Neko Senpai

Neko Senpai About “Rank Order of Application of Tariff Rates”!

Video of This Article

Kamome Senpai

Kamome Senpai This is 9:01 video!!

Hello, it’s IINO.

In this video, I would like to explain “order of application of tariff rates”, using examples.

What Tariff is

First of all, Tariff is simply explained as “a tax paid on goods imported from a foreign country.”

Since it is a tax, payee is the “country”. In other words, tariffs ultimately become “national revenue.” Tariffs like consumption tax and corporate tax are a source of revenue for the government.

And the taxes collected are used to pay for public services necessary for our daily lives.

In addition, the tax on goods imported from abroad is adjusted so that there is not a large difference between the price of the imported and domestic.

Tariffs are also a necessary policy to protect domestic industry.

Normally, customs duties are paid by the importer or the forwarder who is requested to clear customs at the time of import declaration.

This is called a tax declaration and in principle an import permit will not be granted unless the amount equivalent to the declared amount is paid.

What Tariff Rate is

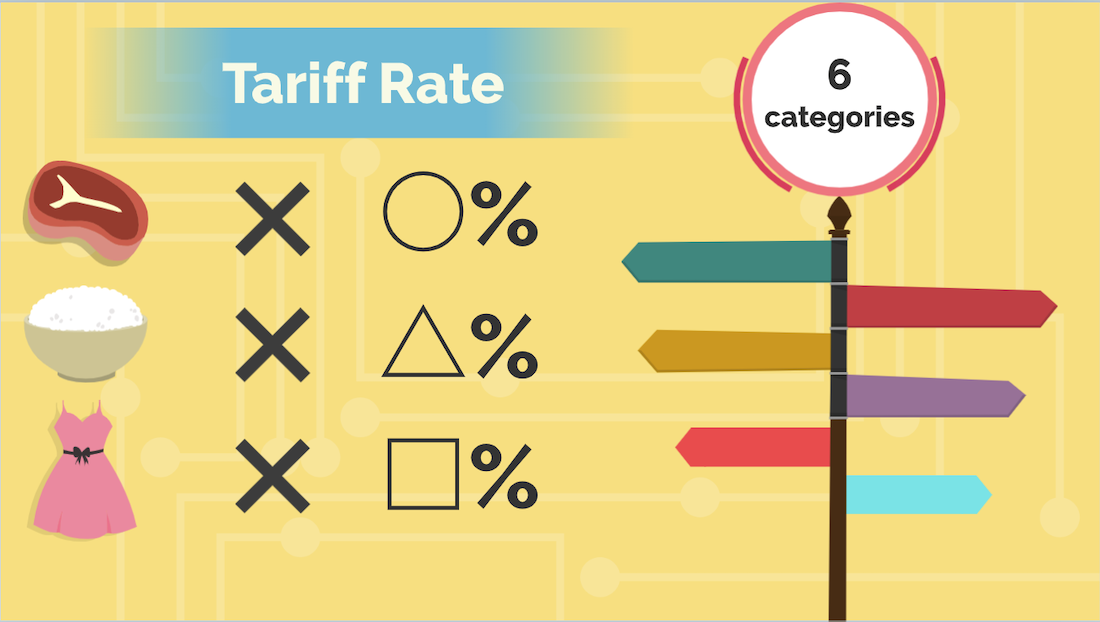

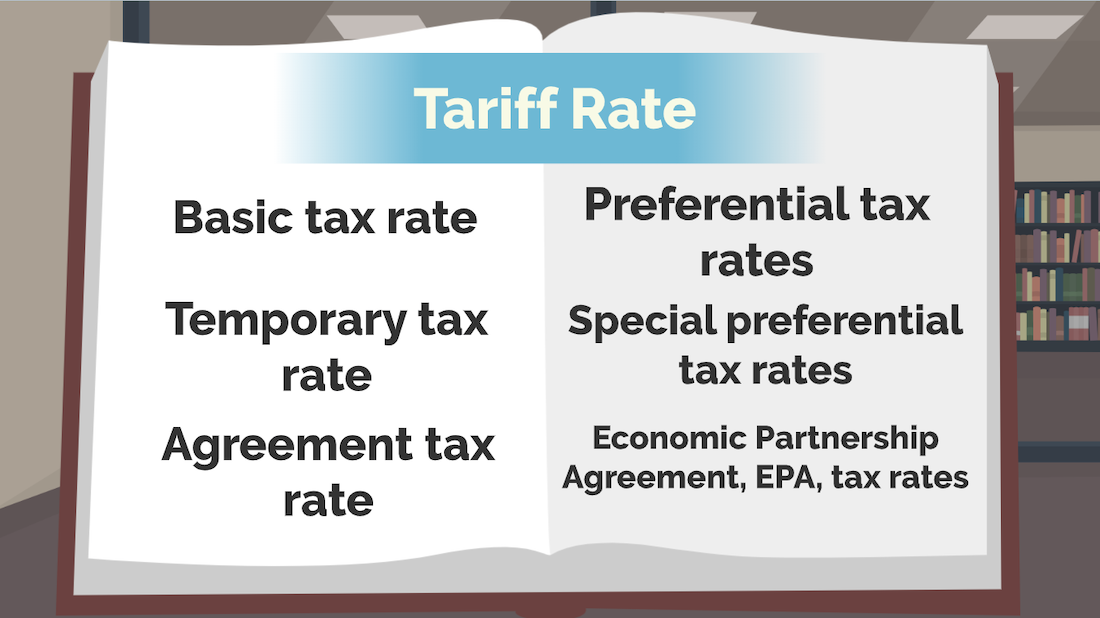

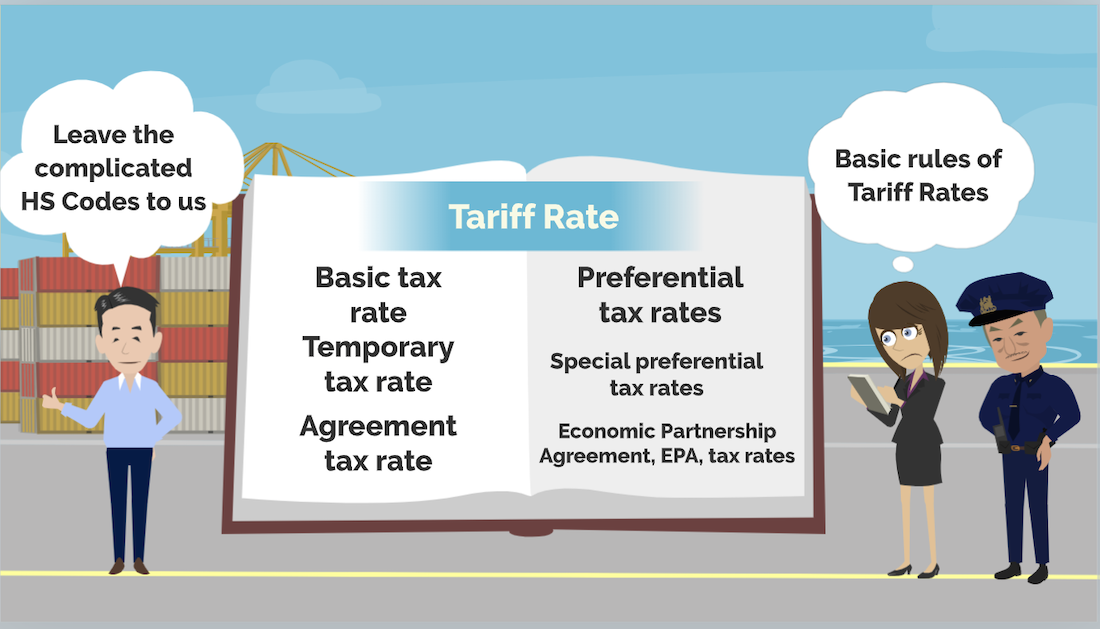

Here is an explanation of “Tariff Rate” on imported goods. Tariff Rates are divided into six major categories.

Roughly speaking, the following types are available.

Basic tax rate

Temporary tax rate

Agreement tax rate

Preferential tax rates

Special preferential tax rates

Economic Partnership Agreement, EPA, tax rates

The types of tariff rates are explained in detail in a separate video which is linked in the overview section.

Please take a look if you are interested.

Basic Knowledge of Customs Tariff/Duty

Order of Appliction of Tariff Rates

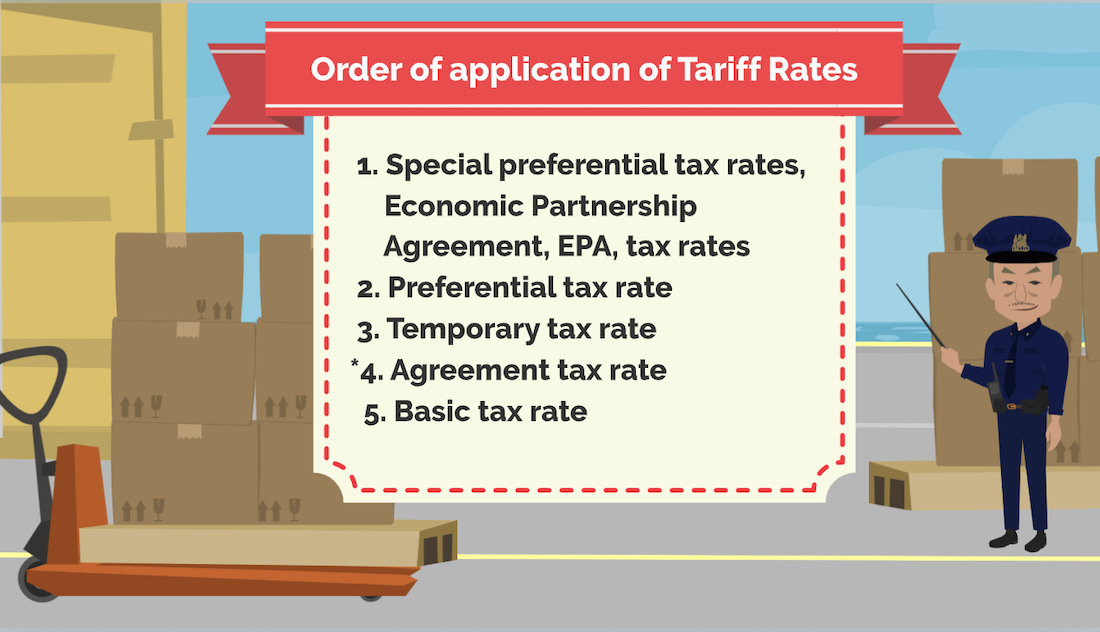

In principle, the order of application of Tariff Rates is as follows.

1. Special preferential tax rates, Economic Partnership Agreement, EPA, tax rates

2. Preferential tax rate

3.Temporary tax rate

*4. Agreement tax rate

5. Basic tax rate

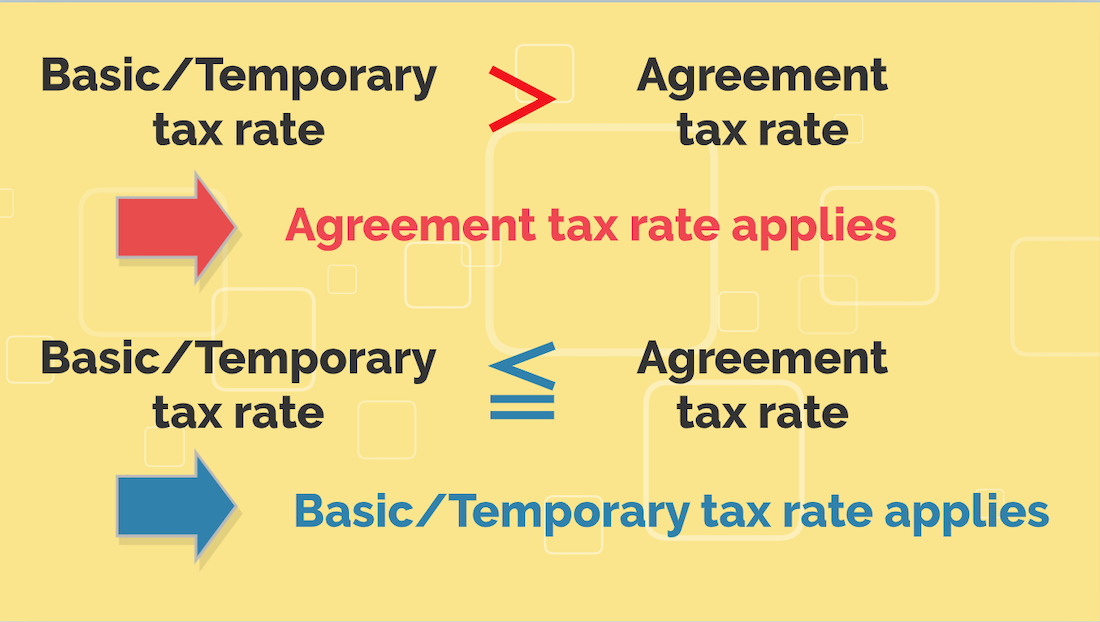

Agreement tax rate is applied when it is lower than Basic or Temporary tax rate. And Basic or Temporary tax rate is applied when they are the same as or lower than Agreement tax rate.

Basic/Temporary tax rate > Agreement tax rate → Agreement tax rate applies

Basic/Temporary tax rate ≤ Agreement tax rate → Basic/Temporary tax rate applies

In the case of Special Preferential, Economic Partnership Agreement or Preferential Tax Rates “Free” or a rate lower than the general rate is applied.

On the importer’s side, it is desirable to apply the lowest possible tariff.

However, in order to apply these preferential tariff rates, a “certificate of origin” proving that the product is of the target country’s origin is required.

The exporter must follow the procedures for issuing a certificate of origin so be sure to have it sent to you by the time you declare imports.

The rate of customs duty differs greatly between filing a certificate of origin and not. Be careful not to lose money in trade transactions.

Example 1: Imports to Japan of Infant Gloves Knitted

Let me take as an example, Tariff Rate on the importation of infant gloves knitted from Indonesia. In this case, the importation into Japan is used as an example.

There is a reason why I specify as “knitted” in this case.

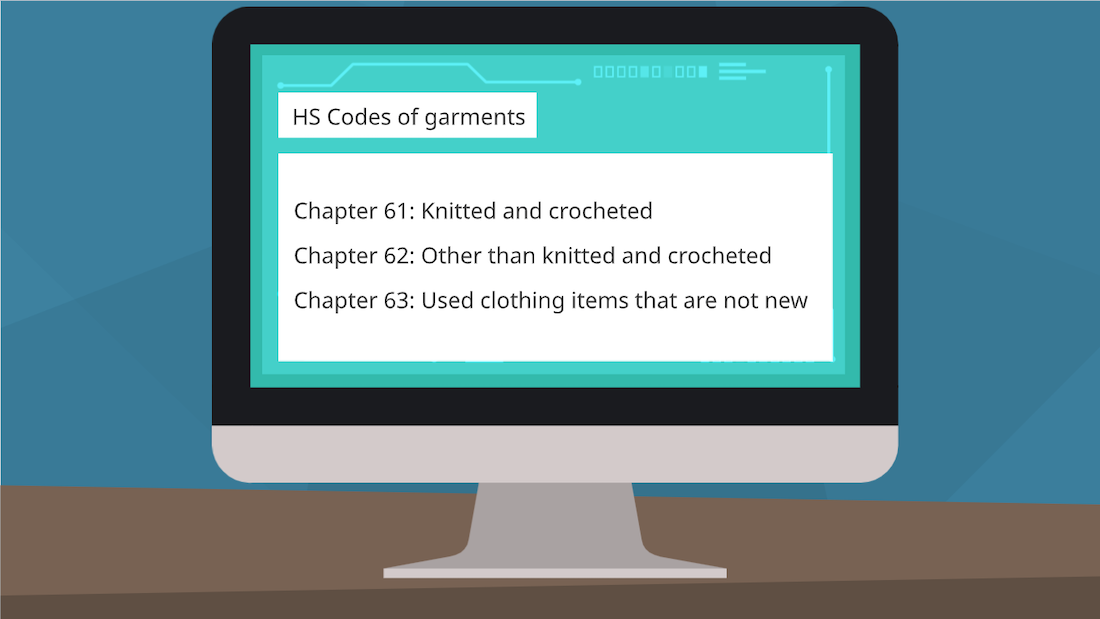

If the imported goods are garments, HS Codes are divided into the following three categories.

Chapter 61: Knitted and crocheted

Chapter 62: Other than knitted and crocheted

Chapter 63: Used clothing items that are not new

About HS Code

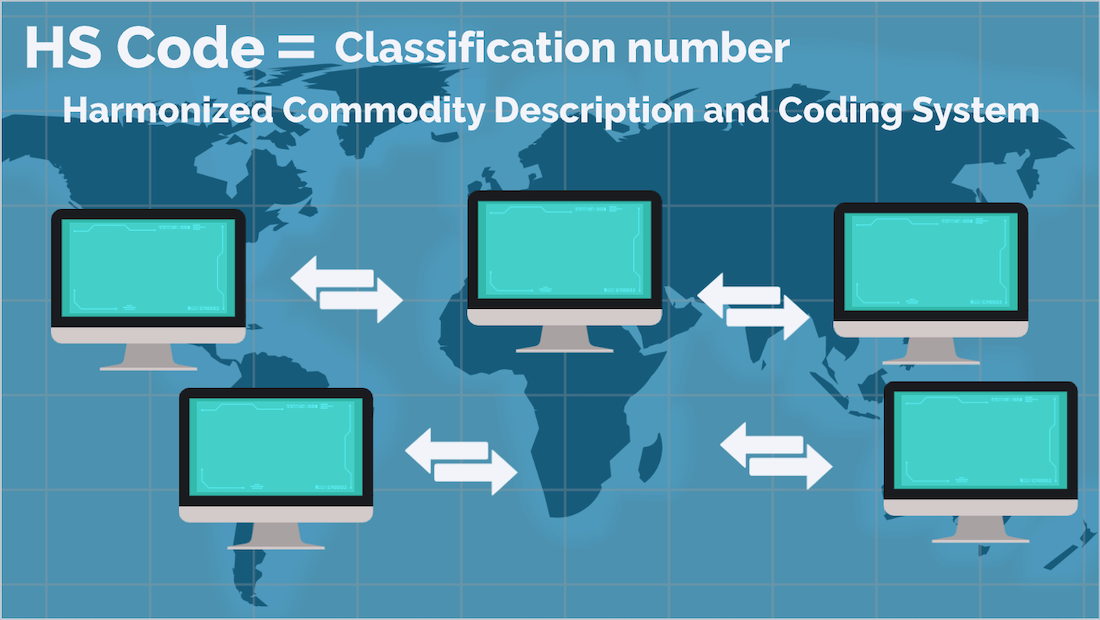

HS Code stands for Harmonized Commodity Description and Coding System and is a classification number assigned to goods handled in trade transactions.

It is a unified system that enables a worldwide understanding of what the commodity is and plays an important role in facilitating imports and exports.

HS Code is explained in detail in a separate video so if you are interested, please refer to the link in the overview section.

Checking HS Code

In order to import goods, look up the “HS Code” and “applicable tariff rate” in advance.

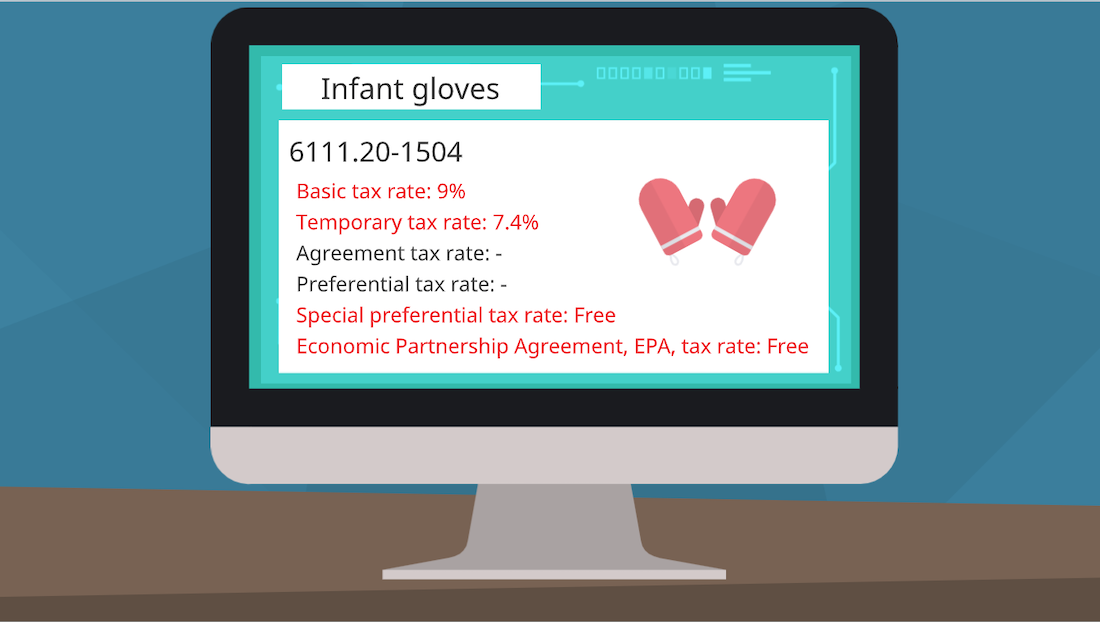

If you look up the HS Code for the infant gloves in this example on the web tariff, you will find the following code number.

6111.20-1504

The classification number is determined by the material and composition of the goods to be imported whether they are intended for men or women and other factors.

If you have difficulty in classifying an item, do not make a judgment on your own but consult with customs or your forwarder.

Checking Tariff Rate

Tariff Rates for infant gloves, HS Code “6111.20-1504” are as follows.

Basic tax rate: 9%

Temporary tax rate: 7.4%

Agreement tax rate: –

Preferential tax rate: –

Special preferential tax rate: Free

Economic Partnership Agreement, EPA, tax rate: Free

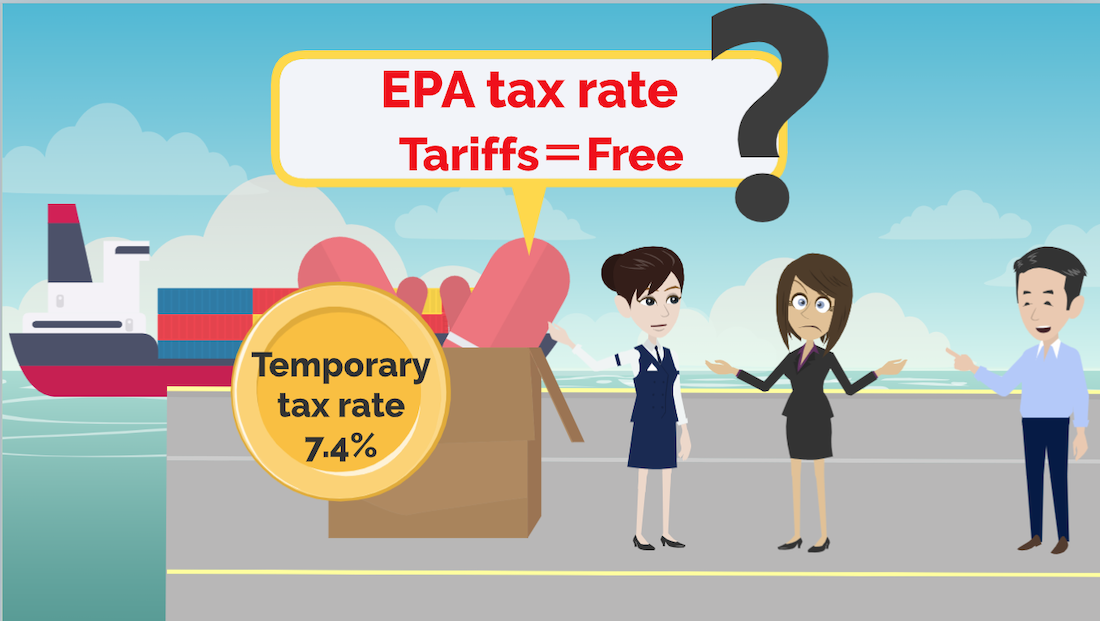

In this case, since we import from Indonesia, EPA tax rate is applied.

The key point is whether the goods are of Indonesian origin.

1. The goods are of Indonesian origin

2. A certificate of origin is issued by the exporter

3. Accepted by customs

If the above applies, “Economic Partnership Agreement tax rate was applied” and the duty is “Free.”

If the importer does not know that EPA tax rate will be applied, Temporary tax rate of 7.4% will be applied resulting in a significant loss for what should have been a tax-free shipment.

However, such cases are often pointed out by customs or forwarders at the time of import declaration.

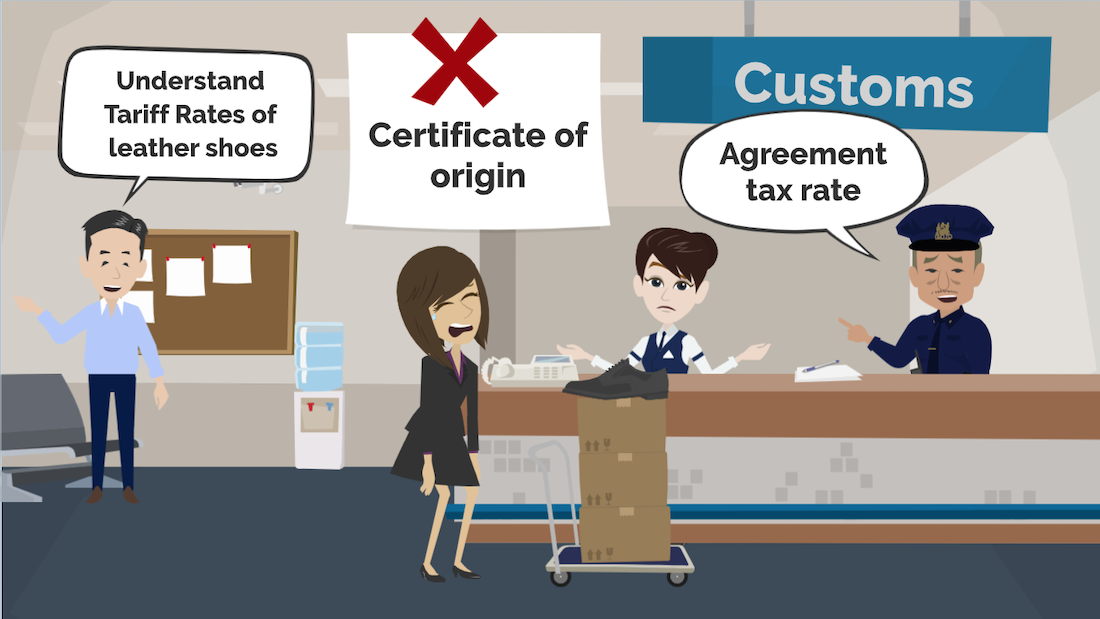

Example 2: Importing to Japan of Leather Shoes

Let me take another example of importing to Japan “leather shoes”.

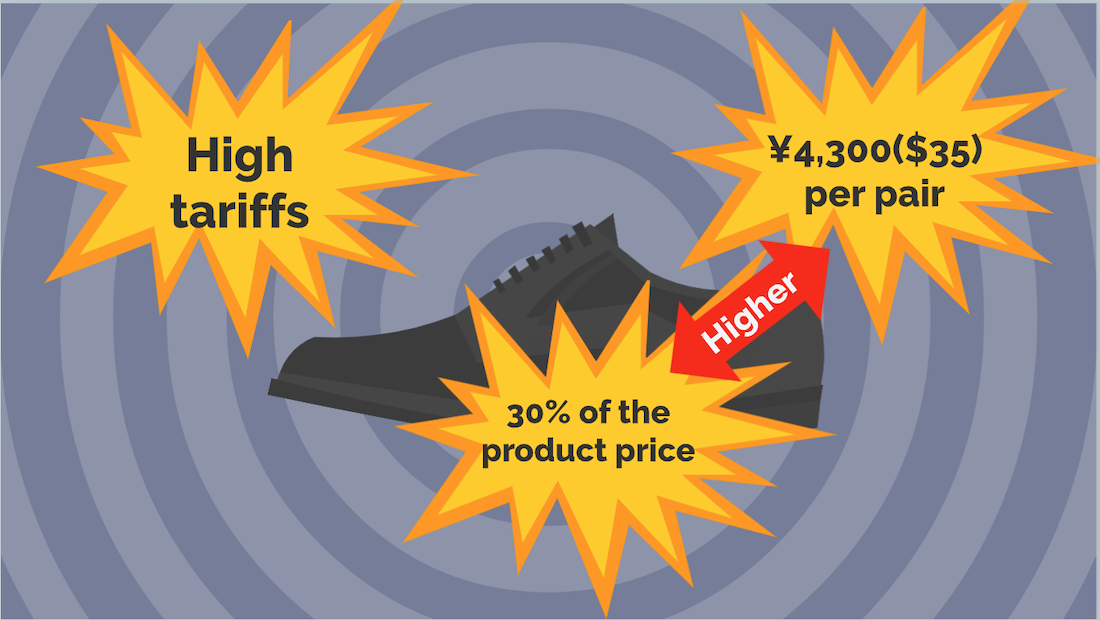

Leather shoes are known to have high tariffs among various imported goods.

Basically, tariff rate on leather shoes is “no more than JPY4,300, about USD35 per pair or 30% of the product price whichever is higher.”

Tariff Quota System

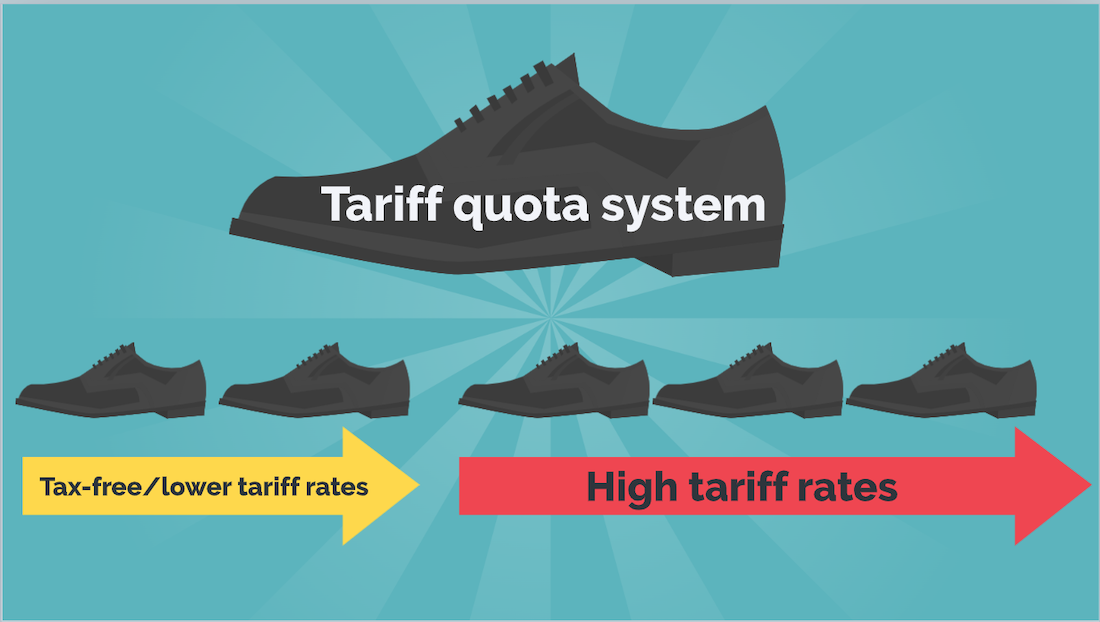

The importation of leather shoes is a commodity subject to the tariff quota system, but is omitted from this explanation.

The tariff quota system is a system under which tax-free or lower tariff rates, primary tariff rates, are applied to certain items only within a certain import volume quota.

For the portion exceeding this fixed import quantity, Tariff Rate higher than the primary Tariff Rate, secondary tariff rate, is applied to protect the domestic product.

Tariff Rates of Leather Shoes

In this case, we import leather shoes a product of Malaysian origin from Malaysia.

Tariff Rate for the product, “leather shoes”, with HS Code “6403.59-019” is as follows.

Basic tax rate:-

Temporary tax rate: –

Agreement tax rate: 30% or JPY4,300 per pair whichever is higher

Preferential tax rate:-

Special preferential tax rates:-

Economic Partnership Agreement, EPA, tax rate: Free, but some countries have tariff rates

When importing from Malaysia, EPA tax rate is applied and there is Free.

However, if a certificate of origin is not submitted at the time of declaration, Agreement tax rate will apply.

Thus, the customer must pay 30% of the merchandise or JPY4,300 per pair whichever is higher.

Since leather shoes have one of the highest tariff rates among various items, it is advisable to understand Tariff Rates in advance when importing them.

Summary

In this video, I introduced the order of application of Tariff Rates and its for two items as examples.

Although Tariff Rates may seem difficult at first glance, you only need to remember the six tariff rates introduced in this video.

You can leave the complicated HS Codes to us, the forwarders and customs. I hope this video will help you understand the basic rules of Tariff Rates even if only roughly.

If you found this video useful, please subscribe to my channel, like it and share on social media.

That’s all for this time. Thank you very much!

Contact to IINO san

★Contact to IINO san★

—————————————–

FaceBook Page

https://www.facebook.com/iinosaan

Linked In Message

https://www.linkedin.com/in/shinya-iino/

Twitter DM

https://twitter.com/iino_saan

—————————————–

IINO

IINO I’m waiting for your contact!

修正版-1024x576.jpg)