Neko Senpai

Neko Senpai About Off Shore Trade

Explained about Off Shore Trade by Video

Kamome Senpai

Kamome Senpai This is 8:35 video.

This time, let’s take a look at off-shore trade.

When you hear the term off-shore trade, it may sound complicated. Off-shore trade is commonly called “between three countries” and “intermediate trade”, and it’s one of the main trade forms.

Once you get used to it, it is not so difficult.

The method is beneficial for both importers and exporters, therefore, if you are dealing with trade, you will use off-shore trade.

However, brokers and freight forwarders need to be very careful when dealing with off-shore trade, as it requires more processes than having just an importer and an exporter.

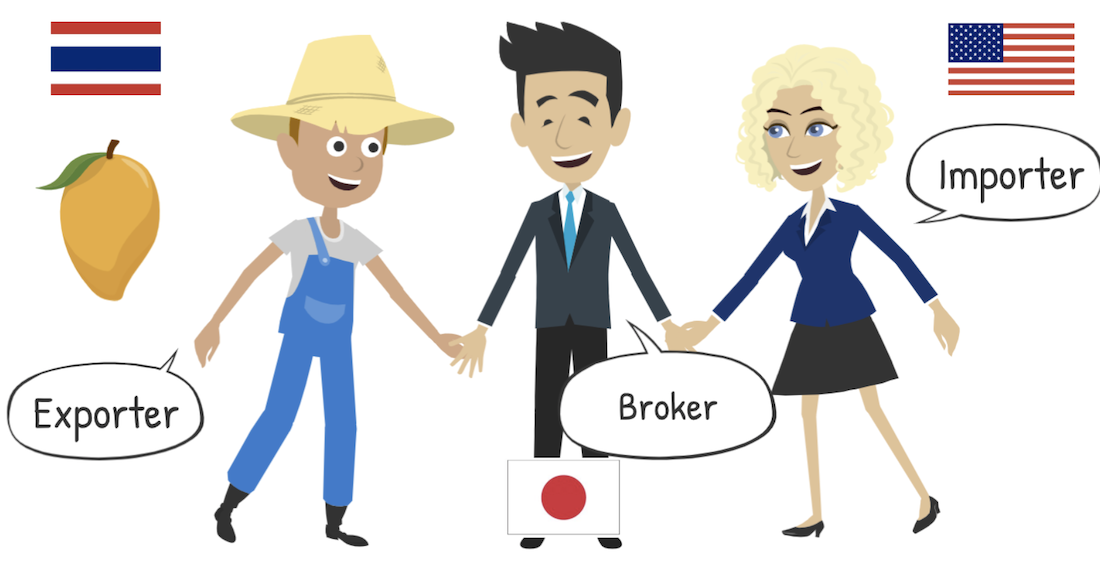

In this video, we will use a business example of importing Thailand Mangos to America, using a Japanese broker. Off-shore trade requires a third country’s broker, in addition to an exporter and an importer.

The following is an example of how it would look;

Exporter:Thailand

Broker: Japan

Importer: America

Difference of Off-shore Trade

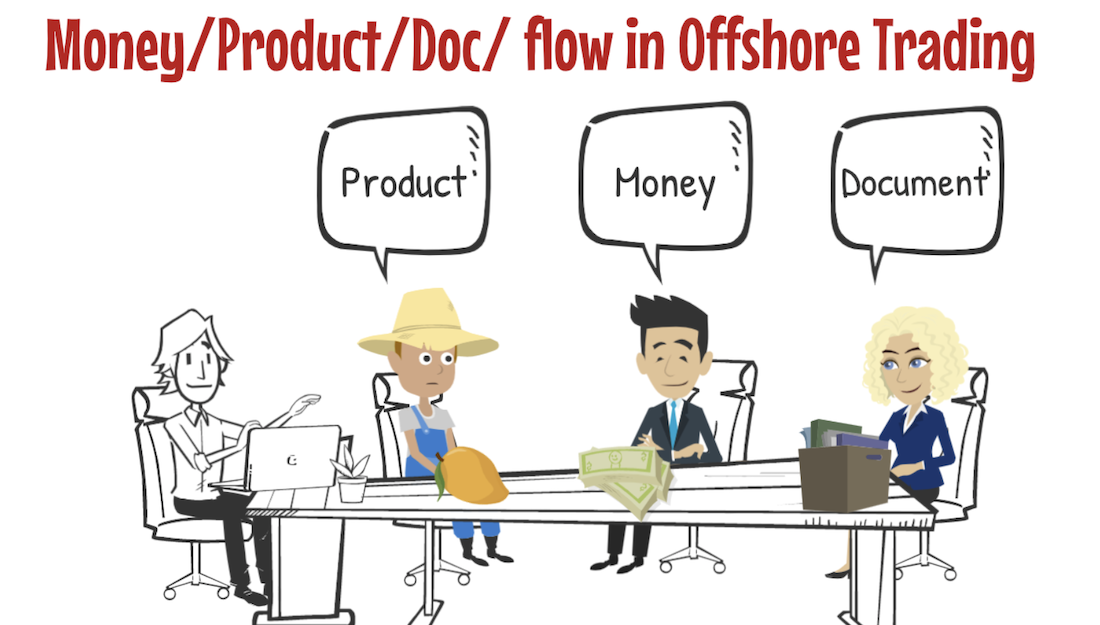

“Money”, “Product”, and “Documentation”, are the keys to international logistics. In off-shore trade, “Money” and “Documentation” flow differently.

Also, the Documentation flow is more complicated and you may experience difficulty, until you get used to it. Now, let’s have a closer look.

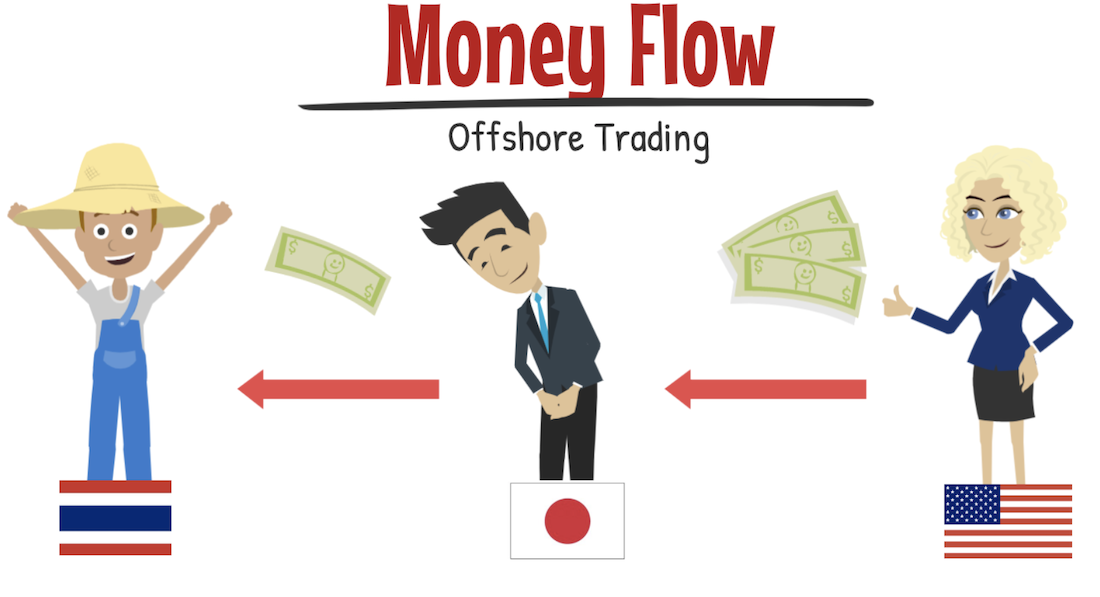

Money Flow

First of all, let’s take a look at the money flow. Once the Japanese broker and the American importer make a deal, American importer will make payment to Japanese agent.

Then, Japanese agent will make payment to the exporter in Thailand. When Japanese agent issues an invoice to American importer, the margin for Japanese agent is included in this.

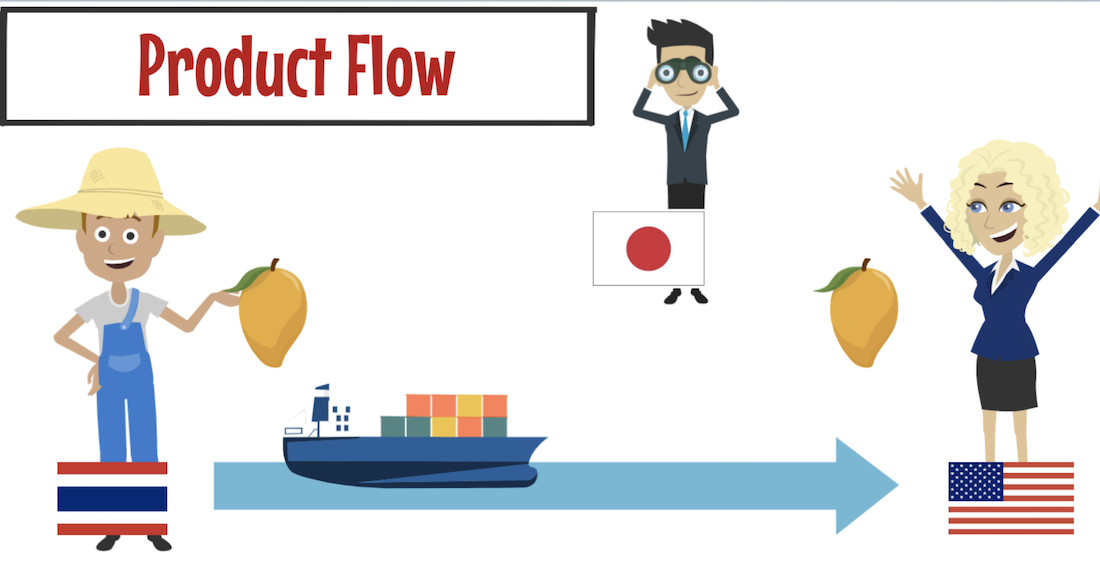

Product Flow

Secondly, let’s take a look at the product flow. A freight forwarder in Thailand, will make arrangements for an American freight forwarder.

The product will be delivered directly from Thailand to America, without going through Japan, the broker country.

Advantage of Off-shore Trade

In off-shore trade, an importer and an exporter will both benefit by having an intermediate broker.

The benefits for exporters are;

• Reduction in negotiation time with an importer, and reduced cost of “sales promotion”.

• Reduced risk of collection from new importers, by having an experienced intermediate broker.

The benefits for importers are;

• An intermediate broker can negotiate the sales cost, and the importer will receive reduced sales cost compared with importing goods themselves.

• Reduction in transportation as the product is shipped directly, from an exporting country to an importing country.

• The product will not go through the third country, therefore it will not be taxed.

As you can see, both exporters and importers will benefit from using off-shore trade.

Matters need to be careful

In off-shore trade, a broker needs to be careful, that an importer does not make direct contact with the supplier, leading to a direct business arrangement in the future.

There are cases when supplier information is provided to an importer, while trading. This time, we will use an example of a broker dealing with a business, while not disclosing a supplier.

There is a recognized trade technique, which can be used in a situation like this.

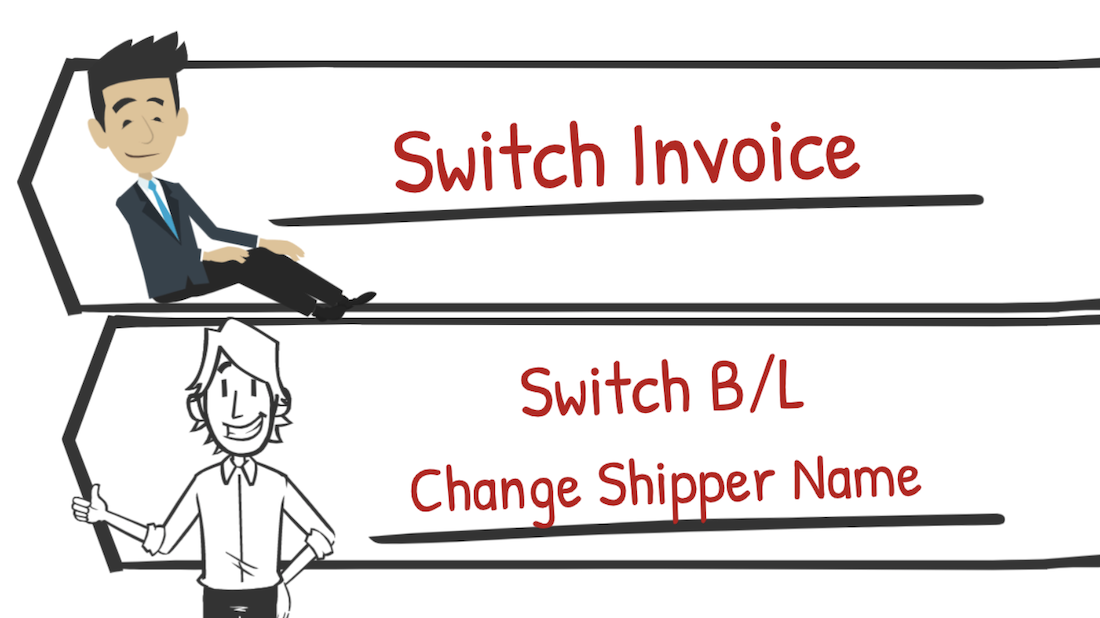

It is called switch invoice and switch B/L. Let’s take a look.

Switch Invoice

First, on the invoice will be Thailand which is the exporting country, and is shown as;,

• Seller: Thailand Company・Buyer: America Company

• Notify: Japan Company

For export customs clearance, the product is shipped directly from an exporting country, to an importing country.

If the term is CIF, they need to use an invoice with the total billing amount, which must include the cost of the product, as well as the shipping weight and insurance costs.

This invoice does not include a margin for Japanese agent.

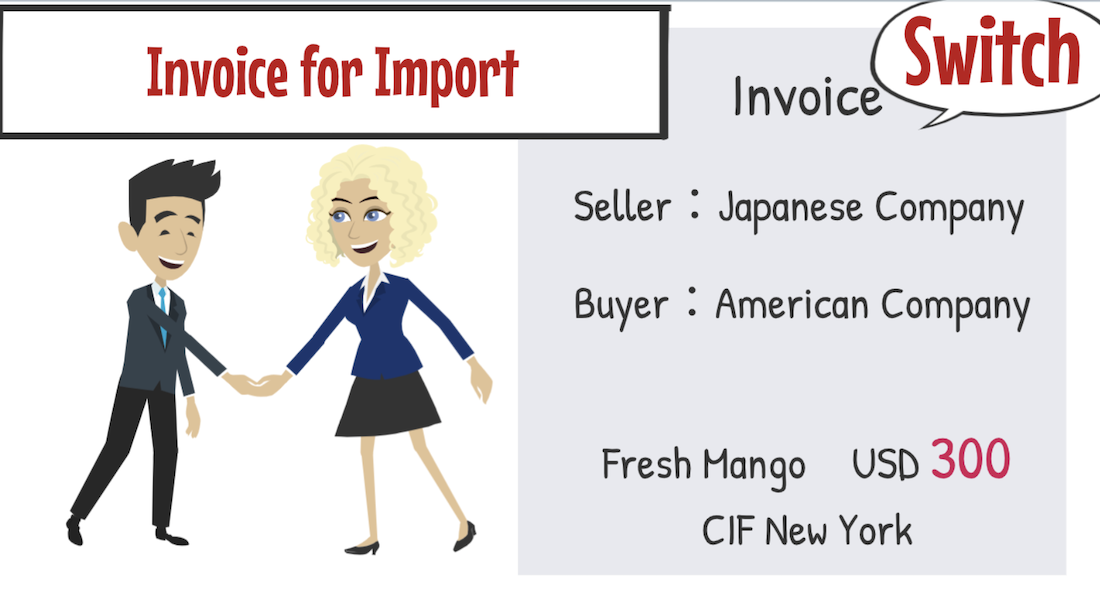

An invoice issued by Japanese agent to the American importer will be shown as;,

・Seller: Japan Company

・Buyer: America Company

You may notice that the supplier information, regarding Thailand is not included in this invoice.

This type of invoice is called switch invoice.

Please note, for us to be able to understand the difference easily, the cost shown is exaggerated on purpose.

If the first invoice for export customs clearance is sent to America, (the importer) by mistake,

they will discover the cost difference between the billing amounts from the Japanese broker.

The importer could then discover the broker’s margin, therefore, you can never make this mistake.

This may cause a trust problem between a broker and an importer, therefore a freight forwarder needs to be extra careful when dealing with invoices.

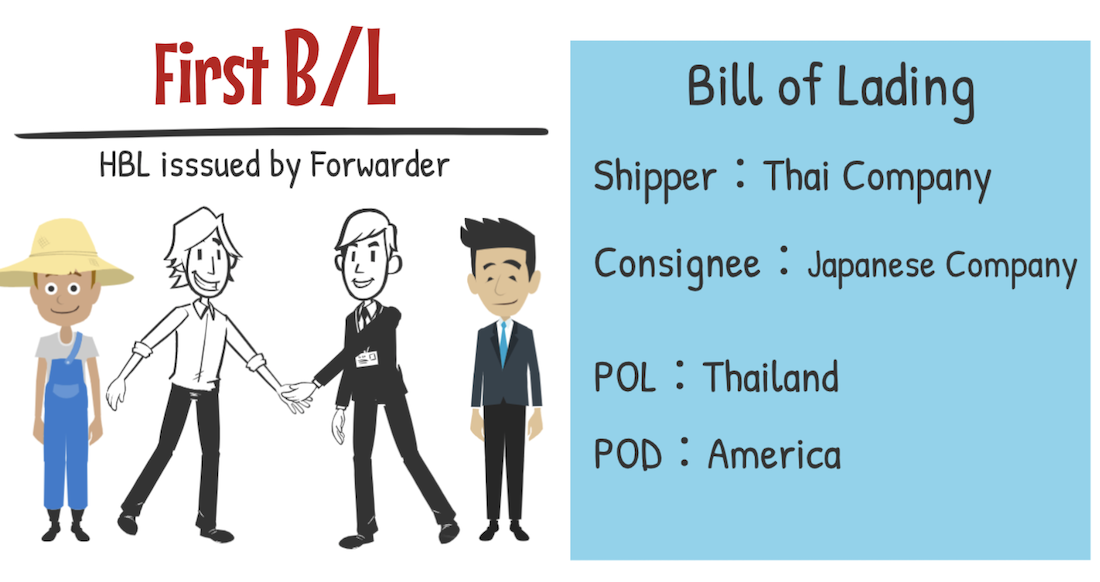

Switch B/L

As you can switch an invoice, you can switch B/L when transporting goods, without disclosing an exporter to an importer.

With this switch B/L, you can use a broker’s company name, on behalf of an exporter’s company name.

Now, let’s take a closer look at how switch B/L works.

First, a Thailand freight forwarder who is an exporting country will issue a B/L.

This B/L is shown as;

・ Shipper: Thailand Company

・ Consignee: Japan Company

This B/L includes the following;

Place of loading – exporting country (Thailand)

Place of discharge – importing country (America)

This original B/L will be sent to a Japanese broker.

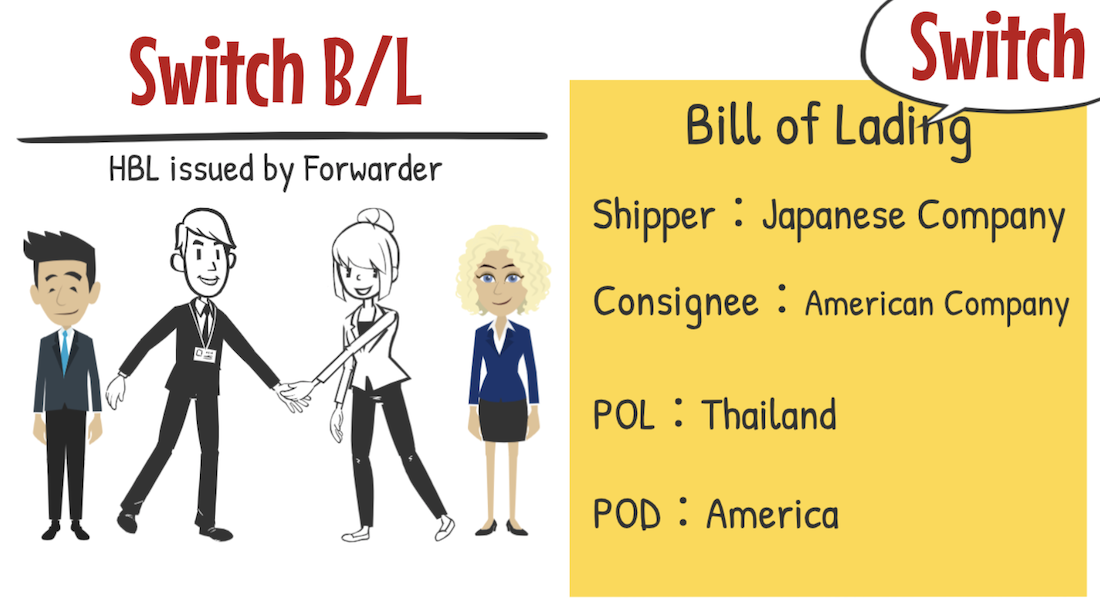

Next, the Japanese broker freight forwarder will switch B/L, and this will be sent to an American importer.

The change point is as follows;

・Shipper: Japan Company

・Consignee: America Company

By using switch invoice and switch B/L, you can prevent the American importer discovering the Thailand supplier information.

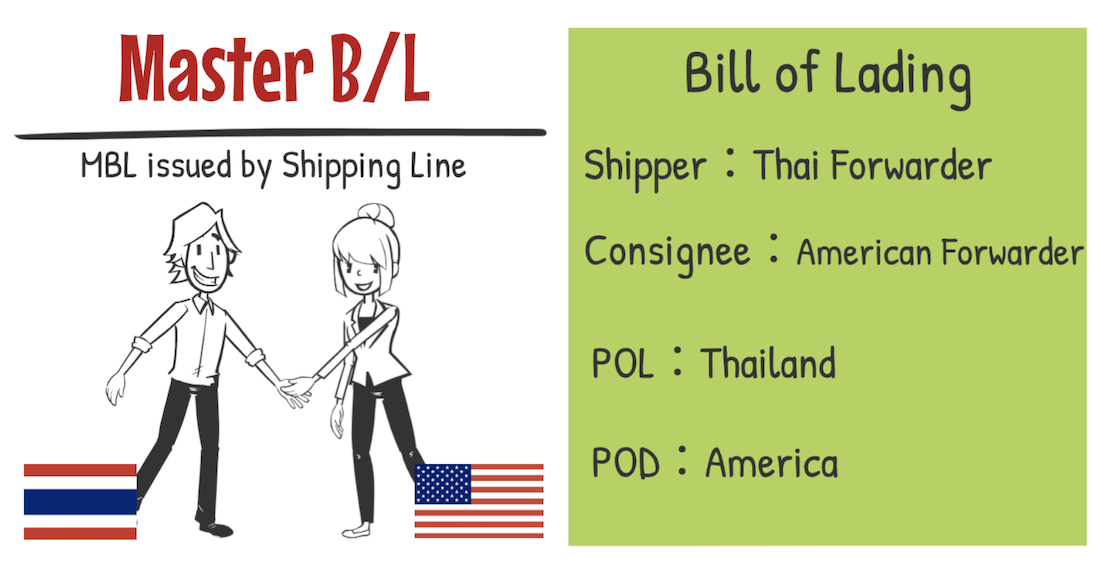

Master B/L, when a house B/L is issued at the place of loading in Thailand is as follows;

・Shipper: Freight forwarder in Thailand

・Consignee: Freight forwarder in America

This is correct as it displays the same flow of the cargo.The difference between a house B/L and a master B/L, is explained in the video link, located in the comment section of this video.

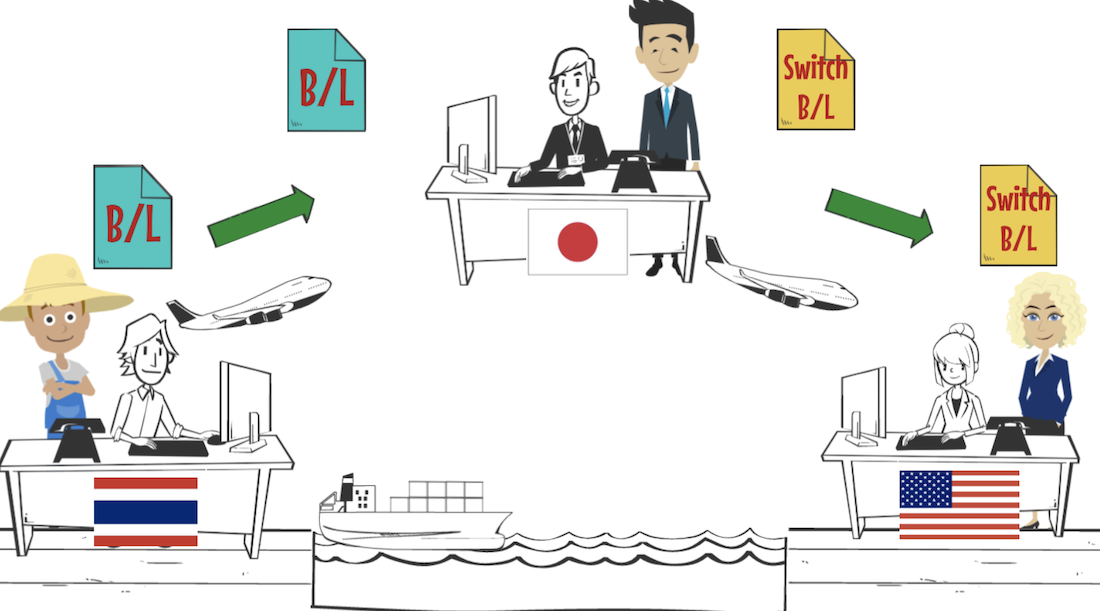

B/L flow of Off-shore Trade

Let’s take a look at off-shore trade’s B/L and cargo flow.

First, a B/L is issued in Thailand and the original is sent to Japan.

A freight forwarder in Japan will switch the B/L.

The switched B/L will be sent to America from Japan.

The cargo loaded vessel departs from the place of loading, to the place of discharge.

Therefore, it is important to make B/L arrangements quickly, when sending cargo by using off-shore trade to nearby countries.

Certification of Origin for Off-shore Trade

Let me also explain a certificate of origin for off-shore trade.

You can take advantage of customs duty, if the trade is between FTA and EPA countries, and provide a certificate of origin issued by an exporting country, to an importing country.

In off-shore trade, if an exporting country and an importing country, are part of FTA and EPA,the benefit is still applicable, even when using an intermediate broker.

In this case, you will need a certificate of origin from an exporting country.

You need to be aware, that even if you are not disclosing an exporter (supplier)’s information, by using a switch invoice and a switch B/L, the exporters information will be written, on the certificate of origin.

If you do not understand the risk of disclosing the exporter’s information, on the certificate of origin, it may cause some problem.

Summary

There are many advantages using off-shore trade, however, you need to be careful when handling documents.

If you make a mistake by sending documents by mistake, information could be disclosed to an importer, a broker and an exporter will lose trust from their customer, (importer).

When using off-shore trade, it is important to maintain good communication, between each business partner to check and confirm during the process.

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!