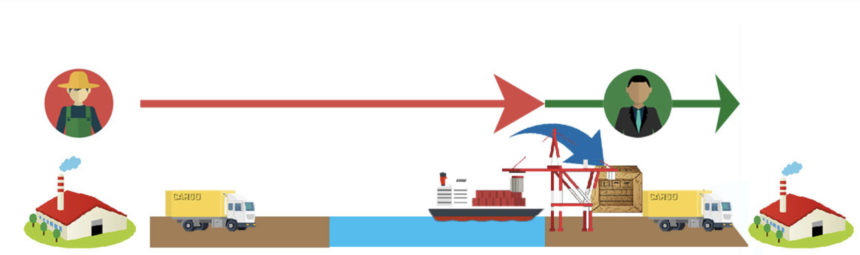

In terms of risk responsibilities, sellers are responsible until the cargo is loaded onto a vessel at the exporting port, once cargo is loaded onto a vessel, it becomes the buyers’ responsibility.

Remember, on CFR and CIF, the location of changing the cost and risk responsibilities are not the same.

Insurance of CFR and CIF

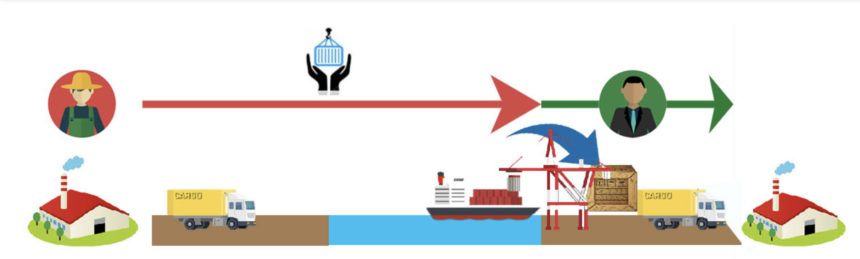

With CIF, it is the responsibility of the exporter to arrange insurance.

CFR does not include any insurance, therefore the importer will either waive insurance or they will arrange insurance.

・CIF:Exporter arrange Insurance

・CFR:Importer arrange Insurance or no insurance for the shipment

Exporter and Importers point of view

Well, let’s see the difference from each the exporter and importers point of view. In what kind of condition, CFR and CIF will be good enough to use?

Exporters point of view

From an exporter’s point of view, if they are exporting high volume cargoes and have a business with a freight forwarder who has strength and experience in exporting to certain countries, they have additional advantages when using CRF or CIF.

Under these conditions, the exporter is responsible for cost until the cargo arrives at the importing port.

Senior Cat

Senior Cat The more volume exporter’s have, the cheaper the freight will become.

Importers point of view

From an importer’s point of view, if you are importing cargo from the country for the first time,or if the freight forwarder is not familiar with the importing countries practices,

you may wish to choose CFR or CIF trading conditions, where the exporter’s take increased responsibility.

カモメ先輩

カモメ先輩 Small volume does not have advantage of the freight.

CPT and CIP

Under group C, in addition to CFR and CIF, there are also CPT and CIP terms.

Risk responsibility of CPT and CIP

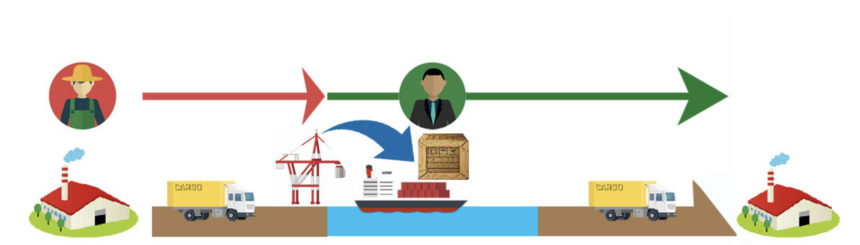

The location of the risk responsibility changes once the cargo is on the deck of vessel when using CFR and CIF.

Alternatively, the location of risk responsibility changes at exporting CY and CFS when using CPT and CIP.

This means CPT and CIP are the conditions used when exporting using container vessels.

Senior Cat

Senior Cat CFR/CIF: Risk move at the deck of the vessel!

カモメ先輩

カモメ先輩 CPT/CIP: Risk move at CY/CFS at exporting port.

Cost Responsibility of Incoterms “C Group”

In terms of cost responsibility, under group C, exporters take responsibility up until the vessel arrives at the importing port.

Difference of CPT and CIP

The following explains the difference between CPT and CIP;

Senior Cat

Senior Cat CPT is short form of “Carriage Paid To”.

Senior Seagull

Senior Seagull CIP is short form of “Carriage and Insurance Paid To”.

As in the case of CFR and CIF, “I” in CIP stands for insurance, which in turn means CPT does not include insurance.

In this instance, all you need to remember is that “I” will always stand for insurance.

Summery

Finally, let’s check your understanding.

This time, we explained the difference between CFR and CIF. Also, we explained the advantages of these terms on cost and risk responsibility of importers and exporters, when considering cargo volume.

CFR and CIF are the business terms that are often used on trading practices, it is important to understand the difference.