Neko Senpai

Neko Senpai About Shipping Specialist Job

Explained about Shipping Specialist Job by Video

Kamome Senpai

Kamome Senpai This is 6:06 video.

This time, let’s take a look at the role of a customs specialist.

What does a customs specialist do? You may wonder whether they use English and whether they are tasked to reduce customs duty.

If you are not involved the international logistics field, you may not be familiar with the role of the customs specialist and you may not be able to understand the role.

This time, we will explain the role of customs specialists.

Business Description of Customs Specialist

A customs specialist specializes in customs clearance functions.

They will receive a job request from another company, shipper and consignee, and submit the documentation to receive an approval when importing and exporting cargo.

Declaration Process

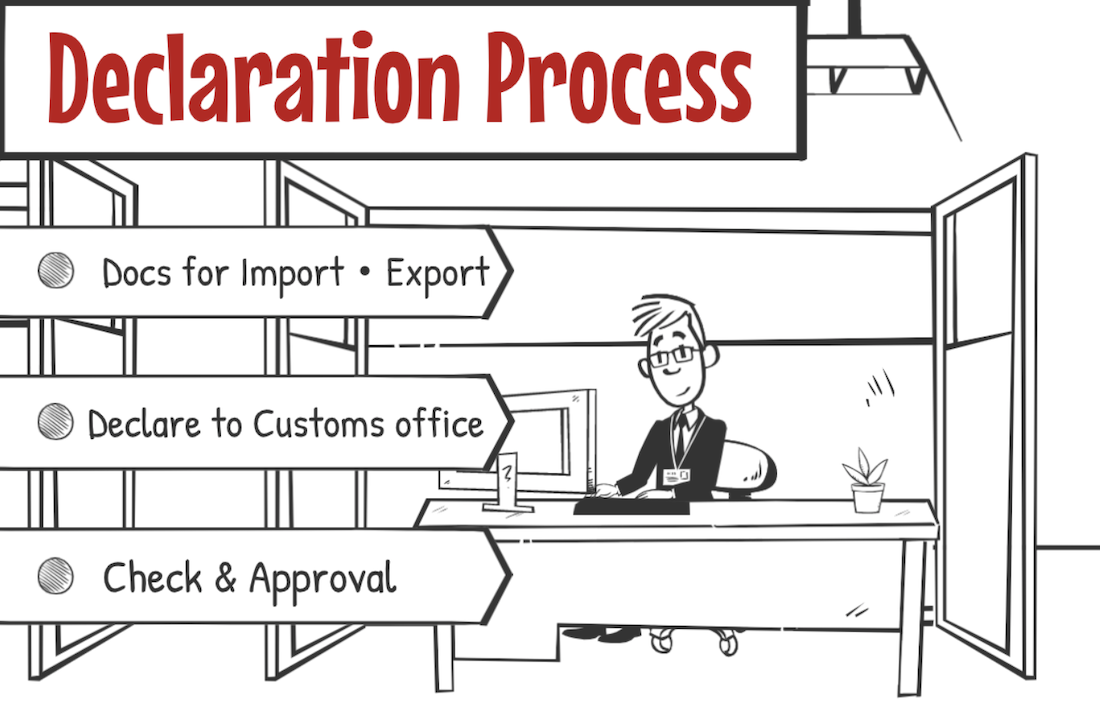

So, declaration process is the main role of a customs specialist. We will explain what they do and how they work in detail.

When a customs specialist receives a job request from another company, they will submit documentation to the customs office.

They will receive documentation for the product invoice, packing list and other documents for import and export shipping.

Then, on behalf of a shipper and consignee, they will declare the documentation to a customs office and receive any necessary checks to receive an approval from the customs office.

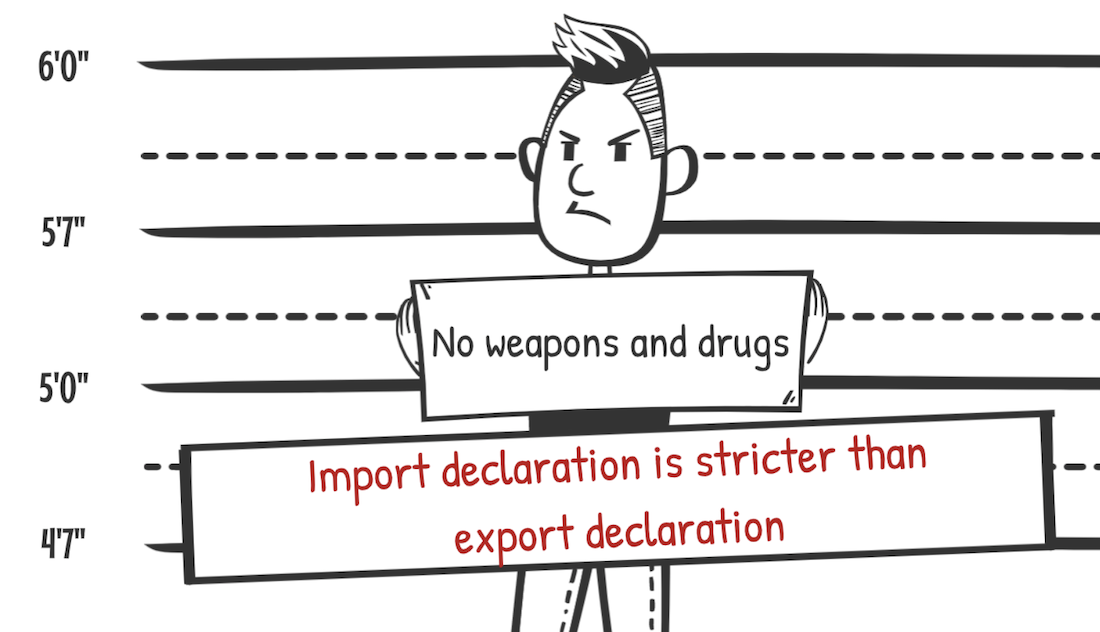

There are export and import declarations in shipping job. I feel that import declaration is stricter than export declaration, as there are the prohibited cargo to import such as weapons and drugs.

Therefore, this time, we will take a closer look at import declaration.

Import Declaration

Necessary Documents

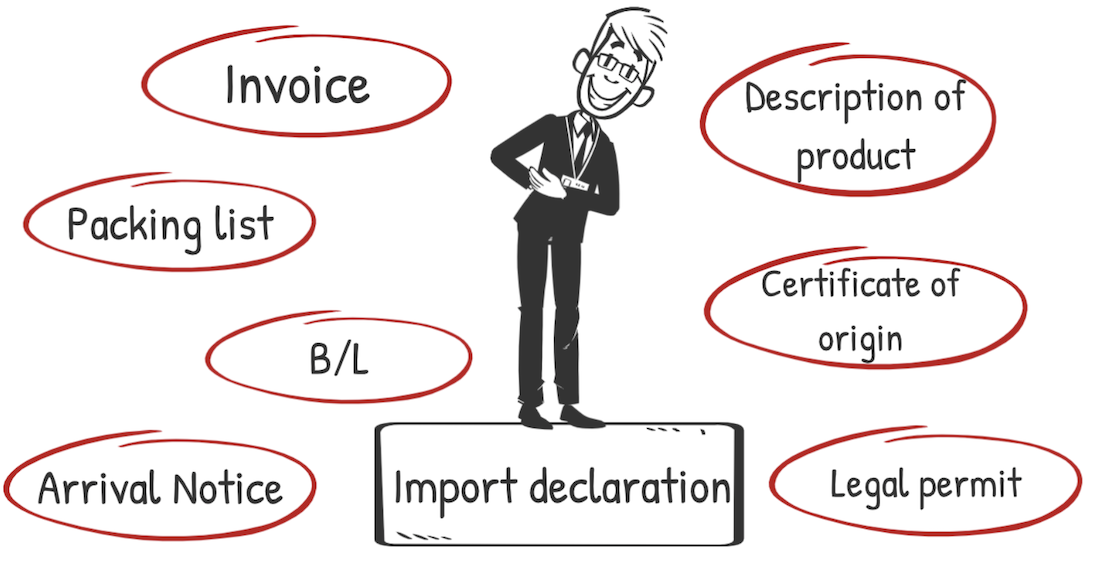

The documentation that is required for an import declaration are as follows.

Invoice

Packing list

B/L

Arrival Notice

Description of product

Certificate of origin

Legal permit if required

To import cargo, you need to prepare documentation and send it to a customs specialist.

Decide HS Code

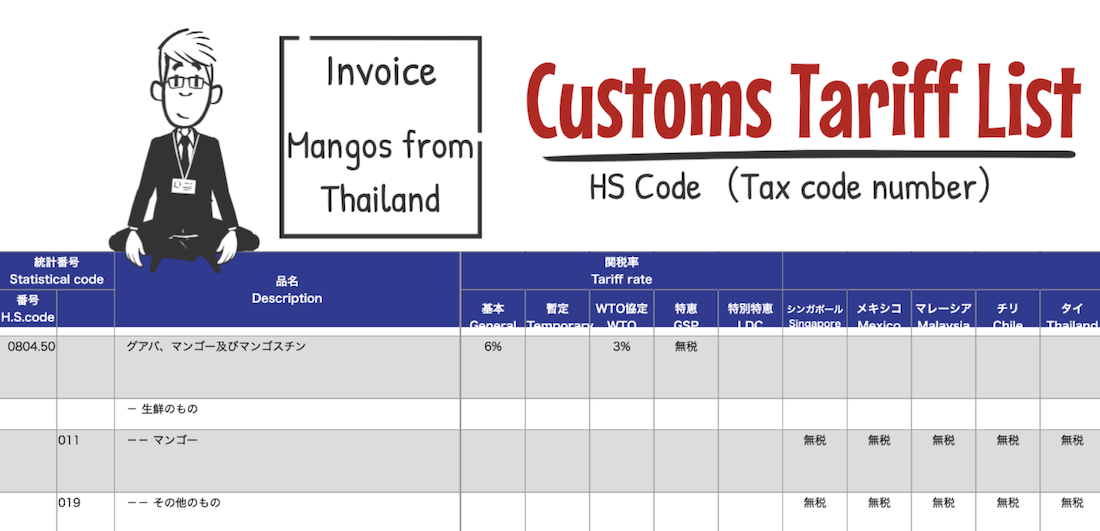

A customs specialist will take a look at the invoice and check the product’s HS code on the customs tariff schedule.

There are tax code numbers called HS codes on the customs tariff list. 9 digits code are allocated for all products using the list and decide the HS code.

Then, you will check the tax rate. Also, EPA is confirmed on the list. For example, when we are importing Mangos to Japan from Thailand, the customs duty is 0% by using EPA.

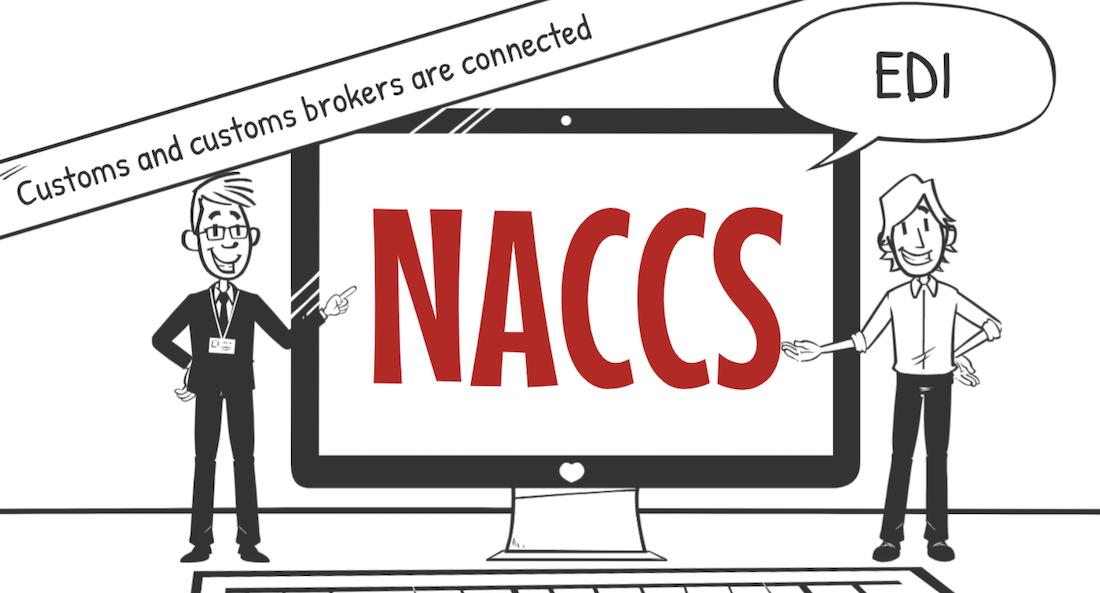

The Customs and customs brokers are connected through a system, called NACCS in Japan. In Thailand and other countries, it called EDI.

When a customs specialist inputs a HS code and cargo cost, the amount of tax will be calculated automatically. To declare an import, all you have to do is to press the send button.

When we take a look at the customs specialists’ role, it may sound simple.

However, one declaration form may only require 5 minutes to complete, on the other hand, it may take more than 1 whole day to complete.

In some jobs, there are 100 items on an invoice, you need to allocate HS code and tax rate for each items. This job takes so much time if there are so many items on an invoice.

Some items are able to allocate HS code easily, but some items are not so simple to allocate suitable HS code. In this case, you may need to ask to the customs beforehand.

It is very important to decide a suitable HC code as it can change the duty rate, which may impact the cost of import.

Import Declaration by NACCS

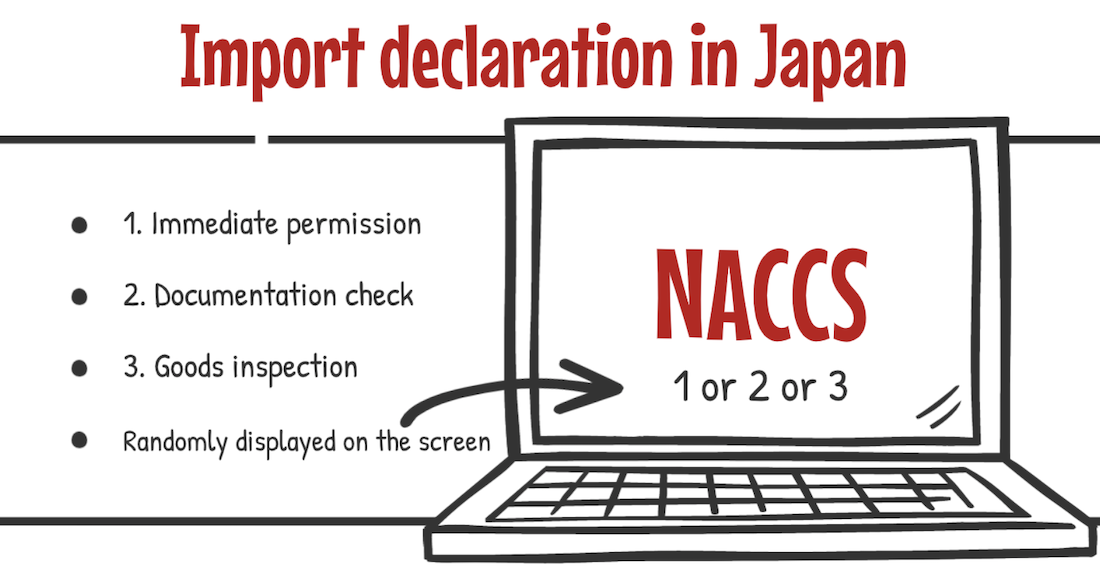

In Japan, there are three types of import declaration patterns.

1. Immediate permission is given

2. Documentation check and then permission is given

3. Documentation check and goods inspection then permission is given

Once the send button is pressed on NACCS, the number of 1, 2 or 3 will be randomly displayed on the screen.

If 1 is displayed, the permission is immediate.

If 2 or 3 is displayed, you need to prepare the necessary declaration documentation.

You need to send them to customs and wait for them to contact you.

If there is no problem on the documentation, the permission will be granted. However, if cargo inspection is required, you have to follow this request.

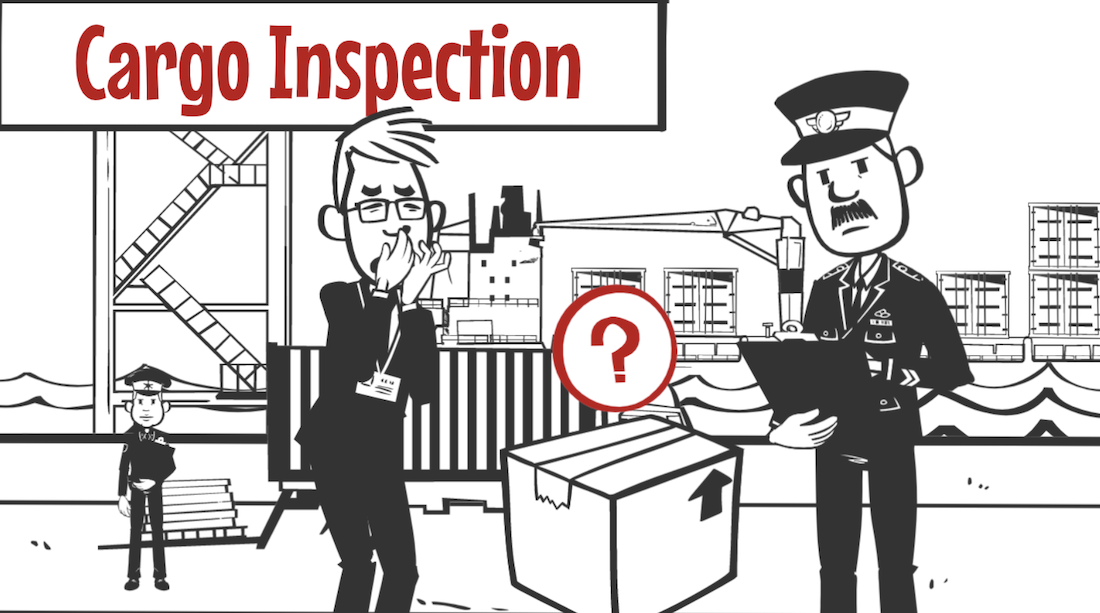

Witnessing the Cargo Inspection

Cargo inspection will be witnessed by a customs broker. Basically, a customs specialist becomes anxious when a cargo inspection is carried out.

They will bring the requested box and it will be open with a customs officer present. They are not allowed to check the contents until this time.

It may contain different goods or different numbers of items inside of the box. Nothing declared on the documentation may be packed inside of the box.

As the customs specialist has declared the cargo, they need to take responsibility. Therefore, they are always nervous when it comes to cargo inspection.

Anyway, once the permission is granted, they can receive the cargo and they can ship the cargo as domestic cargo.

Summary

By now, I hope you know what a customs specialist does. When exporting and importing cargo, a customs specialist is working behind the scenes.

Even if you have never thought of a customs specialist, you are using goods that have been cleared by a customs specialist.

They calculates and checks the documentation to meet the deadline, and for the cargo to be able to be loaded onto the scheduled vessel, or air plane.

It will be very helpful for you to prepare and provide the correct documentation, and essential documentation for a customs specialist work.

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!