What is the first task to remember the Trade Words? It might be thought that it is “Incoterms”. There are 11 kinds of Incoterms with abbreviated 3 English alphabetical letters such as CFR, EXW and so on.

Senior Seagull

Senior Seagull It’s impossible… It is very impossible to remember all 11 kinds of Incoterms.

But don’t worry! Honestly, it is all OK to remember only 6 Incoterms out of 11 which are very often used in trade business.

If you would like to remember all 11 kinds, it’s better to remember this basic 6 Incoterms and then you will extend to get the knowledge for other 5.

Senior Cat

Senior Cat We can remember the 6 kinds out of 11!

For this time, We would like to explain to you what 6 basic “Incoterms” are very easily to understand for you.

- Animation Movie – 6 Basic INCOTERMS

- What is Incoterms?

- Illustrated about “Incoterms”

- EXW / Ex Works (Shipments handling at factories)

- FOB / Free On Board (Shipments handling on board of vessel)

- CFR/Cost & Freight (Shipments including Ocean Freight)

- CIF/ Cost, Insurance & Freight (Shipments including Ocean Freight and Insurance)

- DDU/Delivered Duty Unpaid (Shipments handling at Door Delivery Places without customs fee)

- DDP/ Delivered Duty Paid (Shipments handling at Door Delivery Places including customs fee)

- Conclusion

Animation Movie – 6 Basic INCOTERMS

What is Incoterms?

Before we illustrate about “Incoterms”, let us explain what we use “Incoterms” for the trade business.

“Incoterms” for the trade transaction is…

“Sellers” and “Buyers” discuss and agree based on below 2 thoughts:

Senior Cat

Senior Cat 1.Who pays the Freight in the specific stages of the shipment procedure?

Senior Seagull

Senior Seagull 2.Who is Responsible for the cargo damage in the specific stages of the shipment procedure?

It is enough to understand roughly that “Incoterms” is the International agreements between sellers and buyers. It is OK to remember this 2 basic thoughts as above mentioned.

We are going through the many procedures and steps for cargo delivery in trade business.

Both sellers and buyers must decide which procedures and steps are for either sellers’ responsible or buyers’ responsible.

So it might be very complicated if the cargo faces to the trouble during the shipment.

Cat & Seagull

Cat & Seagull It might start the ugly fights and argues about the responsibilities for the trouble.

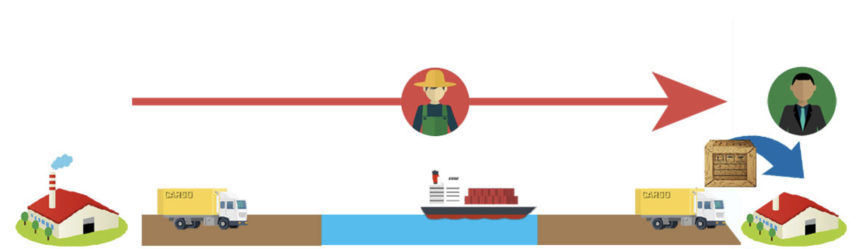

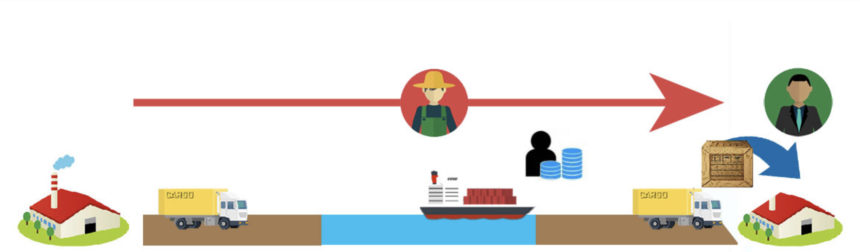

Illustrated about “Incoterms”

The tips to know “Incoterms” is not only memorizing it but also understanding it. We would like to explain 6 basic Incoterms with good illustrations so that you can understand it very well.

You can understand and memorize Incoterms well by checking written letters but also illustration of the trade pictures so that the images of the pictures will help you to understand Incoterms easily into your brains.

EXW / Ex Works (Shipments handling at factories)

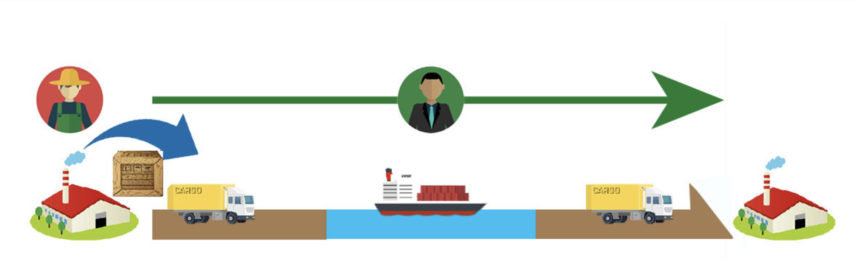

EXW is the agreement of trade business for the step which the cargos hand over from the exporting factory to the buyers. EXW stands for E-Ex Works or Ex Works.

The delivery costs and the responsibilities for the cargo handlings will be transferred from the sellers to the buyers after loading the cargoes into the tracks or in the containers.

Seller

Seller Please take care at your side after we make the productions and then load them into the track or into the containers.

Buyer

Buyer We will take care it all after going through your procedures at your side!

As the point of view at sellers side, it is very easy business for sellers for this case because the all responsibilities of the cargoes will be on the buyers’ account after making the productions at their factories and then loading them into the tracks or into the containers.

Sellers don’t need to take any responsibilities if the cargo shipments face any problems during the cargo delivery.

FOB / Free On Board (Shipments handling on board of vessel)

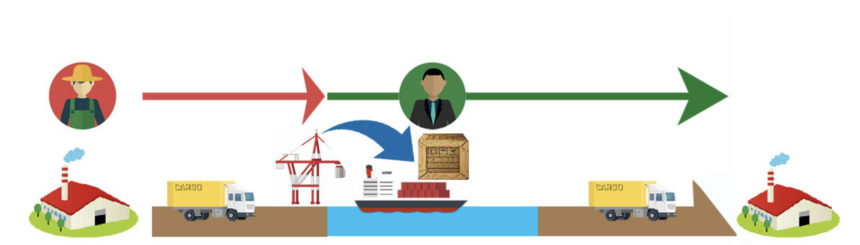

FOB is the transaction terms of trade business that the cargoes’ responsibility will be transferred from the sellers to the buyers when the cargoes are on the board in vessel at ports of loading.

The domestic costs at port of loading such as tracks, customs, and terminal handling charges will be paid on sellers’ account and the buyers will pay ocean freight and the other import cost.

Seller

Seller We will pay all cost with the production fees at our side.

Buyer

Buyer Sure! We will take all responsibilities after the products will be loaded on the vessel.

As we explained to you about EXW in above that all ocean freight cost will be on buyer’s account; on the other hand, in terms of FOB, costs at local loading port will be on sellers’ account.

CFR/Cost & Freight (Shipments including Ocean Freight)

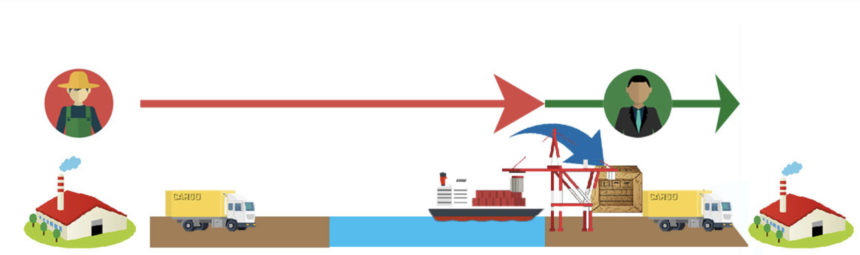

CFR is the transaction terms that buyers will take the costs and responsibilities while the cargos are on board of the vessel until they arrive at the port discharge.

By any chance, buyers will take all responsibilities if the ocean cargo delivery faces any troubles.

Seller

Seller The fire on the vessel caused and the containers fell into the ocean.

Buyer

Buyer It’s not our responsible to take care this issue. Did you get insurance for the cargoes?

Seller

Seller No, I didn’t.

Buyer

Buyer Are you serious!?

※If we can tell you more decent about this, the responsibilities of risk are actually transferring from the sellers’ account to the buyers’ account.

To understand easily for this time, we illustrated to you like this way.

CIF/ Cost, Insurance & Freight (Shipments including Ocean Freight and Insurance)

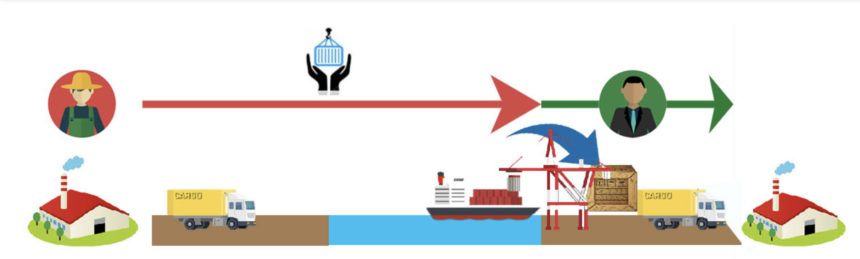

The conditions of CIF is that buyers can arrange the insurances of C&F condition cargoes which as we mentioned for details in above.

Seller

Seller We surely arranged the insurance this time!

Buyer

Buyer It is totally secured to have the insurance on the cargoes.

We explained how to arrange the insurance and the cost of insurances in the other blog articles referring in below;

Do you add the cargo insurance for your shipment? Dangers are hidden everywhere in international transport. If your shipment is not properly insured, your shipment will not be guaranteed for any damage.

DDU/Delivered Duty Unpaid (Shipments handling at Door Delivery Places without customs fee)

DDU is the transaction terms that sellers take costs and responsibilities until the cargoes are delivered to the buyers’ requesting door delivery places.

However, import duty and consumption taxes will be under the buyers account.

Seller

Seller This is called “Door to Door.”

Buyer

Buyer But we will pay the taxes at our side.

Duty and consumption taxes are not that small amount of money and they will affect the companies’ cash flows.

Through our experiences, we have more customers who has the conditions of DDU than DDP which we will explain to you next in below.

DDP/ Delivered Duty Paid (Shipments handling at Door Delivery Places including customs fee)

DDP is the transaction terms that sellers will take all costs and responsibilities for the cargo shipments. Sellers also pay all for import duty and consumption taxes.

Sellers will take all costs for the risk if the cargo shipments face to any problems and it’s the easiest business conditions for the buyers because buyers don’t take any cost arrangement even for taxes.

Seller

Seller We will pay all costs! Take cargoes and products for free!

Buyer

Buyer Thanks!

Sellers will pay all costs in the condition but the costs are usually charged with the production costs on buyers’ account.

If sellers would like to save the costs as much as they could, we know that it might be extra works for sellers but we would recommend to arrange the cargo logistics by themselves because they can take more control for the costs and they will not be charged the extra costs on the products.

Conclusion

These are 6 basic Incoterms which are used in ocean business trade very often. All transaction terms are based on the agreement between sellers and buyers.

If you plan to import the productions from the country as first time, we might recommend you to make agreements with FOB or C&F or CIF.

For exporting products, we would recommend you C&F or CIF. The local charge of inland transportation is depends on the forwarding agents’ advantages or disadvantages.

If the forwarder agents don’t have much experiences for the trading countries local rule, there are many cases which they rely on the forwarding works at discharge side.

All shipments are case by case but please memorize the 6 Incoterms which we explained to you this time so that you can understand the characteristics of each transaction terms in order to arrange the business trade smoothly